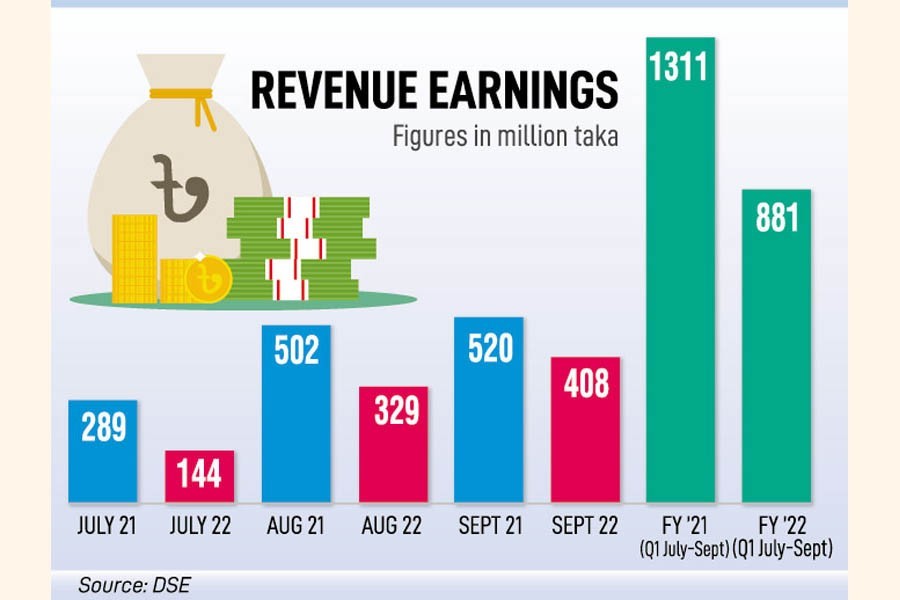

The government's revenue earnings from the Dhaka Stock Exchange dropped 33 per cent year-on-year to Tk 881 million in the first quarter of the current fiscal year, owing to a decline in turnover and share sales by sponsor-directors.

"Sluggish trading activities coupled with low share sales by sponsor-directors reduced the government's earnings from the prime bourse in the July-September quarter," said a DSE high official requesting anonymity.

The government bagged revenue of Tk 881 million in the July-September period of fiscal 2022-23, down from Tk 1,311 million in the same period of the previous fiscal year, according to data from the DSE.

Investors are not confident enough to inject fresh funds into stocks amid a dismal market outlook, which leads to lower turnover, said a merchant banker, requesting anonymity.

"The market has been struggling since the Russia-Ukraine war began in February this year," he said, adding that the situation has been further exacerbated by fears over the possibility of a global economic recession.

Economic uncertainties and erosion of stock prices prompted the securities regulator to impose floor price from July 28 this year, another reason for low turnover.

The floor price system stopped from a free-fall of indices. Big buyers and institutional investors have been upset as they could not buy shares in large volumes at lucrative prices due to the price restriction.

Some 180 companies, including Grameenphone, British American Tobacco, and Robi Axiata have remained stuck at floor prices.

The government earned the amount from TREC (trading right entitlement certificate) holders at the rate of 0.05 per cent in commission and from share sales by sponsor-directors and placement holders at 5.0 per cent.

Of the total earnings in July-September of the current fiscal year, Tk 747 million came from the TREC holders' commission, popularly known as brokerage commission, while Tk 134 million from share sales by sponsor-directors and placement holders.

"The earnings are related to turnover. It's usual that tax will fall if the turnover falls," said the DSE official.

The daily average turnover on the DSE plunged by 44 per cent year-on-year to Tk 12.10 billion in July-September of the current fiscal year.

Selective stocks such as Beximco, Orion Pharma, JMI Hospital Requisite Manufacturing, Bangladesh Shipping Corporation, and Fortune Shoes jointly accounted for 40 per cent of the total turnover during the period.

The government earned Tk 2.91 billion in tax revenue from the DSE, the highest in 11 years, in the last fiscal year, driven by a record turnover.

However, the fiscal 2010-11 witnessed the historical highest tax revenue of Tk 4.47 billion paid by the DSE to the government exchequer when the market had gone haywire before crashing.