Stocks backed to the red again in the outgoing week that ended on Thursday as risk-averse investors dumped their holdings amid 'poor' earning disclosures.

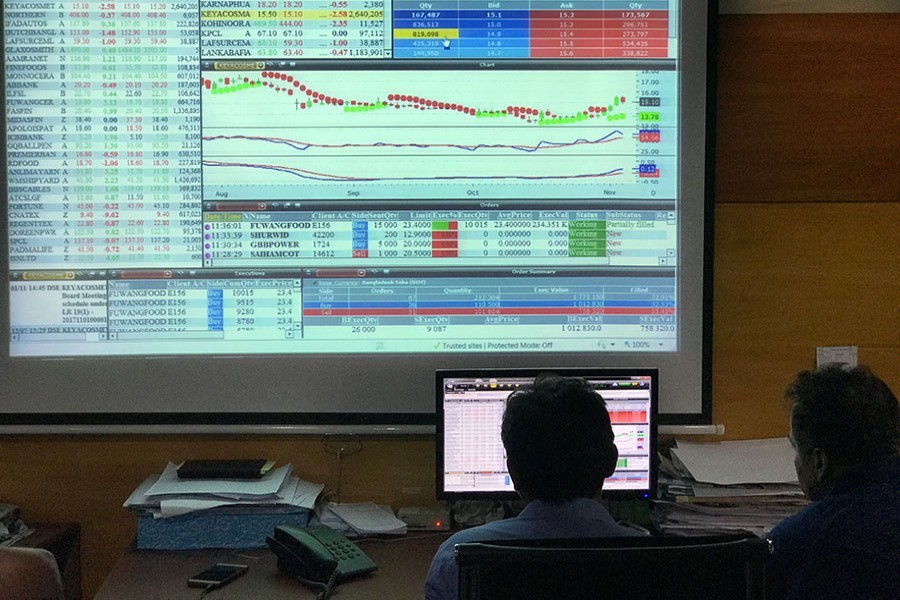

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went down by 61.55 points or 1.29 per cent to finish at 4,710, after adding 89 points in the week before.

Market analysts said recent volatility in the market added further woes to the investors by poor quarterly earnings disclosures by a number of listed companies.

The investors lost confidence in the stock market which triggered sell-off again on large-cap sectors, particularly on engineering, non-bank financial institutions and banking sectors, said a leading broker.

He noted that investors are still suffering from a confidence crisis as the market remained volatile over the last ten months.

The poor financial disclosures of some listed companies tempted the shaky investors to dump shares from most of the major sectors, he added.

A merchant banker said most of the investors remained worried and maintained cautious stance while poor earnings disclosures dented their confidence further.

The outgoing week saw four trading days as the market remained closed on Sunday due to Eid-e-Milad-un Nabi. Of them, only single positive session with 9.56 points increase amidst three negative sessions which ultimately weighted more as DSEX lost 61.55 points.

Two other indices also ended lower. The DS30 index, comprising blue chips, fell 19.67 points to finish at 1,638 and the DSE Shariah Index lost 8.65 points to close at Tk 1,080.

The weekly total turnover on the prime bourse stood at Tk 13.98 billion, down from Tk 16.73 billion in the week before as last week saw four trading days instead of previous week's five.

The daily average turnover rose to Tk 3.49 billion, up 5.60 per cent from the previous week's average of Tk 3.31 billion. EBL Securities said investors' short-term profit-booking sell-offs amid lower than expected earning disclosures dragged the market down.

According to International Leasing Securities, the investors were selling off of shares fearing further fall as the investors found no immediate solution to the current market turmoil.