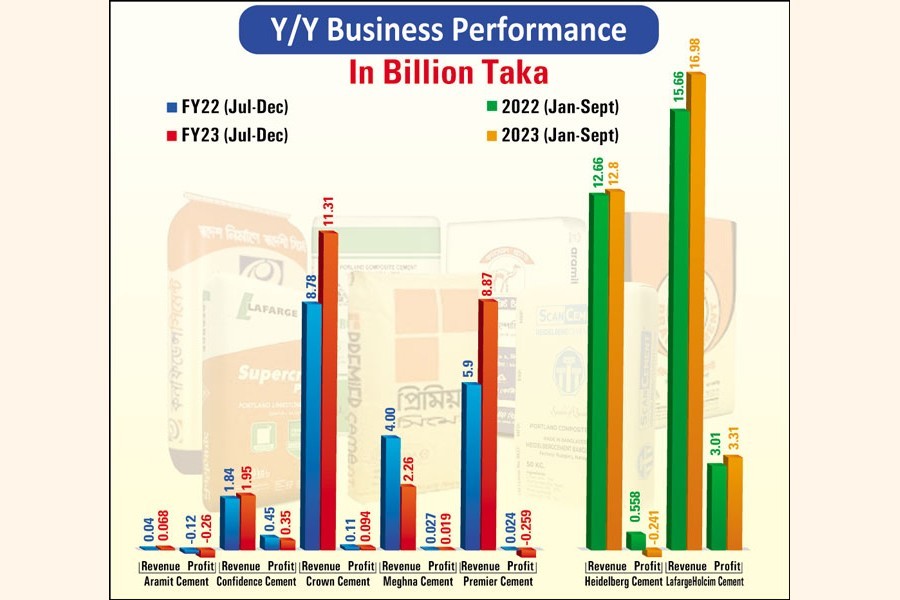

2022 was a year of bad business for the overall cement industry.

Out of the seven cement companies listed, three went into the red and three others saw their profit slowing down at 15-30 per cent.

LafargfeHolcim is the only cement manufacturer that posted a moderate year-on-year growth in profit -- 10 per cent -- in the nine months through September 2022.

The industry's decade-low performance in 2022 was rendered by soaring costs, a decline in development works, and a stiff competition among peers amid the acute crisis of the dollar, industry people say.

Except for LafargfeHolcim, the companies highly depend on imports for raw materials.

The rising prices of raw materials and energy in the global market and a sharp depreciation of the taka pushed up production expenses.

The taka lost its value by about 14.5 per cent in the first half of the FY23 because of the US dollar shortages. Since the Russia-Ukraine war, the currency has weakened by about 25 per cent, making imports expensive.

Aramit Cement's loss widened in July-December 2022, compared to the same period a year earlier. Its loss surpassed the revenue in the six months due to supply shortage of raw materials.

Company Secretary Syed Kamruzzaman said a lack of raw material and foreign exchange loss made the company suffer.

Aramit opened a letter of credit (LCs) for importing raw materials based on the greenback's value at Tk 86, he said, but at the time of the LC settlement, it soared to Tk 106.

"The dollar is still dearer; banks barely agree to open LCs for raw material imports until they are offered an above-market exchange rate," Mr Kamruzzaman said.

Premier Cement Mills PLC entered into the losses in the six months to December 2022. Its losses amounted to Tk 259 million in July-Dec 2022, while it made a profit of Tk 24.46 million in the same period of the previous fiscal year.

Company Secretary Kazi Md Shafiqur Rahman said the company could not avoid losses even though the sales revenue jumped 50 per cent, supported by intensified marketing strategies and capacity expansion by more than three times to 25,520 tonnes a day.

"Raw material prices eased a bit in the recent months but we are still facing challenges in opening letters of credit for imports," he said.

The top-tier cement producer incurred an annual loss of Tk 1.12 billion in the FY22 as against a profit of Tk 652 million the year before, mainly for higher costs of raw materials and shipping charges.

Multinational cement maker Heidelberg Cement also reported a loss of 241.31 million in the nine months through September 2022 while it made a profit of Tk 558.52 million in the same period a year ago.

The company blamed the loss on higher costs of raw materials and shipping charges.

Only LagargeHolcim posted an 8.4 per cent revenue growth and 10 per cent growth in profit year-on-year in the nine months through September, riding on innovation, new product, and new distribution channels.

Heidelberg and LagargeHolcim's financial year ends in December while the rest follow the June-July fiscal year.

"The success in the nine months (Jan-Sept) entirely comes from the strong topline growth. Our new products and new business channels gained traction," said Rajesh Kumar Surana, chief executive officer of LafargeHolcim Bangladesh, earlier.

Digital innovation and development of new business segments contributed strongly to the topline growth, Mr Surana added.

LafargeHolcim Bangladesh has a unique edge in business as it depends on own sources of the core raw material -- limestone -- from mines in Meghalaya, India, which is transported to its Chhatak, Sylhet factory through a conveyor belt.

That helped the company avert freight charges and international raw material market volatility, while the profitability of its competitors swayed on these factors.

There are 37 active cement factories in Bangladesh and more than Tk 300 billion has been invested in the industry, according to Bangladesh Cement Manufacturers Association (BCMA).

Manufacturers have a combined annual production capacity of 58 million tonnes against a local demand of 33 million tonnes.

Despite challenges, the top cement makers have been enhancing production capacity expecting a growth in demand in future while some export cement to neighboring countries.

Bangladesh exported cement worth $9.57 million in the FY22, up from $7.26 million in the FY21.