Stocks bounced back in the outgoing week that ended on Thursday, with turnover gaining momentum as bargain hunters, buoyed by regulatory moves, chased sector-specific shares.

As the two regulators concerned remained stuck to their past decisions, stock investors seemed to be encouraged to put bets on some oversold stocks, market insiders said.

The Bangladesh Securities and Exchange Commission (BSEC) reiterated that the floor price won't be withdrawn until the secondary market gets the due momentum while Bangladesh Bank governor hinted that the bank interest rate-cap will not be lifted anytime soon.

General investors increased their participation anticipating that the market would not fall further due to the assurance from the BSEC, said a merchant banker.

However, the latest increase of 5 per cent in electricity tariff at the consumer level may further strain the profitability of already struggling manufacturing companies, he said.

Meanwhile, the central bank is set to unveil monetary policy for the second half of the current financial year tomorrow (Sunday), aiming to curb inflation and propel the private-sector credit growth amid ongoing economic challenges.

Of the five trading days this week, the first two sessions suffered losses while the last three managed to close in the green amid increased participation of investors.

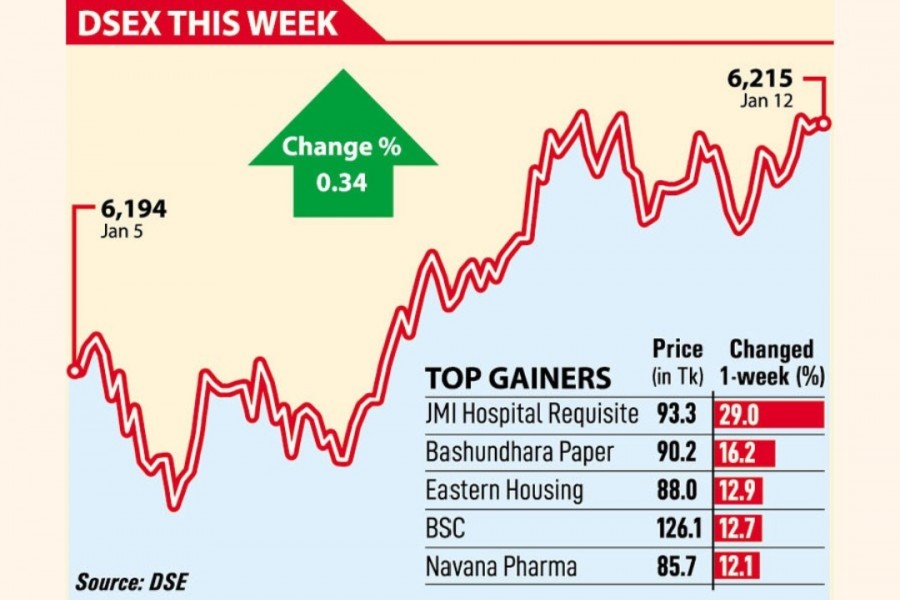

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), settled at 6,215, with a gain of 21.09 points, or 0.34 per cent. The index lost 12.85 points in the week before.

Stocks managed to return to positive territory as investors showed their buying interest in some sector-specific issues, said EBL Securities in its weekly market analysis.

The investors were enticed to chase some sector-specific issues which they deemed lucrative, leading the market to notch a gaining streak for the latter part of the week, said the stockbroker.

Though the week opened with a gloomy mood, the optimistic investors got back their confidence after the regulators' assurance of continuing in both the floor price and the lending rate cap, said International Leasing Securities.

The investors increased their participation in the market over the week riding on the regulators' initiatives, said the stockbroker.

The week's total turnover amounted to Tk 21.21 billion, up from Tk 11.33 billion in the previous week. And the daily turnover averaged out at Tk 4.24 billion, soaring 87 per cent from the previous week's average of Tk 2.26 billion.

Buyers had been concentrated on selective stocks while the majority of stocks remained stuck at the 'floor price' level. Of 380 issues traded, 108 declined, 62 advanced and 210 issues remained unchanged on the DSE floor.

The pharma sector kept its dominance in the turnover chart, grabbing almost 16 per cent of the week's total turnover, closely followed by IT (15.5 per cent) and miscellaneous (12.7 per cent).

Bangladesh Shipping Corporation became the week's turnover leader with shares worth Tk 1.35 billion changing hands, followed by Bashundhara Paper Mills (Tk 1.31 billion), Genex Infosys (Tk 977 million), Orion Pharma (Tk 877 million) and Intraco Refueling Station (Tk 804 million).

JMI Hospital Requisite was the week's top gainer, rising 29.05 per cent while Orion Infusions was the worst loser, shedding 11.88 per cent.

Orion Infusions stock price tumbled 56 per cent or Tk 470 in a month to close at Tk 372.20 on Thursday.

Two other indices of the DSE also edged higher. The DS30 Index, comprising blue-chip companies, rose 5.65 points to close at 2,199 and the DSES Index gained 4.30 points to finish at 1,357.

The Chittagong Stock Exchange (CSE) also ended higher with the CSE All Share Price Index (CASPI) rising 54 points to settle at 18,353 and its Selective Categories Index (CSCX) gaining 33 points to close the week at 10,999.