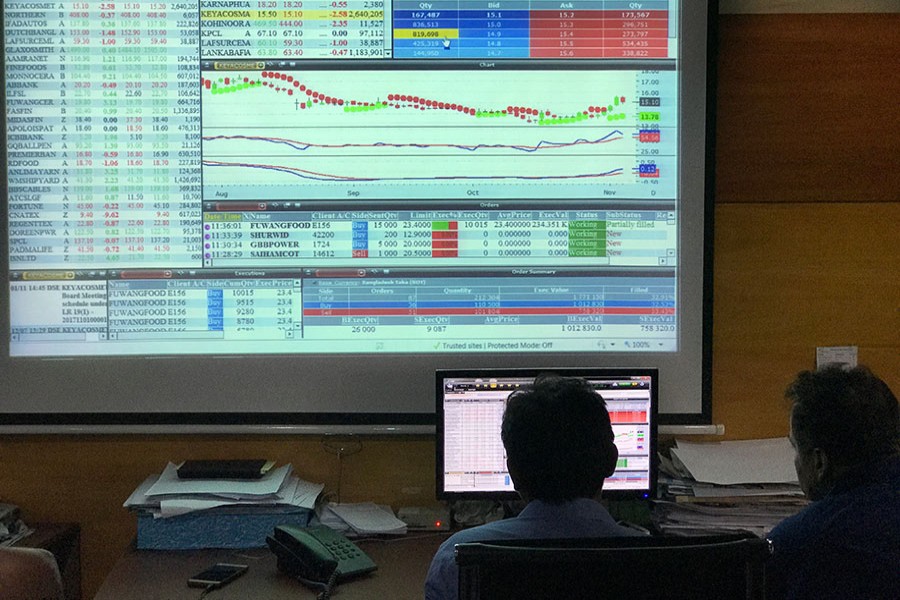

The net profit of the Dhaka Stock Exchange (DSE) gradually declined in last five fiscal years (FYs) as the 'trade volume' plummeted during the period.

The net profit of the prime bourse declined despite the revenue gradually rose in last five FYs.

The officials of the premier bourse said the increased cost for maintenance and construction and the newly-imposed tax on their income were blamed for the decline of the net profit.

According to the latest annual report, the exchange's net profit stood at above Tk 1.04 billion for the FY 2017-18. The amount was above Tk 1.23 billion in the FY 2016-17.

As a result, the net profit of the premier bourse declined 15.78 per cent or above Tk 195 million in the FY 2017-18 from the previous FY.

On the other hand, the revenue of the DSE increased in the FY 2017-18 from the value observed in the previous FY.

Asked, a DSE official said the greater part of their income mainly come from the trade volume.

"After the 2010-11 stock market debacle, the exchange's trade volume declined. That's why, the DSE's net profit plummeted in last five FYs," the DSE official said.

He also said another part of their income comes from the FDR (Fixed Deposit Receipt) whose interest rate also declined during the period.

The premier bourse enjoyed 100 per cent tax rebate till the FY 2015-16. After the demutualisation, the exchange came under tax net in the FY 2016-17, according to the DSE official.

In the FY 2016-17, the DSE paid 20 per cent of the stipulated amount of tax for non-listed companies.

The exchange paid 40 per cent of the stipulated amount of tax in the 2017-18.

"In this way, the tax holiday facility will be reduced fully and the exchange will pay tax like other non-listed companies. The non-listed companies pay tax at a rate of 35 per cent," the DSE official said.

The DSE reported net profit of above Tk 1.19 billion the FY 2015-16, above Tk 1.34 billion in the FY 2014-15 and above Tk 1.34 billion in the FY 2013-14.

"The exchange's cost also increased due to introduction of new trading software. The construction of DSE's own building at Nikunja was another reason behind the decline of net profit," the DSE official said.

The amount of the exchange's revenue was above Tk 2.09 billion in the FY 2017-18, above Tk 2.08 billion in the FY 2016-17, above Tk 1.87 billion in the FY 2015-16, above Tk 1.94 billion in the FY 2014-15 and above Tk 1.92 billion in the FY 2013-14.

The profit margin of the premier bourse gradually declined in last five FYs. The exchange's profit margin was 70 per cent in 2013-14, 69 per cent in 2014-15, 64 per cent in 2015-16, 59.51 per cent in 2016-17 and 50 per cent in 2017-18.

The profit margin is one of the commonly used profitability ratios to gauge profitability of a business activity. It represents how much percentage of sales has turned into profits.