Stocks bounced back in the outgoing week to Thursday, snapping a three-week losing streak, as bargain hunters put fresh bets on some selective stocks, although investors' participation continued to decline amid persisting economic headwinds.

Surge in prices of pharma stocks such as Beacon Pharma and Beximco Pharma helped the benchmark equity index close in the green, market insiders said.

The pharma sector gained 2.90 per cent while Beacon Pharma and Beximco Pharma jointly contributed almost 28 points to the index during the week.

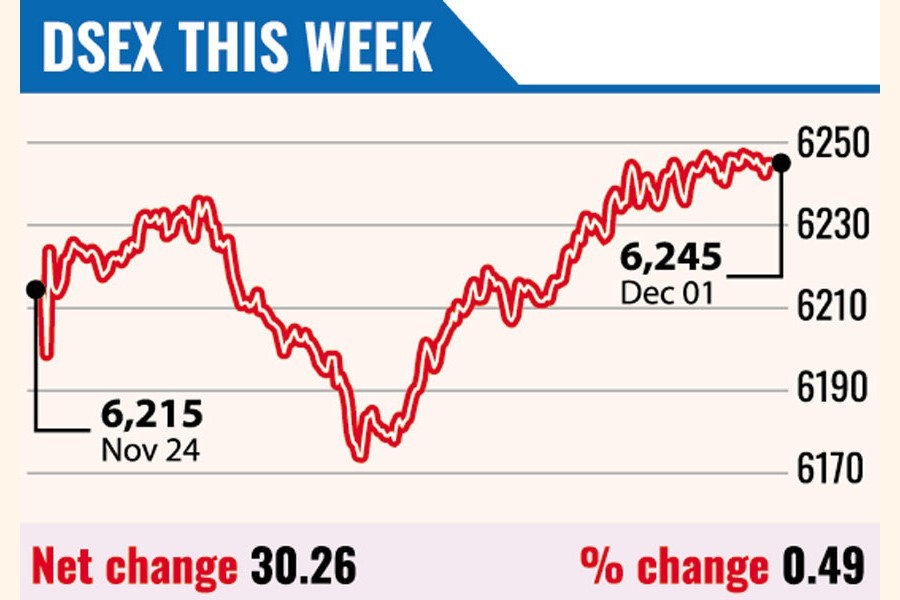

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), edged up 30.26 points, or 0.49 per cent, to settle the week at 6,245, after losing 196 points in the past three straight weeks.

Of the five trading days this week, the four sessions closed higher while one suffered loss.

Trading was restricted to only a handful of stocks as most stocks remained stuck at floor price over the past few weeks, said a merchant banker.

"The investors' participation has yet to rebound across the bourse as liquidation opportunities got squeezed since the majority of scrips remained stuck at the floor," he said.

Stocks rebounded from a month-long bearish trend and ended on green this week as investors have begun to show their interest on some sector-specific stocks, said EBL Securities in its weekly analysis.

However, funds in the market have still remained stuck as most of the stocks have continued to lie on the floor. The investors still preferred to remain on the sidelines, causing the average turnover to decline.

According to International Leasing Securities, the country's businesses and economic activities continued to slow down due to the inflation, dollar crisis and inefficiency of the banking sector.

General people prefer to hold cash to meet the high-cost living standard instead of making any investment or bank deposit. As a result, money flow to the bank as well as the capital market is shrinking, said the stockbroker.

The week's total turnover amounted to Tk 20.25 billion on the prime bourse, down from Tk 20.68 billion in the previous week. And the daily turnover averaged out at Tk 4.05 billion, down 2.10 per cent from the previous week's average of Tk 4.13 billion.

The country's economy has been under pressure in recent months due to inflation, increasing external debts, volatility on the foreign exchange market, depleting foreign reserves, widened trade deficit and energy crisis, said a leading broker.

However, a robust export performance coupled with remittance rebound has raised hopes as Bangladesh's earnings from merchandise shipment crossed the $5-billion mark for the first time in November.

Inward remittance also stood at $1.59 billion in November, up 4.5 per cent from October, according to data from the Bangladesh Bank.

Of 367 issues traded, 56 advanced, 40 declined and 271 remained unchanged on the DSE floor.

The small-cap IT sector dominated the turnover chart, grabbing 21.5 per cent riding on sector leader Genex Infosys, closely followed by pharma sector (16.5 per cent) and life insurance (15 per cent).

Major sectors posted gains with pharma booked the highest gain of 2.90 per cent, followed by food with 0.25 per cent, banking 0.12 per cent, power 0.10 per cent and engineering 0.09 per cent.

Genex Infosys kept its dominance in the week's turnover chart with shares worth Tk 1.29 billion changing hands, followed by Bashundhara Paper Mills, Aamra Network, Chartered Life Insurance and Orion Pharma.

Jute Spinners -a junk stock-was the week's top gainer, soaring 22.30 per cent while Orion Infusion was the worst loser, shedding 20.40 per cent.

Two other indices of the DSE also edged higher. The DS30 Index, comprising blue-chip companies, gained 26.46 points to close at 2,216 and the DSES Index advanced 16.21 points to finish at 1,370.

The Chittagong Stock Exchange (CSE) also rebounded, with the CSE All Share Price Index (CASPI) gaining 80 points to settle at 18,419 and its Selective Categories Index (CSCX) advancing 49 points to close the week at 11,036.

Of the issues traded, 40 declined, 39 advanced and 169 issues remained unchanged on the CSE trading floor.

The port-city bourse traded 13.72 million shares and mutual fund units with turnover value of Tk 488 million.

babulfexpress@gmail.com