Stocks extended a winning streak in the outgoing week to scale fresh peaks, with investors renewing their appetite for shares in the cement, power and financial-institution sectors.

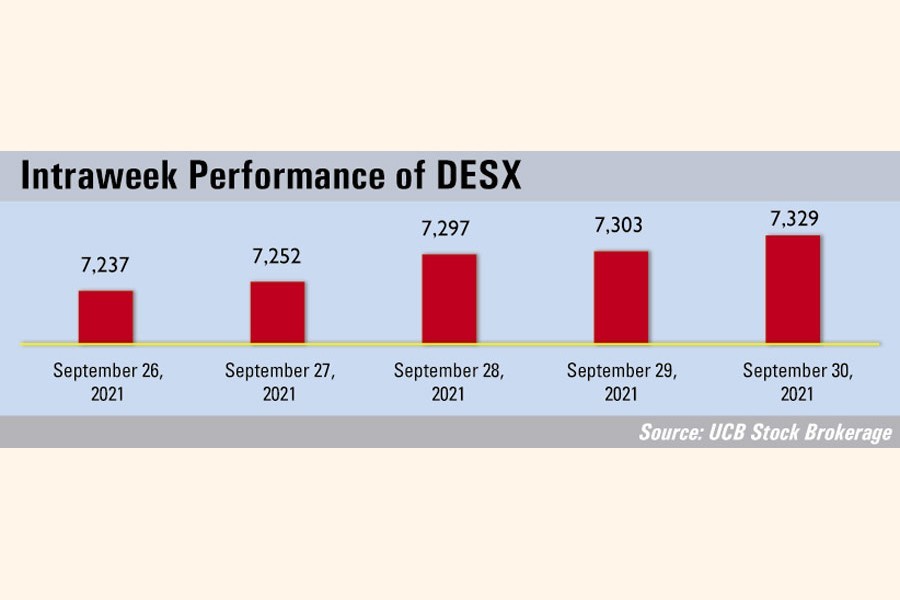

Week on week, the key DSEX index of the Dhaka Stock Exchange (DSE) climbed 78.44 points or 1.08 per cent to settle at 7,329, the highest since the launch of the DSEX on January 27, 2013.

Two other indices also gained -- the blue-chip DS30 rose 36.97 points to close at its historical high at 2,710, while the DSE Shariah Index (DSES) went up by 11.04 points to end at 1,592.

Of the five sessions of the market in this week, the first session saw correction but the four others closed higher.

The week's total turnover stood at Tk 111.45 billion on the prime bourse, up from Tk 97.09 billion in the previous week. And the daily average turnover clocked in at Tk 22.29 billion, which was 15 per cent higher than the previous week's average of Tk 19.42 billion.

Market analysts said stocks extended the rally for a second straight week as investors are putting fresh funds on stocks, anticipating positive momentum ahead.

The cement, non-bank financial institution (NBFI) and power sectors pushed the market upward, they said.

The cement sector soared 11.90 per cent while NBFI sector surged 8.70 per cent and power sector saw a rise of 2.50 per cent.

As institutional investors' funds continued to flow into the stock market, the index saw an uptrend, said a merchant banker, adding that many institutional investors took advantage of the central bank's incentive package and actively made investment.

He also noted that the investors were buoyed by improving pandemic situation, gradual economic recovery and lower interest rates on bank deposits.

"Although many good issues are still lucrative, investors should be cautious about buying overvalued stocks," he said.

On the other hand, some junk stocks continued to rise despite several attempts to discourage investors from pouring money into these shares, he added.

According to EBL Securities, investors continued to stay positive about the market as they expect the macro-economic outlook to stay favourable and the listed companies to post growth in their earnings.

Although the week saw the index go up, losers took a modest lead over the gainers, as out of 378 issues traded, 221 closed lower, 146 higher and 11 issues remained unchanged on the DSE trading floor.

Despite a fall in the share prices of most companies, the market ended positive as a number of large-cap stocks such as Investment Corporation of Bangladesh, LafargeHoilcim, Orion Pharma, Beximco and Shahjibazar Power Company gained substantially.

Among the major sectors, cement generated the highest return of 11.90 per cent riding on sector heavyweight LafargeHolcim, which soared 17.71 per cent alone, followed by financial institutions (8.70 per cent) and power (2.50 per cent).

On the other hand, engineering, banking and telecoms sectors lost 1.0 per cent, 0.70 per cent and 0.50 per cent respectively.

LafargeHolcim was the most-traded stock with shares worth Tk 7.48 billion changing hands, followed by Orion Pharma, Beximco, Beximco Pharma and Shahjibazar Power.

Orion Pharma was the week's top gainer, posting a 21.13 per cent gain while Desh Garments was the worst loser, shedding 14.99 per cent.

The Chittagong Stock Exchange (CSE) also ended higher with the CSE All Share Price Index (CASPI) soaring 231 points to settle at 21,377 and the Selective Categories Index (CSCX) rising 148 points to close at 12,835.

Of the issues traded, 186 declined, 147 advanced and 12 remained unchanged on the CSE trading floor.

The port city's bourse traded 114.82 million shares and mutual fund units with turnover value of Tk 4.56 billion.

Meanwhile, trading on the DSE SME Platform commenced on Thursday with six companies -- four came from OTC market while two are newly listed companies.