Stocks rebounded in the outgoing week, snapping a four weeks losing streak, as bargain hunters took benefit of the low prices of shares despite 'strict' lockdown and reduced trading hours.

However, presence of investors on the trading floor was very thin. Most investors executed their trading online or through mobile app, a Dhaka Stock Exchange (DSE) official told the FE.

The prime bourse and brokerage houses also encouraged investors to conduct share trading using virtual platforms amid the pandemic.

The week witnessed four trading days as the market remained closed on April 14 due to Pahela Baishakh. Of them, the first session saw sharp fall while last three ended higher.

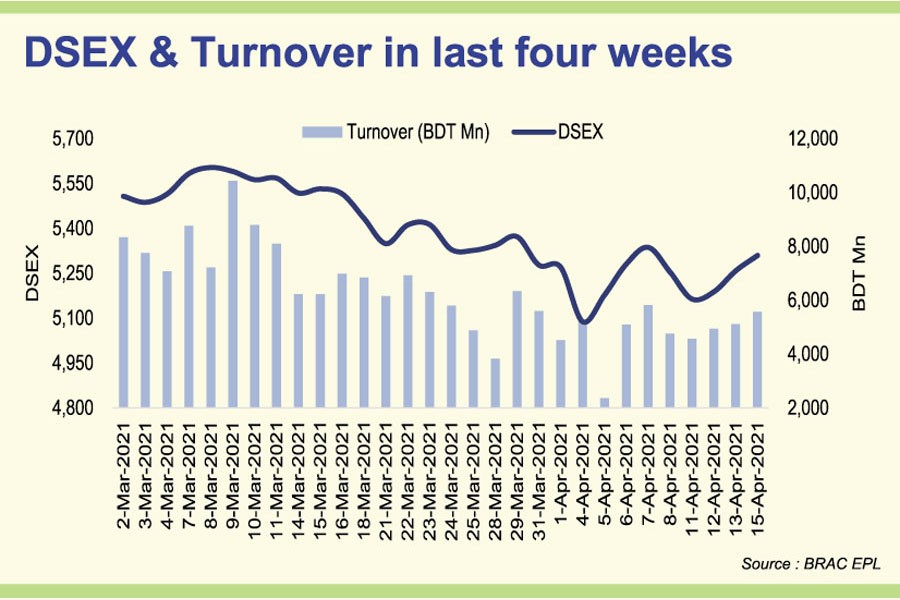

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), went up by 55.1 points or 1.05 per cent to settle at 5,310, after losing 314 points in the four consecutive weeks.

Market analysts said lucrative price levels of many stocks and lowering the circuit-breaker limit to 2.0 per cent from the existing 10 per cent for 66 companies encouraged the investors to take fresh position on stocks.

Despite the virus-induced strict lockdown, market managed to close higher due to positive regulatory initiatives, said a merchant banker.

He noted that the investors, mostly institutional ones, are taking advantage of low-priced securities, which helped the market to close higher.

The investors' positive attitude beat the lockdown worries although the week started on a massive fall, commented EBL Securities.

The stockbroker noted that the stock market regulator's last moment decision to keep the market open in line with banks had positively impacted investors' enthusiasm.

Buoyancy in mutual fund, financial institution, and cement sectors led the key index of the major bourse to cross 5,300-point mark during the week, commented International Leasing Securities.

Mutual funds saw the highest gain of 8.5 per cent, followed by cement with 6.6 per cent and financial institution 2.7 per cent.

Two other indices also ended higher with the DSE30 Index, comprising blue chips, soared 36.43 points to finish at 2,026 and the DSE Shariah Index (DSES) rose 11.42 points to close at 1,209.

The week's total turnover on the prime bourse stood at Tk 20.19 billion which was Tk 23.24 billion in the week before as last week saw four sessions instead of previous week's five.

The daily turnover averaged out at Tk 5.05 billion, which was 8.58 per cent higher than the previous week's average of Tk 4.65 billion.

Gainers took a strong lead over the losers, as out of 367 issues traded, 217 advanced, 90 declined and 60 remained unchanged on the DSE trading floor.

Beximco - the flagship company of Beximco Group- was the most- traded stock with shares worth about Tk 2.05 billion changing hands, followed by Robi, Bangladesh Finance, Asia Pacific Insurance and Central Insurance.

The mutual funds saw the highest gain as six out of top 10 gainers were belonging to mutual fund sector.

CAPM IBBL Islamic Mutual Fund was the week's top gainer, posting a gain of 20.36 per cent while Premier Bank was the worst loser, losing 18.38 per cent, following its price adjustment after record date during the week.

The market-cap of DSE also rose to Tk 4,627 billion on Thursday, up by 0.77 per cent over the week before.

The Chittagong Stock Exchange (CSE) also ended higher with the CSE All Share Price Index - CASPI -gaining 148 points to settle at 15,379 and the Selective Categories Index - CSCX rising 87 points to close at 9,277.

Of the issues traded, 149 advanced, 101 declined and 29 remained unchanged on the CSE trading floor.

The port city's bourse traded 23.54 million shares and mutual fund units with turnover value of Tk 734 million.