Inflation measurement has two key dimensions which include economic and statistical factors. Economic factors arising from price movement of different commodities of CPI basket can be ascribed as momentum. On the other hand, the statistical factors are stemmed from the price swing twelve-months earlier which can be attributed as base effect. The base effect in inflation can be positive or negative with different magnitudes. If the change between the price indices of the two consecutive months of the base period is negative, then current inflation will suppress, offsetting the price momentum. The opposite will happen when the price change is positive, uplifting the present measured inflation. Therefore, it is very important to measure the momentum and base effect of inflation which would help forecast robust inflation, providing guidance for price stability.

Base effect has a considerable impact on the development of measuring CPI inflation. The base effect also contributes to shape the headline CPI inflation. In general, the volatility in inflation can mostly be explained by the developments in the components of consumer price index. However, the changes in CPI inflation in a particular month sometimes refer to not only the recent development in price but also to price fluctuations of the corresponding period in the previous year. Hence, this base effect refers to the contribution of price movements in the base period [i.e., Pt-13 - Pt-12 ] to measure the annual inflation rate. However, sometimes identifying the base effect is a difficult task in practice because only the irregular price changes in the previous year should be considered for determining the base effect. RBI (2014) also finds that an extreme or unusual change in CPI inflation might be misleading without considering the base effect.

Therefore, it is critical to understand the base effect in CPI inflation with a view to identifying an appropriate policy stance for inflation. This note tries to look into the effect of base effect on four series of CPI inflation, i.e., headline, food, non-food and core, of Bangladesh for the duration of 2020M01 to 2021M06, covering the pandemic period. Furthermore, it also attempts to forecast the inflation rate along with the base effect for the next twelve months from 2021M07 to 2022M06.

Therefore, it is critical to understand the base effect in CPI inflation with a view to identifying an appropriate policy stance for inflation. This note tries to look into the effect of base effect on four series of CPI inflation, i.e., headline, food, non-food and core, of Bangladesh for the duration of 2020M01 to 2021M06, covering the pandemic period. Furthermore, it also attempts to forecast the inflation rate along with the base effect for the next twelve months from 2021M07 to 2022M06.

