Stocks notched a second week of gains, as investors started coming off the sidelines to join the market rally, optimistic about improved economic outlook in coming days.

Out of the five trading days this week, four sessions closed higher, thanks to higher participation of retail investors.

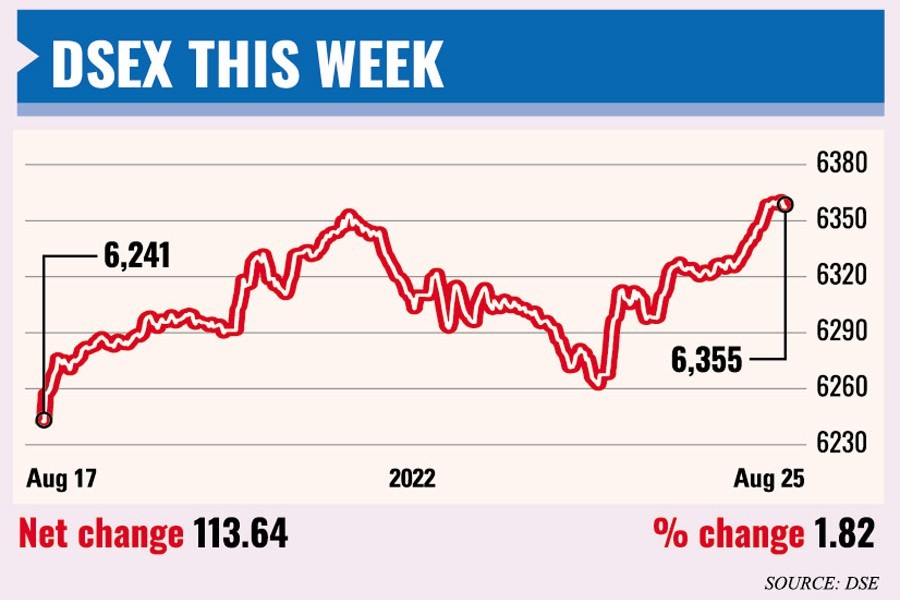

DSEX, the key index of the Dhaka Stock Exchange (DSE), climbed 113.64 points or 1.82 per cent to settle the week at 6,355.07. The DSEX surged a total of 206 points in the past two consecutive weeks.

Market operators said stocks remained afloat as investors put fresh funds on major sector stocks amid growing confidence in the market.

Gradual stability of the exchange rate in the country and a move to import fuel oil from Russia has lifted investor sentiment, said a merchant banker.

Stocks ended higher owing to the slight mitigation of investors' concern regarding the future pessimistic outlook of the economy, said EBL Securities, in its weekly market review.

The stockbroker noted that the market witnessed a substantial bull run as investors injected fresh funds, indicating growing confidence in the market.

The stock market remained bullish amidst enthusiastic participation as the investors are more confident and buoyant to put fresh bets anticipating positive momentum ahead, said International Leasing Securities.

Besides, Bangladesh is contemplating importing Russian oil that will decrease the fuel prices as well as inflation in the country, said the stockbroker.

"All the measures taken have tempted the investors to remain active on the trading floor," said the stockbroker.

The week's total turnover stood at Tk 69.34 billion on the prime bourse as against Tk 28.39 billion in the previous week with only three trading days.

The daily turnover averaged out at Tk 13.86 billion, up 47 per cent over the previous week's average of Tk 9.46 billion.

The textile sector dominated the turnover chart, capturing 17 per cent of the week's total turnover, followed by pharmaceuticals (14 per cent) and miscellaneous (12 per cent).

Two other indices of the DSE also ended higher this week. The DS30 Index, comprising blue-chip companies, rose 47.03 points to close at 2,267.35 and the DSES Index advanced 24.23 points to finish at 1,390.61.

Major sectors posted gains. The non-bank financial institutions booked the highest gain of 6.33 per cent, followed by pharma with 2.29 per cent, power 1.05 per cent, food 0.83 per cent, banking 0.53 per cent, engineering 0.50 per cent and telecom 0.18 per cent.

Gainers took a strong lead over the losers, as out of 389 issues traded, 191 closed higher, 114 lower and 84 issues remained unchanged on the DSE floor.

Beximco became the week's most-traded stock with shares worth Tk 4.77 billion changing hands, followed by Orion Pharma (Tk 3.46 billion), Bangladesh Spinning Corporation (Tk 1.84 billion), LafargeHolcim (Tk 1.79 billion) and Delta Life Insurance (Tk 1.68 billion).

Orion Infusion was the week's top gainer, advancing 50.89 per cent while Bangladesh Industrial Finance Company was the day's worst loser, shedding 16.81 per cent.

The Chittagong Stock Exchange (CSE) also extended the gaining streak with the CSE All Share Price Index (CASPI) soaring 273 points to settle at 18,643 and its Selective Categories Index (CSCX) rising 167 points to close the week at 11,172.

Of the issues traded, 165 advanced, 103 declined and 83 issues remained unchanged on the CSE trading floor.

The port-city bourse traded 57.76 million shares and mutual fund units with a turnover value of Tk 1.68 billion.