Stocks rebounded strongly in the week to Thursday, paring two weeks of losses, amid high optimism as the securities regulator reintroduced the 'floor price' for all the equities.

Continuous fall of share prices prompted the Bangladesh Securities and Exchange Commission (BSEC) imposed the 'floor price' again, which came into effect on Sunday.

Following the regulatory intervention, the market skyrocketed as investors rushed to pour fresh funds. All the five trading days of the week ended higher as prices of most of the securities jumped automatically on the first day of the week due to 'floor price' adjustment.

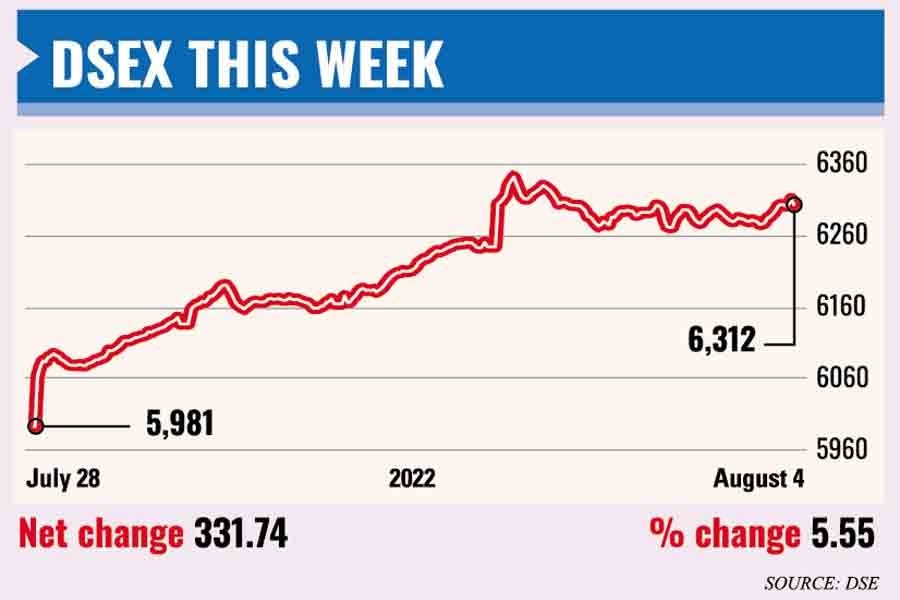

The benchmark DSEX index of the Dhaka Stock Exchange (DSE) finally ended the week 331.74 points or 5.55 per cent higher at 6,312.25, after losing 396 points in the previous four consecutive weeks.

Two other indices of DSE also ended higher this week. The DS30 Index, comprising blue-chip companies, rose 120 points to close at 2,265 and the DSES Index jumped 67 points to finish at 1,375.

Market operators said the regulatory intervention halted the market fall as the bargain hunters showed their buying appetite for the stocks available at a lucrative price after the recent price erosion.

The market witnessed a substantial increase in participation as the investors put fresh funds on lucrative issues anticipating that the market would not fall further due to floor price, said a merchant banker.

Some positive economic indicators such as rise in remittance inflow, declining imports, falling inflation and positive export growth also prompted investors to put fresh funds on stocks, he added.

"The investors were more confident and buoyant to put fresh bets anticipating positive momentum in coming months," he said.

Meanwhile, Bangladesh Bank on Thursday issued a circular approving a new calculation method relating to banks' exposure to the capital market.

As per the new method, effective immediately, the cost prices of the stocks will now be considered during the calculation.

"The banks' capital market exposure calculation on the cost price basis of stocks will reduce the sale pressure from the banks in coming months," said the merchant banker.

"All the regulatory measures created a bullish vibe in the market that led to higher participation of the investors," said International Leasing Securities.

According to EBL Securities, the reinitiating of floor price by the regulator coupled with the finance ministry's recommendation to calculate banks' capital market exposure at cost price basis boosted the investors' optimism.

"Record remittance inflow in July and growth in exports are some of the leading indicators that the country's economy is recovering from its gloomy phase," said the stockbroker.

The floor price may curb the market turnover in the coming days as it might hinder the opportunity for prompt liquidation of the securities, said an asset manager, seeking anonymity.

The imposing floor price may stop the index from sliding in the short run, but it will slow the movement of the market in the long run, he said.

The week's total turnover on the DSE also jumped to Tk 50.58 billion as against Tk 31.69 billion in the previous week.

The daily turnover averaged out at Tk 10.12 billion, up nearly 60 per cent over the previous week's average of Tk 6.34 billion.

The textile sector kept its dominance on the turnover chart, capturing 24 per cent of the week's total turnover, followed by miscellaneous (11 per cent) and pharmaceuticals (10 per cent).

All the sectors witnessed heavy buying pressure, leading to the share price surge of more than 96 per cent of stocks. Out of 388 issues traded, 373 advanced, seven declined and eight issues remained unchanged on the DSE.

Bangladesh Industrial Finance Company (BIFC) was the week's top gainer, soaring 35.10 per cent while United Insurance Company was the worst loser, losing 8.40 per cent.

Among the major sectors, the miscellaneous saw the highest gain of 10.70 per cent, followed by textile (8.40 per cent), cement (8.10 per cent), financial institutions (6.50 per cent) and banking sector (4.70 per cent).

The Chittagong Stock Exchange (CSE) also rebounded strongly with the CSE All Share Price Index (CASPI) jumping 944 points to settle at 18,541 and its Selective Categories Index (CSCX) rising 567 points to close the week at 11,109.

Of the issues traded, 327 advanced, nine declined and nine issues remained unchanged on the CSE trading floor.

The port-city bourse traded 36.82 million shares and mutual fund units with turnover value of Tk 906 million.