Stocks tumbled in the outgoing week as worried investors' dumped their holdings amid concern on the looming impact of the single-digit interest rate on the banking business.

Due to coronavirus pandemic, stock markets around the world plummeted last week as it has become increasingly clear that the virus will take a huge toll on the global economy.

The situation is not different in Bangladesh too as many listed companies import their raw materials from China, which has been on shut for a month for the massive outbreak of the virus that has already killed 3,000 lives.

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 253 points or 5.34 per cent to settle at 4,480.

Market analysts said the central bank's latest directive on lending rates and the Supreme Court's order on GP to pay another Tk 10 billion to the telecom regulator within 90 days triggered sell-offs in the heavyweight banking and GP shares.

An analyst said the investors kept dumping major stocks fearing possible impact of the single-digit interest rate on the banking business as well as the country's overall economy.

The Bangladesh Bank (BB) has formally instructed banks to fix a maximum 9.0 per cent interest rate on all loans, except for credit cards, with effect from April 1.

A leading broker said the implementation of the single-digit interest rate may directly affect the banks' profits as the interest is the main source of banks' income.

Such a step will also slow down credit flow to the private sector, he noted.

The banking sector has already taken a hit from this policy change, as the sector lost 7.53 per cent value during the week.

The decision to roll back the postal saving scheme's yield rate to its previous level has also adversely affected the market, said an analyst.

A merchant banker said poor earnings disclosures by a number of large-cap companies also hit the investors' sentiment which prompted investors for selling shares.

Earnings of most of the companies failed to meet investors' expectations. Consequently, a section of investors liquidated their holdings which had an adverse effect on the index, he said.

Two other indices also closed lower. The DS30 index, comprising blue chips, plunged 100.43 points to finish at 1,492 and the DSE Shariah Index lost 44.90 points to close at 1,044.

The outgoing week saw five trading days as usual and all five sessions closed lower.

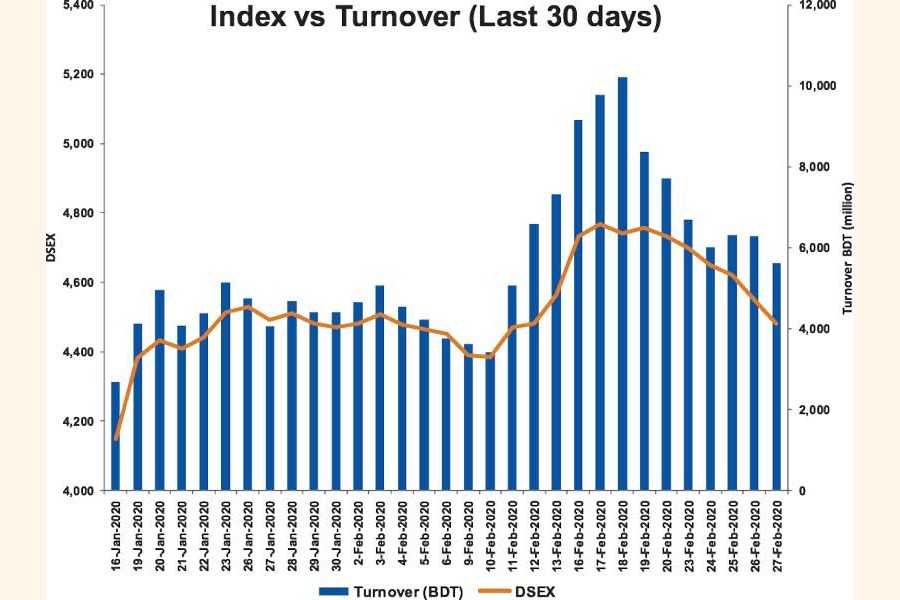

The weekly total turnover on the DSE stood at Tk 30.87 billion, down from Tk 45.21 billion in the week before.

The daily turnover averaged Tk 6.17 billion, down 32 per cent from the previous week's average of Tk 9.04 billion.

EBL Securities said the banks' reluctance to form a special fund for stock market investment even after two weeks of the central bank's declaration seemed to put investors in a doubt about a soon-to-be market recovery.

According to International Leasing Securities, investors liquidated their holdings considering the decline in the profitability of the banks due to the central bank move which might squeeze the dividend yield.

The food sector suffered most, losing 7.71 per cent, closely followed by banking with 7.53 per cent, telecom 7.11 per cent, power 5.10 per cent, financial institutions 4.74 per cent and engineering 4.45 per cent.