A handful of low-cap companies pulled the index into the green this week as political tension eased a bit and large-cap companies remained reluctant to budge from the floor.

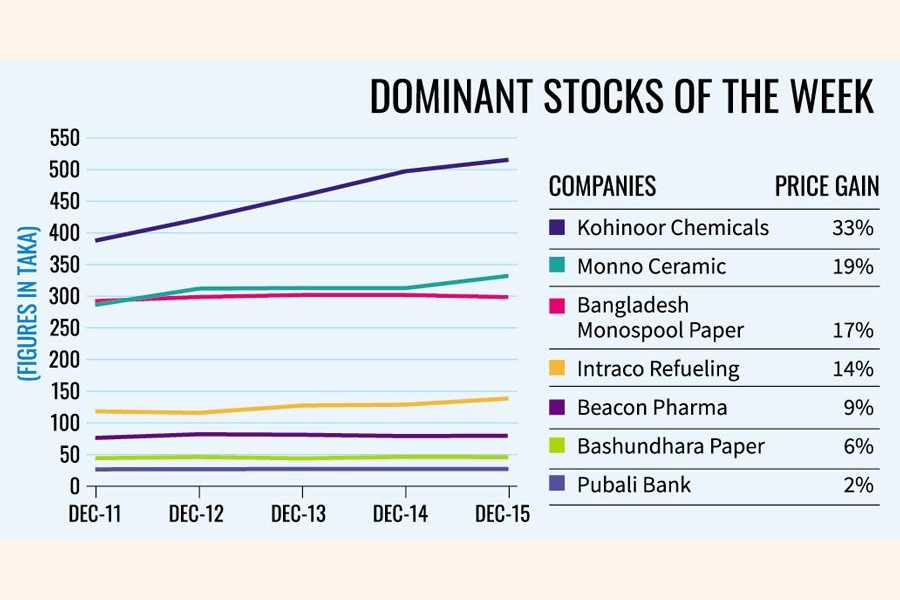

The stocks -- Kohinoor Chemicals, Beacon Pharma, Monno Ceramics, Interco Refueling Station, Pubali Bank, Bangladesh Monospool Paper Manufacturer and Bashundhara Paper Mills -- helped the market gain 17 points in the five-day period through Thursday, according to EBL Securities.

Overall, the benchmark index of the Dhaka Stock Exchange (DSE) went up 29 points, or 0.47 per cent, to settle the week at 6,256. It lost 17.55 points the week before.

The seven companies accounted for nearly 20 per cent of the weekly turnover of Tk 24.56 billion, increased from Tk 15.37 billion in the previous week.

The market movement has been largely dictated by the low-cap firms because the large-cap stocks, such as Grameen Phone and Square pharmaceuticals, have failed to attract investors while being stuck at the floor for the last several weeks, insiders say.

In fact, a majority of the issues have not moved from the floor for long. Of the 391 issues traded, 64 advanced, 30 declined and 297 issues remained unchanged on the DSE during the week.

The stocks that used to pull up or drag down the market have not been traded much because of the limited liquidation opportunities, said Mir Ariful Islam, managing director and CEO of Sandhani Asset Management.

Among the top ten large-cap companies in the prime bourse, nine have not seen any trade in the last few weeks.

As a result, the movement of low-cap stocks leads to a marginal loss or gain of the market. The trend has continued over the last two months.

Market operators say that though the market edged higher, investors' confidence is yet to rebound on the trading floor in the absence of any positive trigger.

Investors preferred to stay on the sideline after securing a short-term gain, said EBL Securities in its weekly market analysis.

The week began with optimism and continued positively for three straight sessions after "the alleviation of tension regarding the potential political unrest", it said.

Optimistic investors were active on the trading floor as the regulator urged insurers to come up with fresh investments in the market, said International Leasing Securities.

Moreover, the Capital Market Stabilization Fund (CMSF) provided Tk 200 million during the week in capital support to tackle the liquidity crisis.

"All the initiatives created a positive sentiment among the investors" rendering an increase in participation in the market, said the stockbroker.

The week's daily turnover averaged out at Tk 4.91 billion, up 60 per cent from the previous week's Tk 3.07 billion.

Salvo Chemicals became the week's turnover leader with shares worth Tk 1.75 billion changing hands, followed by Intraco Refueling Station, Monno Ceramic Industries, Bashundhara Paper Mills, and Genex Infosys.

Kohinoor Chemicals was the week's top gainer, soaring 32.94 per cent while Eastern Lubricants Industries was the worst loser, shedding 9.09 per cent.

Two other indices of the DSE also edged higher. The DS30 Index, comprising blue-chip companies, rose 4.09 points to close at 2,208 and the DSES Index advanced 11.35 points to finish at 1,373.

The Chittagong Stock Exchange also climbed up, with the CSE All Share Price Index rising 109 points to settle at 18,447 and its Selective Categories Index gaining 66 points to close the week at 11,053.

The port-city bourse traded 49.32 million shares and mutual fund units with a turnover value of Tk 1.12 billion.