Square Pharmaceuticals has yet again proved its dominance in the industry and business acumen.

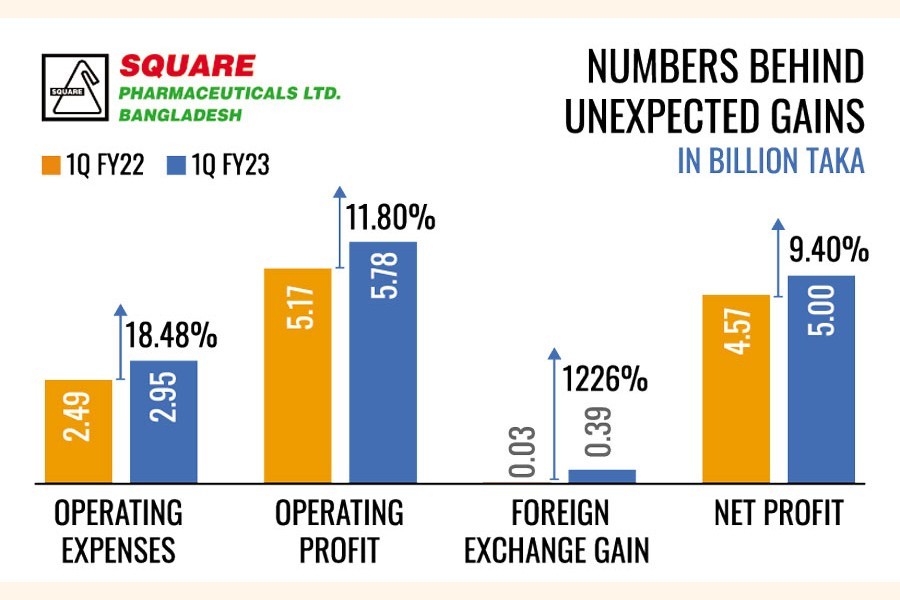

Just like many other pharma and non-pharma companies, it has experienced a significant rise in administrative and operating expenses because of the today's macroeconomic realities - costlier foreign raw materials and the taka losing its value against the dollar.

But a nearly 1193 per cent growth in the foreign exchange gain to $0.398 billion, calculated on purchases or sales of goods or services in a foreign currency or on forex assets, helped Square ensure a 9.40 per cent profit growth in Q1 of FY23 compared to the same quarter a year ago.

"Unprecedented fluctuation in the forex rate during the last quarter resulted in unusual foreign exchange gain in the reporting quarter," the company said.

During the same time, Renata and Beximco's profit declined for, as explained, higher expenses.

The foreign exchange gain varies in translated earnings as the taka depreciates or appreciates against the dollar.

Square's revenue from export sales amounted to $4.9 million for the quarter, which led to a marginal gain from volatile exchange rates.

What actually made a big difference is the company's income from FDRs (fixed deposit receipt) worth around $48 million, said Square Pharma's Chief Financial Officer (CFO) Md Zahangir Alam.

Drug manufacturers can legally retain 30 per cent of their earned foreign currencies and make investments in FDR and other overseas assets.

The robust growth in the non-operating income boosted Square's quarterly profit, and in turn, its earnings per share, thus helping the company stay ahead of its competitors in Q1 through September of FY23.

Square Pharmaceuticals has reported a consolidated EPS of Tk 6.20 for the quarter.

The company exports drugs to as many as 37 countries and its annual export volume is around $25 million. Over the three months through September, the taka was depreciated by 10 per cent against the US dollar.

During the period, Square Pharmaceuticals also saw a whopping 845 per cent growth in cash incentives at a government-fixed rate of 10 per cent on export proceeds to Tk 25.25 million.

Another leading drug maker, Beximco Pharmaceuticals received Tk 63.81 million in cash incentives for the first quarter of FY23, indicating that its export volume was higher than Square Pharma.

Beximco's foreign exchange gain was $69.39 million in the quarter, less than Square's, but it also grew exponentially from a negative value of $1.99 million in the Q1 of FY22.

A senior official of an export-oriented company said the foreign exchange gain could be negative if there were liabilities or foreign debts.

Reached by phone, an official of Beximco Pharmaceuticals refused to make comments on the matter.

Beximco's consolidated EPS declined marginally for the Q1 of FY23 as the EPS of its subsidiary Nuvista Pharma declined while another subsidiary Synovia Pharma suffered losses.

Due to a decline in operating profits and net profits, the consolidated EPS of another drug maker Renata Ltd also plummeted 10 per cent year-on-year to Tk 11.62 for the Q1 of FY23.

The drug makers had achieved a robust growth in revenues in the previous fiscal year when health specialists prescribed their drugs following the outbreak of Covid-19, said a senior official of the IDLC Investments.

As the pandemic waned, sales fell and so did revenue.

Considering that, it is not unwise to conclude that Square Pharmaceuticals made a good growth in revenue. The company's revenue increased 8.01 per cent to Tk 16.07 billion in the Q1 of FY23 compared to the same period of the previous fiscal year.