Three out of four companies have showed surprising performance in the Dhaka Stock Exchange after their transfer from the Over-the-Counter market in June last year.

Representatives of the companies claim that the mandatory reforms prior to the listing on the main market helped boost their businesses, but experts think a deeper look at the fundamentals may reveal whether the stocks' movement reflects the scenario on the ground.

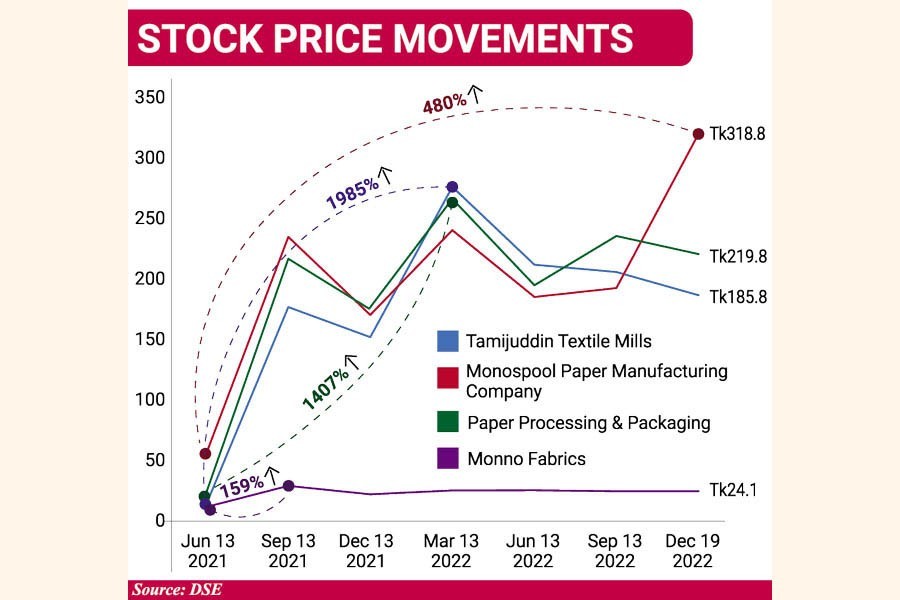

In the three months after the start of the trading in the main market, Paper Processing & Packaging shot up 1237 per cent to Tk 235.30. It kept on rising to Tk 313.70 on February 22 this year.

The share price has been corrected to Tk 219.8 each on Monday.

Two other companies -- Monospool Paper Manufacturing Company and Tamijuddin Textile Mills -- have also had abnormal hikes before settling at Tk 318.80 and at Tk 185.80 respectively on Monday.

In the four-member group, only Monno Fabrics suffered a decline to hit the floor at Tk 24.10 on the DSE on September 26. It has been stagnant there since.

Md. Ashequr Rahman, managing director at Midway Securities, said the companies could escape from rigorous reporting of their financial position when listed on the OTC market.

He expressed skepticism about the stock price rally observed after the listing on the DSE.

All the companies, however, registered three-digit profit growth year-on-year for the FY22.

The EPS of Paper Processing grew 245 per cent while Tamijuddin Textile Mills' 222 per cent, Monospool Paper's 343 per cent, and Monno Fabrics' 100 per cent.

The growths in income seem outstanding especially when it is taken into consideration that the companies had been delisted from the exchange's main board 13 years ago for poor performance.

The Bangladesh Securities and Exchange Commission (BSEC) launched the OTC market in September 2009, to facilitate the trading of de-listed companies. It also appointed independent directors at the companies to help ensure corporate governance.

The regulator in February last year accepted the companies' proposals to get relisted on the main board, subject to the fulfillment of some conditions, including the enhancement of their paid-up capitals.

Paper Processing and Monospool Paper had paid-up capitals of around Tk 30 million before the relisting. They increased the shareholders' equity to Tk 104.50 million and Tk 93.89 million by issuing stock dividends.

The companies' representatives said they would gradually fulfill the minimum paid-up capital requirement of Tk 300 million.

Two other companies -- Monno Fabrics and Tamijuddin Textile - have way more than the required capital as their shareholders' equity stands at Tk 1150 million and Tk 300.65 million.

"As per the regulatory conditions, the sponsor-directors sold a portion of their holdings to repay the bank loans," said Md. Emdadul Haque, company secretary of Monospool Paper.

Having the loan burden reduced, the company could return to the standard corporate practices, "which enhanced production", he said.

Even after the reforms, the stocks' movement looks abnormal.

On this, Managing Director of IDLC Investments Md. Moniruzzaman said investors in Bangladesh get influenced by the market trend. "So, sometimes it's very difficult to find the merit of a particular stock price hike."