Stocks kept losing for the two straight weeks that ended on Thursday after the government passed a bill to bring surplus money of state and autonomous agencies to the national exchequer.

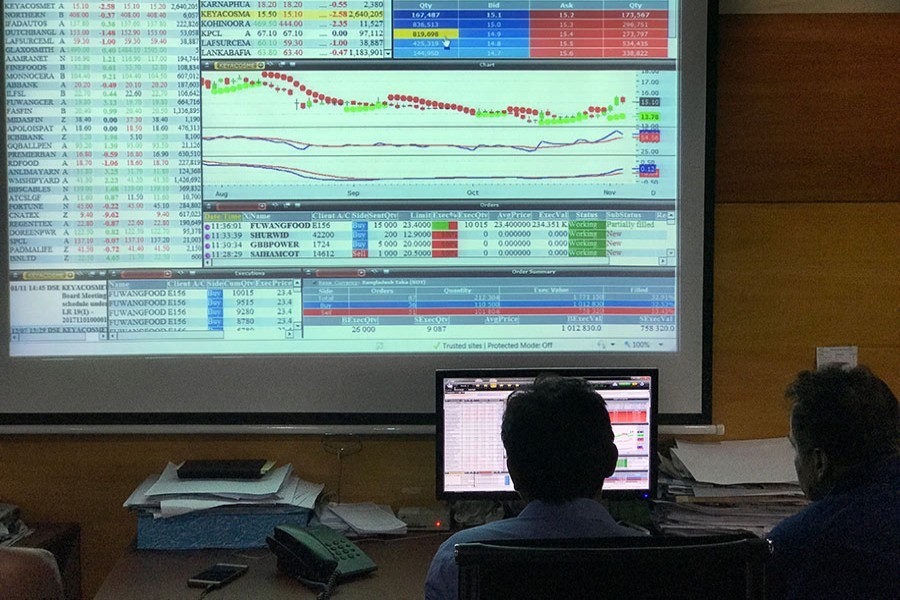

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 16.70 points or 0.37 per cent to settle at 4,452.

Market experts said poor earnings, falling export and private sector's credit growth coupled with no progress of the government's recent moves to stabilise the market dampened investors confidence.

Lower-than-expected earnings of most of the companies and fresh concern over the tussle between Grameenphone and telecom regulator also made investors cautious, said a leading broker.

He noted that a bill over depositing surplus money of state owned entities to the national exchequer was passed, which also eroded investor confidence.

The government passed a bill Wednesday in the parliament to bring the surplus money of 61 state and autonomous agencies to the state coffer.

"Most of the investors are in fear of negative effects on the stock market after government decided to bring the surplus money of the state and autonomous agencies to the national exchequer," commented EBL Securities.

Two other indices also ended lower. The DS30 index, comprising blue chips, fell 10.18 points to finish at 1,513 and the DSE Shariah Index also saw a fractional loss of 0.88 point to close at 1,027.

The outgoing week saw five trading days as usual. Of them, first two sessions saw positive note while last three ended lower.

The weekly total turnover on the prime bourse stood at Tk 22.22 billion, slightly down from Tk 22.25 billion in the week before.

The daily turnover averaged Tk 4.44 billion, down 0.15 per cent, from the previous week's average of Tk 4.45 billion.

According to International Leasing Securities investors confused about the market movements over the macro-economic outlook like dwindling export earnings coupled with lethargic private sector credit growth.

The stockbroker noted that desolation of the recent government's initiatives to calm down the ailing capital market, fresh tussle between GP and telecom regulator prompted the investors to go for liquidation of their holdings.

Some of the investors opted for rebalancing their portfolios based on the recent quarterly earnings disclosures, said the stockbroker.

Among the major sectors, cement suffered most, losing 4.90 per cent, followed by banking with 1.92 per cent, non-bank financial institutions 1.90 per cent, textile 0.70 per cent and food 0.30 per cent.

On the other hand, power, telecom and pharma sectors gained 1.10 per cent, 1.0 per cent and 0.60 per cent.

The market capitalisation of the DSE also fell 0.13 per cent to Tk 3,404 billion on Thursday, from Tk 3,408 billion in the previous week.

However, gainers outnumbered the losers, as out of 358 issues traded, 173 closed higher and 152 ended lower while 33 issues remained unchanged on the DSE floor in the outgoing week.

LafargeHolcim dominated the week's turnover chart for the third straight weeks with shares worth Tk 1.56 billion changing hands during the week.

Phoenix Finance First Mutual Fund was the week's best performer, posting a gain of 23.88 per cent while the United Airways was the worst loser, losing 15.79 per cent.

The Chittagong Stock Exchange (CSE) also ended lower, with its CSE All Share Price Index - CASPI - losing 44 points to settle at 13,542 and the Selective Categories Index - CSCX - shedding 24 points to finish the week at 8,211.

Here too, the gainers beat the losers as 160 issues closed higher, 127 ended lower and 20 remained unchanged during the week

The port city bourse traded 45.33 million shares and mutual fund units worth Tk 970 million in turnover last week.