Dhaka bourse closed the week's first session with a moderate rise in broad index following investors' increased participation in transactions.

Major sectors of listed securities on Sunday played a market supportive role and helped Dhaka Stock Exchange (DSE) extend the gaining streak for seventh consecutive session.

The market opened the day's session positively and the DSE broad index DSEX continued an upward trend for an hour.

Later, the DSEX declined for half an hour and a recovery stance was observed after the midsession and the premier bourse closed the session with a moderate rise.

At the end of the session, the DSEX settled at 6497.39 with a rise of 0.71 per cent or 45.86 points.

The shariah based index DSES advanced 0.73 per cent or 10.35 points to close at 1426.07.

DS30 index comprising blue chip securities closed at 2373.80 with a rise of 0.76 per cent or 18.11 points.

Of 378 issues traded on Sunday, 202 advanced, 124 declined and 52 were unchanged on the premier bourse DSE.

Most of the large cap companies on Sunday saw price appreciation on the premier bourse DSE.

Of the companies which witnessed price appreciation, the share price of Grameenphone advanced 2.96 per cent, British American Tobacco Bangladesh Company 2.74 per cent, Square Pharmaceuticals 1.28 per cent, Robi Axiata 0.34 per cent and United Power Generation & Distribution Company 0.12 per cent.

On Sunday, the DSE posted a turnover of Tk 9.50 billion which was 8.57 per cent higher than the turnover of the previous session.

Of total turnover, Tk 292 million came from transactions executed in block board.

According to a market review of International Leasing Securities, stocks ended green for the seventh consecutive session following a significant recovery of 213.6 points in broad index throughout the last week.

"Investors put fresh bets on sector-wise issues as they have now confidence in the market amid rising turnover. Institutional fund flows to the large cap scrips created a vibe among the investors that caused a rise in investors' participation," said the International Leasing Securities.

Of the sectors which saw price appreciation, bank advanced 0.3 per cent, engineering 0.8 per cent, fuel & power 1.1 per cent, general insurance 3.2 per cent, life insurance 0.9 per cent, pharmaceuticals & chemicals 0.6 per cent, and telecommunication 2.1 per cent.

Of the sectors which witnessed price correction, financial institutions declined 0.1 per cent, paper & printing 0.3 per cent, tannery 0.4 per cent and textile 0.4 per cent.

Investors' participation was concentrated mostly on pharmaceuticals & chemicals sectors which grabbed 13.6 per cent of the market turnover followed by food & allied 12.7 per cent, textile 11.2 per cent and miscellaneous 8.8 per cent.

Beximco topped the scrip wise turnover chart with a value of Tk 386 million followed by BDCOM Online Tk 212 million, Shepherd Industries Tk 204 million, Fu Wang Food Tk 201 million and Orion Pharma Tk 197 million.

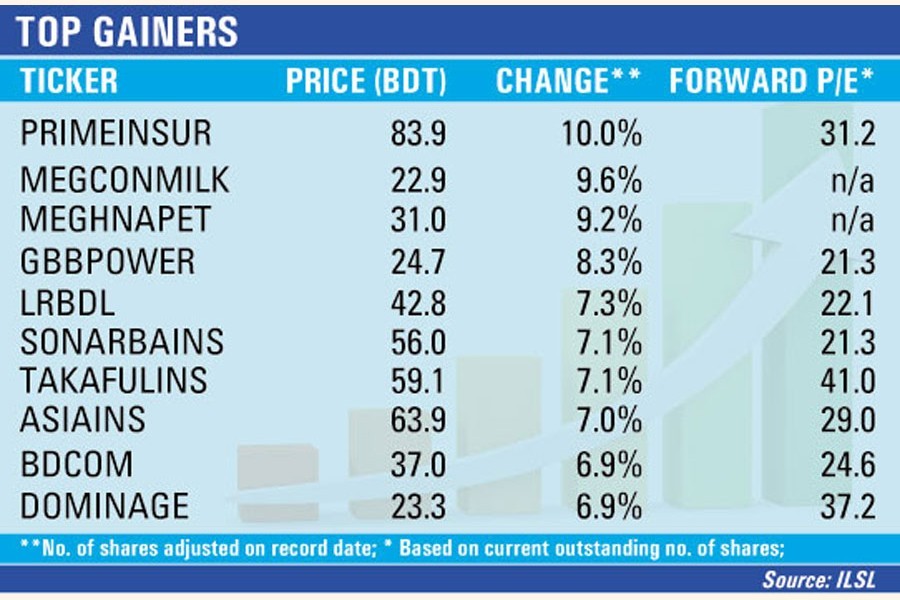

Prime Insurance Company was the number one gainer with a rise of 9.96 per cent or Tk 7.60 to close at Tk 83.90 each.

Standard Bank was the worst loser after declining 4.17 per cent or Tk 0.40 to close at Tk 9.20 each.

CASPI, benchmark index of Chittagong Stock Exchange (CSE), advanced 0.78 per cent or 147.61 points to close at 19039.35 on Sunday.

Of 303 issues traded, 173 advanced, 94 declined and 36 were unchanged and the port city bourse CSE posted a turnover of Tk 206.74 million.