It was 2016 when Swadesh Investment Management last performed as an issue manager while bringing out the initial public offering of Dragon Sweater and Spinning Limited.

A fine of Tk 5 million has recently been slammed on the merchant bank for having failed to meet the target of at least one IPO in every two years and for non-compliance with other regulatory obligations.

Swadesh Investment, however, is not alone in this. As many as 30 investment banks have played no role in the listing of new stocks on the Dhaka Stock Exchange in the last five years.

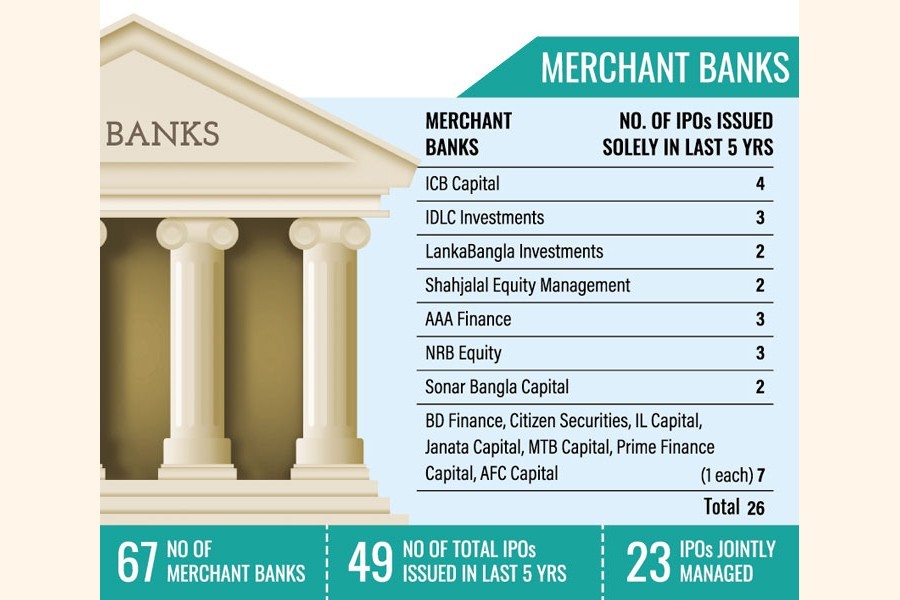

Bangladesh Securities and Exchange Commission has so far given licences to 67 merchant banks, a much higher number when compared to 49 IPOs offered since 2018.

Merchant banks or investment banks provide business advices to corporate clients, and, in doing so, they often help companies to expand by raising capital from the public through an IPO.

They explore the market, find out the demand and set the IPO price and date among many other activities.

Only a handful of the 67 investment banks have been active in the issuance of new stocks over the five years' time to November 27 this year.

Experts say institutional inefficiency is to take the blame for the poor performance of the merchant banks.

But former chairman of the securities regulator, Faruq Ahmad Siddiqi said, "They [merchant banks] themselves lack the capacity to bring an IPO."

Amid the dearth of new IPOs, these institutions have continued working as brokerage firms, managing their portfolios.

Ahsan H Mansur, executive director of the Policy Research Institute (PRI), said the securities regulator should consider a company's experience, history and corporate governance while giving the licence to an applicant for the role of a merchant bank.

"The number of issue managers is very large given the market size. The securities regulator should look into the activities of merchant banks in case of managing IPOs," he said.

Mr Mansur added that the number of merchant banks should be cut down if they failed to bring new private corporations into the public domain.

The country's second largest telecom operator Robi Axiata went public in 2020, and its IPO was managed by IDLC Investments.

That same year, Walton Hi-Tech Industries made its trading debut through an IPO managed by AAA Finance and Investment.

Between 2018 and 2022, ICB Capital Management managed four IPOs solely and six IPOs jointly.

Except for a few issue managers, others had a sharing role in the issuance of IPOs.

Mohammad Rezaul Karim, a spokesperson of the BSEC, said the pandemic and the Ukraine-Russia war had slimmed down the possibility of business expansion.

"Companies' profit margins declined due to a rise in finance costs on the back of the depreciation of the local currency. Many companies have been trying to overcome the loss and many are likely to go public in the year to come."

Meanwhile, only six companies have gone public so far this year, raising an aggregate amount of Tk 5.53 million.

The securities regulator has been striving to ensure that quality IPOs are offered so the stock market can flourish further.

A top BSEC official has recently said the securities regulator is not an issue manager. "Nevertheless, the BSEC itself is working to enhance the supply of good shares to the market."

The securities regulator has sought explanations from merchant banks about the non-performing stocks that they helped being listed with the capital market.