Stocks retreated into the red in the outgoing week to Thursday, as it appears that the prolonged bearish market may not fizzle out anytime soon.

In the absence of a major market trigger in these times of economic uncertainty, investor confidence continues to weaken, prompting them to liquidate their holdings while some others held to the sidelines, market insiders said.

On Thursday, the Bangladesh Securities and Exchange Commission (BSEC) lifted floor prices of 169 securities on Thursday but allowed them to fall only by 1 per cent in a day. Still, investors stayed away from the market.

The measure was expected to facilitate trading of the shares, thus increasing activities in the stock market. Instead, fewer transactions took place and turnover slumped to 29-month low on the day.

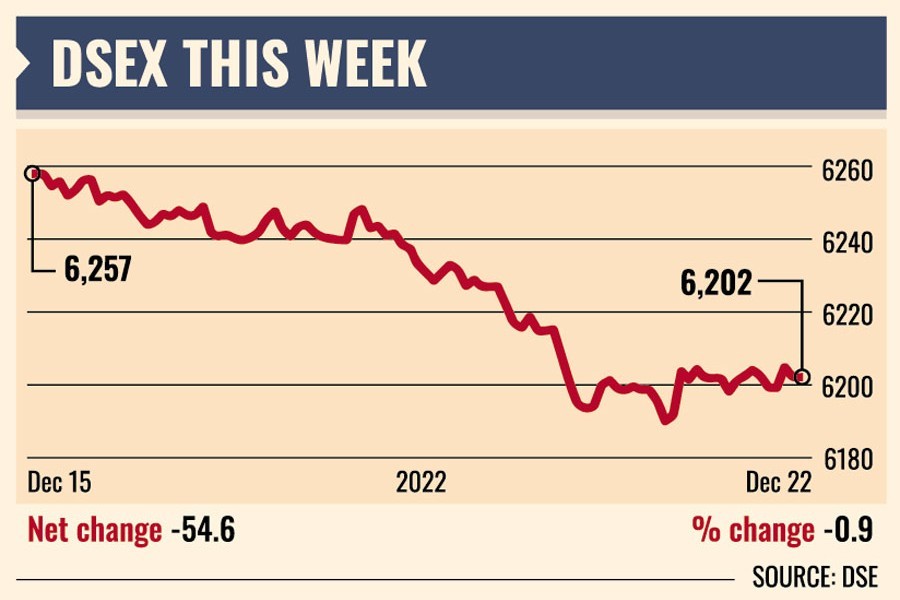

Of the five trading days this week, the first four sessions ended in the red while the last one managed to bounce back. DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), settled the week 54.61 points, or 0.87 per cent, lower at 6,202 after gaining 29 points in the week before.

Stocks returned to the downtrend amid a confidence crisis stemming from worries about the weakening macro-economy and dismal performance forecasts of the listed companies, said a merchant banker.

The ongoing depressed market situation, liquidity crunch and lack of institutional participation altogether eroded the investor confidence.

He said the liquidity in the market continued to be squeezed, with single-day turnover hitting two-and-a-half-year low in the last session of the week as investors were reluctant to put fresh bets on stocks.

"Large-cap stocks, which dominated the market earlier, also remained unmoved due to limited liquidation opportunities," he added.

Of 381 issues traded, only 19 advanced, 147 declined and 215 issues remained unchanged on the DSE.

The week's total turnover clocked in at Tk 16.81 billion, down from Tk 24.56 billion the previous week. And the daily turnover averaged out at Tk 3.36 billion, down 32 per cent from the previous week's average of Tk 4.91 billion.

The investors' confidence weakened due to depressing macroeconomic outlook and dismal earnings projections of the listed companies, said EBL Securities, in its weekly market analysis.

The prolonged bearish sentiment in the market has been exacerbated by the government's decision to slash the GDP growth target for FY'23 by 1 per cent which fueled the prevailing concerns over the sluggish economic output of the country.

Moreover, the regulator's decision to withdraw floor prices from certain issues put further strain on the ailing market, while the 1 per cent lower circuit breaker has yet to attract investors' participation at the current prices, as they preferred to take a wait-and-see approach amidst the current scenario of the market, it said.

The pharma sector dominated the turnover chart, grabbing almost 14.40 per cent of the week's total turnover, followed by engineering (12 per cent) and ceramics (11.5 per cent).

According to International Leasing Securities, stocks backed to the red after a single-week break as the risk-averse investors opted for liquidating their position to escape from further losses.

The jittery investors remained pessimistic and reluctant to make fresh investments in the stocks ahead of macroeconomic uncertainty in the coming year.

The regulator lifted floor prices of 169 stocks on Thursday. All the news caused thin participation of the investors in the market, the stockbroker said.

Monno Ceramics Industries emerged as the week's turnover leader with shares worth Tk 1.38 billion changing hands, followed by Intraco Refueling Station, Bashundhara Paper Mills, Monno Agro & General Machinery and Genex Infosys.

Sea Pearls Beach Resorts was the week's top gainer, soaring 12.31 per cent while Orion Infusions was the worst loser, shedding 26.66 per cent.

Two other indices of the DSE also edged lower. The DS30 Index, comprising blue-chip companies, shed 13.97 points to close at 2,194 and the DSES Index lost 15.32 points to finish at 1,357.

The Chittagong Stock Exchange (CSE) also ended lower with the CSE All Share Price Index (CASPI) losing 119 points to settle at 18,328 and its Selective Categories Index (CSCX) shedding 71 points to close the week at 10,981.