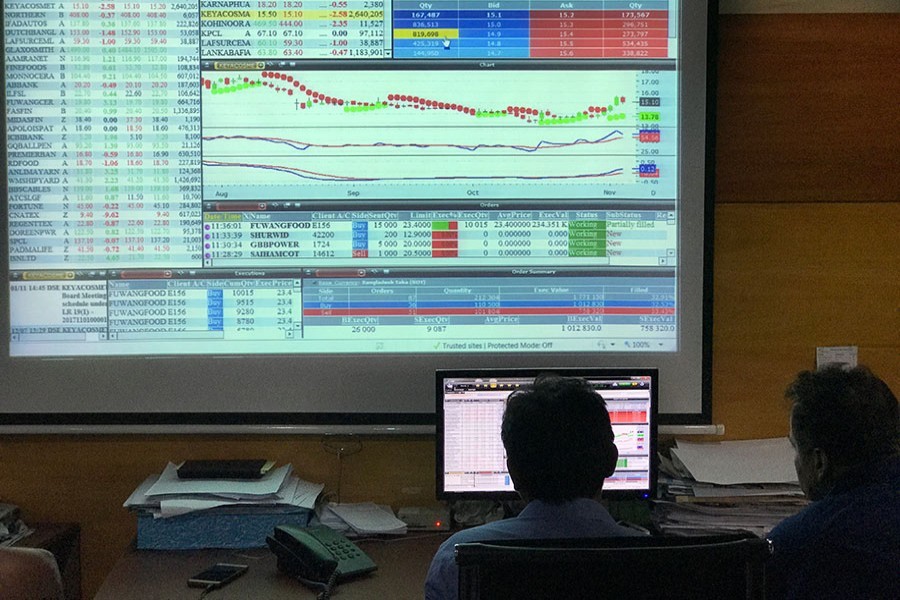

With a series of negative factors at play, worried investors continued to dump shares to ward off further losses, pushing the benchmark equities index lower for the second consecutive week that ended on Thursday.

Week on week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), dropped 82.76 points or 1.62 per cent to settle at 5013.

According to market analysts, a lack of investor confidence, the telecom regulator's wrangling with Grameenphone (GP), soaring non-performing loans and falling portfolio investment were among the factors behind the latest erosion in stock prices.

The growing concern stemming from a row between the telecom regulator and the GP over claims of unpaid dues prompted investors to sell off shares in the mobile phone operator, said a leading broker.

GP, the largest listed company in terms of market capitalisation, wiped out 5.29 per cent during the week to close at Tk 295.50 each on Thursday.

Its share price plunged more than 30 per cent in the past five months after the Bangladesh Telecommunication Regulatory Commission (BTRC) declared GP to be a significant market power.

The telecom regulator also threatened to cancel the licence of the GP over unpaid audit claims of more than Tk 125.79 billion.

On Thursday, the telecom regulator issued a show-cause notice to GP, asking the mobile operator to explain why their 2G and 3G licences would not be revoked for non-payment of audit claims.

About other factors, the broker said the financial sector is not performing well as investors are suffering from a confidence crisis due to soaring non-performing loans, which hit hard the banking sector stocks. The sector lost 1.90 per cent in the outgoing week.

Falling foreign portfolio investment in the country's capital market also dented the local investor confidence, he added.

The net foreign investment in DSE remained negative for the six consecutive months as of August, as the foreign investors bought shares worth Tk 1.77 billion and sold Tk 2.79 billion worth of shares, resulting in the net position of negative Tk 1.02 billion.

The outgoing week saw a total of five trading days as usual. Of them, first four sessions ended lower while the last session posted a marginal gain.

Like the benchmark index, two other market indices finished lower. The DS30 index, comprising blue chips, fell 42 points to close at 1,758 and the DSE Shariah Index lost more than 16 points to settle at Tk 1,167.

The weekly turnover on the prime bourse stood at Tk 19.73 billion, down from Tk 22.43 billion in the week before.

The daily turnover averaged out at Tk 3.95 billion, which was 12 per cent lower over the previous week's average of Tk 4.48 billion.

The International Leasing Securities said that as the investors are losing confidence in the market and looking for an exit, the DSEX came down close to 'psychological' 5,000-mark.

The stockbroker noted that investors have still been grappling with the financial market volatility.

The market capitalisation of the DSE also fell 1.66 per cent to Tk 3,745 billion on Thursday, from Tk 3,808 billion in the previous week.

Most of the major sectors showed negative performances, with telecom posting the highest loss, shedding 4.70 per cent, followed by non-bank financial institutions (2.70 per cent), banking (1.90 per cent), food (2.0 per cent), power (1.10 per cent) and textile (1.60 per cent).

Losers outnumbered the gainers, as out of 355 issues traded, 233 closed lower, 104 ended higher and 18 issues remained unchanged on the DSE floor in the outgoing week.

Monno Ceramic Industries dominated the week's turnover chart, with 4.78 million shares worth nearly Tk 1.09 billion changing hands during the week.

Kay & Que was the week's best performer, posting a gain of 22.12 per cent while Padma Islami Life Insurance was the worst loser, shedding 15 per cent.

The port city's bourse, Chittagong Stock Exchange (CSE), also ended lower, with its CSE All Share Price Index - CASPI - losing 317 points to settle at 15,263 and the Selective Categories Index - CSCX - shedding 191 points to finish the week at 9,266.