Stocks witnessed yet another bearish week to Thursday, the shortened week after Eid vacation, as jittery investors remained in selling mode amid growing macroeconomic worries.

This week saw three trading days as the market remained closed for the first two days on the occasion of Eid-ul-Azha and all the three sessions closed in the red.

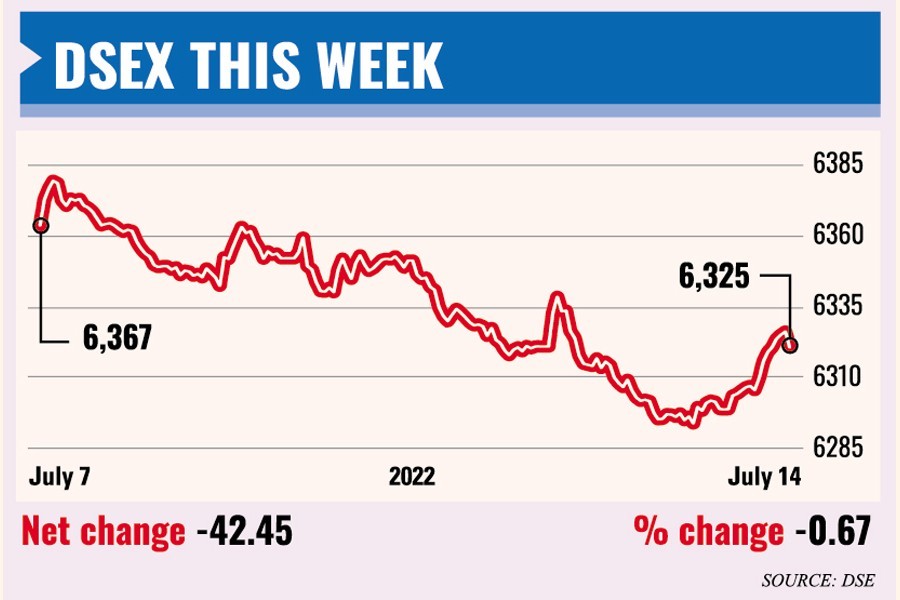

Week on week, DSEX, the key index of Dhaka Stock Exchange (DSE), slipped 42.45 points or 0.67 per cent to settle at 6,324.50. DSEX lost over 52 points in the past two weeks.

Market operators said the market outlook remains bleak as investors are concerned over several macroeconomic issues such as shrinking foreign currency reserves, depreciating local currency and high inflationary pressure.

The looming uncertainty over the global economy and the commodity market instability continued to dampen the investor sentiment, said a merchant banker, seeking anonymity.

"The ongoing bearish sentiment coupled with inflationary pressure and volatile foreign exchange market created a confidence crisis among the investors," he said.

The news of foreign-exchange reserves falling below $40 billion level for the first time in two years also made investors shaky, he said.

The stock market passed a gloomy week after the Eid vacation as the investors remained cautious amid growing macroeconomic worries fuelled by power cuts in the several regions in the country due to the shortage of natural gas supply, according to International Leasing Securities.

According to EBL Securities, the market saw three consecutive negative sessions this week as investors remained pessimistic about the market outlook amidst growing macroeconomic concern.

"Shrinking foreign currency reserves, widening current account deficit, high inflationary pressures are the key macroeconomic issues concerning the investors," said the stockbroker.

Two other indices of DSE also ended lower this week. The DS30 Index, comprising blue-chip companies, dropped 19.92 points to close at 2,273.85 and the DSES Index, which represents Shariah-based companies, fell 10.54 points to finish at 1,377.35.

The week's total turnover dropped to Tk 19.62 billion on the prime bourse as against Tk 38.14 billion in the week before.

The daily turnover averaged out at Tk 6.54 billion, down 14 per cent over the previous week's average of Tk 7.63 billion.

The investors' activities were mostly focused on the textile sector, capturing 18 per cent of the week's total turnover, followed by miscellaneous sector (11 per cent) and engineering sector (10 per cent).

Major sectors suffered losses, with the general insurance sector posting the highest loss of 2.30 per cent, followed by miscellaneous (2.28 per cent), cement (1.60 per cent), telecoms (1.50 per cent), pharma (0.80 per cent), food (0.40 per cent), engineering (0.30 per cent) and banking (0.10 per cent).

On the other hand, power and textile sectors gained 0.30 per cent and 0.10 per cent respectively.

Losers took a strong lead over the gainers, as out of 388 issues traded, 234 declined, 114 advanced and 39 issues remained unchanged on the DSE trading floor.

Junk stock Meghna Condensed Milk Industries was the week's top gainer, posting a 23 per cent gain, while Janata Insurance was the worst loser, shedding 8.60 per cent.

The Chittagong Stock Exchange (CSE) ended lower with the CSE All Share Price Index (CASPI) losing 156.43 points to settle at 18,595.40 and its Selective Categories Index (CSCX) losing 94.99 points to close the week at 11,143.25.

Of the issues traded, 210 declined, 96 advanced and 23 issues remained unchanged on the CSE trading floor.

The port-city bourse traded 20.45 million shares and mutual fund units with turnover value of Tk 615 million.