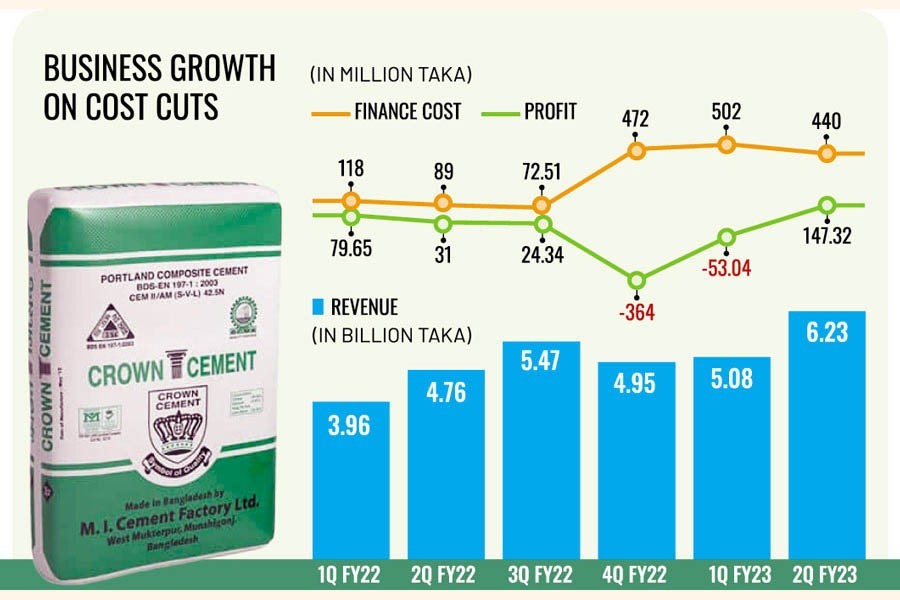

Crown Cement returned to profit in the second quarter of the FY23 ended in December, having suffered losses in the previous two quarters, as it boosted revenue while cutting down costs.

It secured a profit of Tk 147.32 million in the three months through December 2022 while the loss in the first quarter of the ongoing fiscal year was Tk 53.04 million.

The fourth quarter of the previous fiscal year ended in June 2022 was even worse, registering a loss of Tk 364 million. The huge negative earnings wiped out profits made in the rest of the FY22 and brought annual loss to Tk 229 million.

The cement manufacturer endured an "unprecedented" foreign exchange loss in the April-June quarter of 2022.

While the dollar remained strong against the taka, company Secretary Md. Mozharul Islam said Crown Cement reduced overhead costs and increased product prices and sales.

Product prices were up by 15.50 per cent. The sales revenue surged 31 per cent year-on-year to Tk 6.23 billion in the Q2 through December 2022.

In the same quarter, pricier imported raw materials caused a 22 per cent year-on-year rise in the cost of sales.

However, general and administrative expenses were slashed by 5.30 per cent while marketing, selling and distribution expenses by 5.12 per cent year-on-year in the October-December period of 2022.

"The company is trying to minimize costs as much as possible under the prevailing circumstances and focusing on increasing sales to offset the erosion in profit margins," Mr Islam said.

Despite the hefty profit in Q2 of the FY23, profit in the six months through December 2022 fell 15 per cent year-on-year to Tk 94.28 million.

The cement maker said that although its revenue increased in the six months through December 2022, remarkably high foreign exchange loss ate away at its profit.

The company's sales revenue jumped 29.56 per cent year-on-year to Tk 11.30 billion in July-December 2022.

On the other hand, the finance cost soared 354 per cent to Tk 942 million in the six months due to a foreign currency loss of Tk 660 million for the devaluation of the local currency.

The company translated its foreign currency liabilities at the exchange rate of Tk 93.5 per dollar through June 2022 while the rate was Tk 102.15 per dollar from then on up to the end of September 2022.

The cement manufacturer's short-term and long-term loans also rose by Tk 1103.70 million in the six months through December 2022 as it took loans for business expansion and to cover the additional cost of currency conversion.

Listed in 2011, the stock has been languishing at the floor price of Tk 74.40 since July 31, 2022.

There are 37 active cement factories in Bangladesh and more than Tk 300 billion has been invested in the industry, according to the Bangladesh Cement Manufacturers Association (BCMA).

Manufacturers have a combined annual production capacity of 58 million tonnes while the local demand is 33 million tonnes. Currently, Crown Cement's annual production capacity is 3.30 million tonnes.

Seven cement makers are listed on the bourses. Most of the listed cement companies' profits dropped, even some suffered losses in recent quarters due to the rising production costs, higher freight charges, and sharp devaluation of the local currency against the dollar on the back of the Russia-Ukraine war.

In such a challenging time, the top cement makers have expanded production capacity in anticipation of higher future demand while some are exporting cement to neighbouring countries.

Bangladesh exported cement worth $9.57 million in the FY22, increased from $7.26 million in the FY21. Crown Cement earned foreign remittance to the tune of about Tk 139 million in the latest fiscal year.