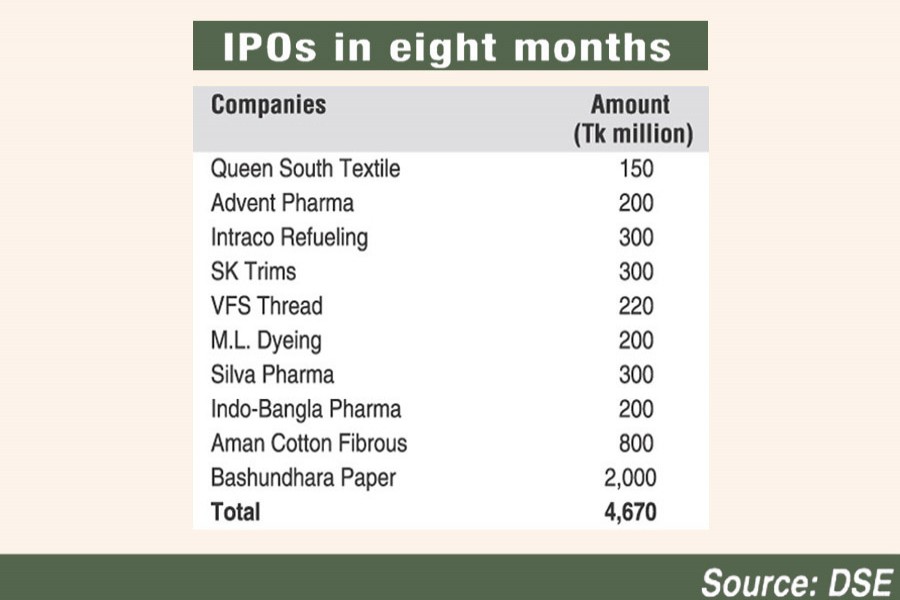

Ten companies raised an aggregate amount of Tk 4.67 billion through initial public offerings (IPOs) in the first eight months of this calendar year.

Market operators said the fund raising through the IPOs is going to surge this year, after hitting a ten-year low in 2017, as some 21 companies already applied for raising Tk 13.07 billion through the IPOs.

In 2017, six companies and a mutual fund raised only Tk 2.19 billion through IPOs, according to statistics from the Dhaka Stock Exchange (DSE).

The IPO is the first sale of a stock of a private company to the public.

According to officials of the securities regulator, 21 more companies submitted applications to the Bangladesh Securities and Exchange Commission (BSEC) for raising funds both through the fixed price and book-building method.

The companies include textile, power, real estate, ceramic, engineering, automobile, pharmaceuticals, IT and insurance sectors.

Of the firms, 11 companies submitted their applications to collect more than Tk 10.66 billion under the book building method.

STS Holding sought to raise Tk 750 million, Shamsual Alamin Real Estate Tk 800 million, Esquire Knit Composite Tk 1.50 billion, Runner Automobiles Tk 1.0 billion, ADN Telecom Tk 570 million, Popular Pharmaceuticals Tk 700 million.

Delta Hospital Tk 500 million, Index Agro Tk 500 million, Energypac Power Generation Tk 1.50 billion, Star Ceramics Tk 600 million and Baraka Patenga Power Tk 2.25 billion.

Of the companies, BSEC allowed Esquire Knit Composite, Runner Automobile and ADN Telecom to explore IPO cut-off price - a requirement for going public under the book building method.

And rest 10 companies would raise Tk 2.40 billion under the fixed price method.

New Line Clothing applied for raising Tk 300 million, Silco Pharmaceuticals Tk 300 million, Electro Battery Company Tk 225 million, Mohammed Elias Brothers Tk 250 million and SS Steel Tk 250 million under the fixed price method.

Express Insurance has also applied for raising Tk 267 million, Desh General Insurance Tk 160 million, Infinity Technology Tk 300 million, Crystal Insurance Tk 160 million and Genex Infosys Tk 200 million under the fixed price method.

The applications of the companies are at different stages of getting approval from the securities regulator, said a BSEC official.

Merchant bankers, who handle the IPOs, however, are urging the regulator to expedite the process for companies with good fundamentals.

If a company is good, it can be permitted even with premium, but if the company fundamentals are weak, it should not be allowed even at the face value, said a leading merchant banker.

According to the latest amendments to the public issue rules, the 'book building' method is mandatory for the companies willing to offer their primary shares at a premium.

Only the companies interested to offer their stocks at face value will be allowed to float IPOs under the fixed price method.