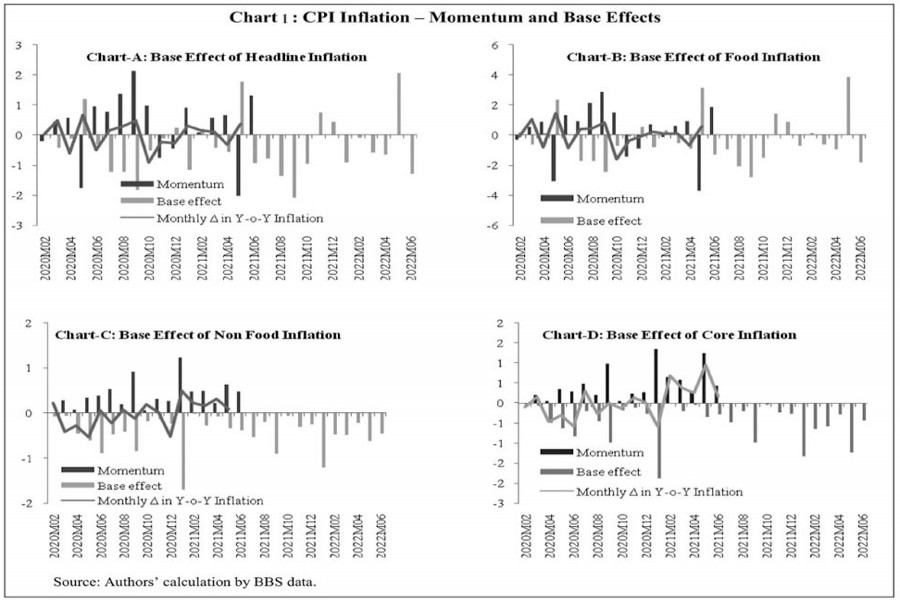

IMPACT OF BASE EFFECT: The Bangladesh economy witnessed significant fluctuation in the CPI inflation during the Coivd-19 pandemic period. This note considers the sample period ranging from 2020M01 to 2021M06 in order to understand the base effect during the Covid-19 pandemic period. Four segments of chart-1 outline the base effect for the four CPI series i.e., headline food, non-food and core. In May 2020, unfavourable (positive) base effect outweighed the fall in price momentum (Chart-1A). However, the fall in price momentum in headline inflation came from negative price momentum in food inflation. Stockpiling of rice following the nation-wide lockdown at the end of March 2020 contributed to the lower demand and negative food price momentum in May 2020. Moreover, fall in the price of fish, vegetables and spices added to the negative price momentum. Although the price momentum is strong, the favourable (negative) base effect kept the headline inflation lower during July-September 2020. The strong price momentum resulted from the rise in the price of rice, fish and vegetables but moderated by the fall in the price of eggs and meat, and spices.

Favourable base effect was diminished during the last three months of 2020 resulted in a spike in headline inflation in October 2020 (Chart-2A). Food price momentum especially prices of rice, fish and vegetables largely contributed to this hike. However, the favourable base effect significantly lowered the headline inflation in January 2021 despite a substantial price momentum.

Price momentum dropped considerably in May 2021 due to fall in the price of eggs and meat and spices, although an unfavourable base effect uplifted the headline inflation (Chart 2A and 2B). On the other hand, inflation in June 2021 increased because of strong price momentum from both food and non-food items (Chart 2B, 2C). Similar pattern of price momentum and base effect interaction was observed in food inflation which indicated the strong influence of food inflation on headline CPI inflation. The observed price momentum for CPI headline as well as for food inflation was highly volatile during the Covid-19 period. Commencement of nationwide lockdown at end March 2020 and April 2021 caused the food inflation momentum to fall in the next month, seemingly indicated that people stockpiled the food items which consequently cut down the demand for food items in the next month.

Charts 2C and 2D indicate that the base effect for non-food inflation remained favourable for the sample period which was very much similar to the core inflation. In addition, strong price momentum in September 2020 and January 2021 mainly stemmed from Medical Care and Health, and Transport and Communication expenses was offset by substantial base effect of non-food inflation.

Note: This policy note uses core inflation data (Chart 2D) compiled by Research Department, Bangladesh Bank, on the basis of BBS data.

INFLATION OUTLOOK: Twelve months ahead base effect can be calculated by the aforesaid method which can be used for giving an insight of the inflation by how much it would be manifested to increase or decrease. From the base effect calculated for the twelve months ahead, it is evident that favourable base effects will dampen the headline inflation in FY22 because of the negative price changes in the base period of food inflation except for the months of November and December 2021 and May 2022. Both for food and non-food inflation, the base effect is significantly negative for the month of September 2021 which suggests that CPI headline inflation would be much lower than the actual price increase. The evolution of the headline inflation during November-December 2021 will likely to be influenced by unfavourable or positive base effects. Thereafter, base effect will become negative or favourable during the first half of 2022 excluding May 2022 (Chart 2A).

CONCLUSION: The analysis finds that the base effect revealed the true change in the price level. Here, the note finds significant base effect for various months of the sample period of 2020M01 to 2021M06. During July-September 2020 and January 2021, the price momentum was much higher, although the substantial negative base effect offset the momentum. However, significant positive base effect was evident in May 2020 and May 2021, notwithstanding the considerable amount of fall in price momentum. Surprisingly, strong relationship between headline and food CPI as well as between non-food and core CPI was found through the base effect calculations. The note figures out the base effect for the next twelve months which gives an insight to inflation outlook.

Since one of the monetary policy objectives of the Bangladesh Bank is to keep inflation within the targeted level, assessing inflationary pattern is critical to formulate prudent policy stance. The quantification of base effect helps explain the unusual fluctuations in the inflation rate. As a monetary authority, the BB needs to be cautious whether these unusual changes (high inflation or deflation) are for price momentum or for base effect.

Nasrin Akther Lubna is Deputy Director, Dr. Md. Salim Al Mamun is Deputy General Manager, Md.Yousuf is Deputy Director, and Dr Md. Ezazul Islam is General Manager of Chief Economist's Unit of the Bangladesh Bank. [email protected]