Stocks extended the winning streak for a second week straight to Thursday as the optimistic investors kept their buying binge on sector-specific issues in anticipation of quick gains.

Of the five trading days this week, only one session suffered losses while four others closed higher amid increased participation of investors.

Investors chased the lucrative shares throughout the week in the hope that hardships on the macroeconomic front will ease, as the country is close to getting the International Monetary Fund loan loomed, market operators said.

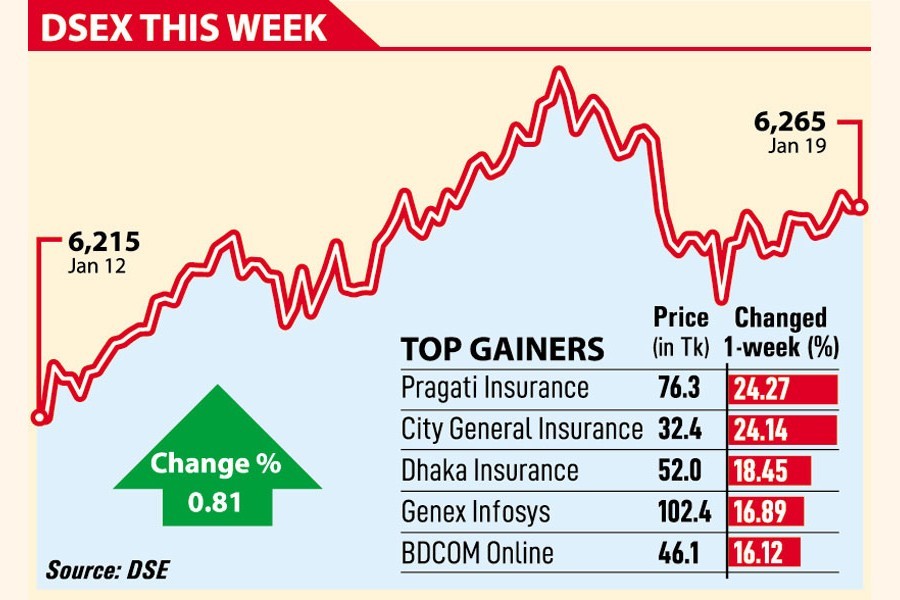

Week on week, DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), gained 50.39 points, or 0.81 per cent to settle at 6,265. The index added over 71 points in the past two weeks.

General investors seemed to be encouraged to put bets on some oversold stocks because of the regulator's assurance to keep the 'floor price' in place for now. The 'favourable monetary' policy also helped them gain confidence.

"Despite some volatility, as recently announced monetary policy and the regulators' efforts to ease the banks' capital market exposure have created some optimism among investors," said EBL Securities in its weekly analysis.

The week started on a positive note due to the continuation of buying spree on sector-specific issues that are expected to be somewhat immune to earnings volatility caused by recent macroeconomic adversities, the stockbroker said.

This recent news of the possibility of a future fund inflow of around Tk 60 billion through the easing of banks' capital market exposure has provided support to carry on the momentum, the stockbroker said.

However, the market witnessed a major setback in the fourth session of the week owing to cautious investors' reaction to a staggering hike in fuel and energy prices for industrial and commercial sectors, it added.

Investors' participation in the market continued to soar this week, leading the total weekly turnover to Tk 38.51 billion, an 82 per cent increase over the week before. The average daily turnover stood at Tk 7.70 billion as against Tk Tk 4.24 billion in the previous week.

"Some big investors, including institutional investors, were putting fresh bets on lucrative stocks which pushed the market turnover and index higher," said Md. Sajedul Islam, senior vice president of the DSE Brokers Association of Bangladesh.

The general investors are getting their confidence back gradually following various initiatives taken by the regulators, said Mr Islam, managing director of Shyamol Equity Management.

Investors were mostly active in the IT sector, capturing 19.6 per cent of the weekly turnover, followed by pharmaceuticals (12.8 per cent) and life insurance (10.6 per cent).

Most of the sectors ended in the green, with general insurance posting the highest gain of 7.80 per cent as the top three weekly gainers came from the insurance sector.

"The institutional investors move forward to support the market in line with the regulator's encouragement," said International Leasing Securities.

The central bank unveiled an accommodative but cautious monetary policy for the second half of the 2023, aiming to achieve maximum growth with curbing inflationary pressures on the economy which helped to boost the investors' confidence, said the stockbroker.

However, some investors remained cautious as the government hiked gas prices up to 179 per cent for power, industries, and commercial sectors, said the stockbroker.

The latest increase of gas and electricity tariff may further strain the profitability of already struggling manufacturing companies.

Buyers had been concentrated on selective stocks while the majority of stocks remained stuck at the 'floor price' level. Of 389 issues traded, 207 remained unchanged, 114 advanced while 68 declined on the DSE floor.

Genex Infosys became the week's turnover leader with shares worth Tk 2.92 billion changing hands, followed by Bangladesh Shipping Corporation, Bashundhara Paper Mills, Orion Pharma and Aamra Networks.

Pragati Insurance was the week's top gainer, rising 24.27 per cent while Orion Infusions was the worst loser, shedding 4.87 per cent.

Two other indices of the DSE also ended higher. The DS30 Index, comprising blue-chip companies, rose 9.56 points to close at 2,208 and the DSES Index gained 10.15 points to finish at 1,367.

The Chittagong Stock Exchange (CSE) also ended higher with the CSE All Share Price Index (CASPI) rising 123 points to settle at 18,476 and its Selective Categories Index (CSCX) gaining 74 points to close the week at 11,072.