Stocks extended the winning streak for the two consecutive weeks that ended Thursday as enthusiastic investors continued their buying appetite on bank and telecommunication issues.

Market operators said the positive momentum in some large-cap issues, especially from banking, telecom, pharmaceuticals and food & allied sectors helped the bourse to stay upbeat.

The banking sector posted the highest return of 4.45 per cent as 27, out of 30 listed banks ticked higher.

Four banks gained more than 10 per cent each.

The telecom sector also surged 3.42 per cent as Grameenphone, the country's largest market-cap listed company's shares price jumped 4.0 per cent to close at Tk 456.90 each.

"The market extended the winning streak riding on heavyweight bank and telecom issues," said an analyst at a leading brokerage firm.

The week featured five trading sessions as usual. Of them, first session saw marginal correction while last four closed higher.

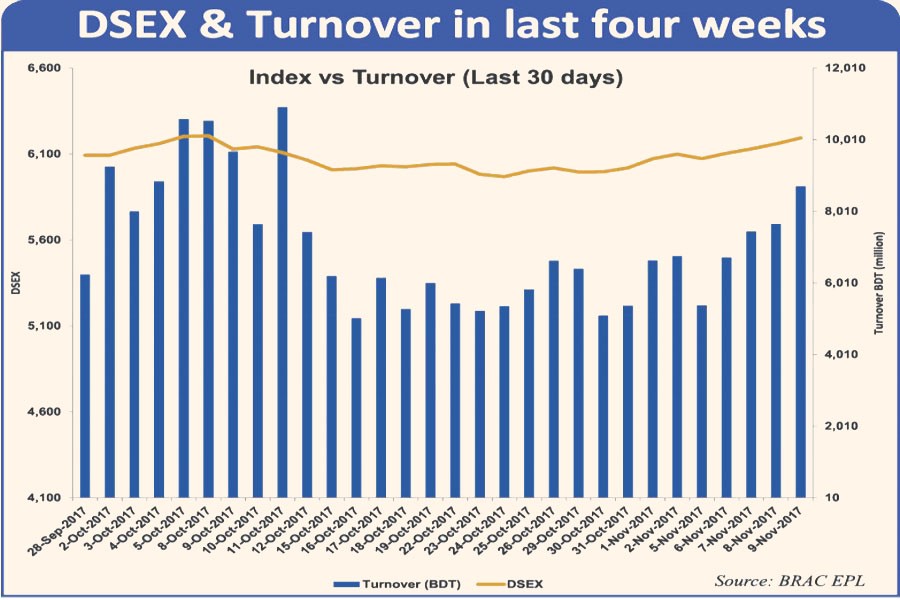

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE) jacked up by 94.54 points or 1.55 per cent to finish at 6,193.

The two other indices -- the DS30 index and the DSE Shariah Index (DSES) - also closed higher at 2,244 and 1,341 points.

Both the indices added 42.64 points and 12.18 points respectively.

"During the week banking, pharmaceuticals and telecommunication sector stocks contributed more to keep the market up," commented City Bank Capital Resources, a merchant bank, in its weekly analysis.

The port city bourse Chittagong Stock Exchange (CSE) also ended higher. The CSCX advanced 180 points or 1.56 per cent to finish at 11,618.

International Leasing Securities, a stockbroker noted that the market observed an upbeat vibe throughout the week riding on the news of soaring of net foreign investment in the capital market in the first 10 months of 2017 compared to the same period of last year.

Net position of foreign portfolio with the DSE stood at Tk 16.23 billion in January-October, compared to Tk 8.0 billion in the same period a year ago.

However, some investors were reshuffling their portfolios after observing the year-end corporate declarations and first quarter earning disclosures, the stockbroker added.

According to EBL Securities, "The market witnessed an upbeat tune throughout the week riding on regained confidence among the market participants".

The stockbroker noted that preferable year-end and quarter-end earnings declarations by several companies helped them to remain positive about market.

The total turnover for the week amounted to Tk 35.91 billion on the DSE, which was Tk 30.27 billion in the week before.

The daily turnover averaged Tk 7.18 billion, which was nearly 19 per cent higher than the previous week's average of Tk 6.05 billion.

Block trade accounted for 1.6 per cent of the total weekly turnover, where stocks like BATBC, Beximco Pharma, Shahjalal Islami Bank, Square Pharma and Singer Bangladesh dominated the block trade board.

Banking sector kept its dominance over the turnover chart, grabbing 35 per cent of the week's total transaction, followed by engineering with 18 per cent and pharmaceuticals 11 per cent.

Out of 336 issues traded, 207 closed lower, 116 ended higher and 13 issues remained unchanged on the DSE trading floor during the week.

The market capitalisation of the DSE rose 1.37 per cent as it was Tk 4,123 billion on the opening day of the week and it stood at Tk 4,179 billion on closing day of the week.

City Bank topped the week's turnover chart with 53.90 million shares worth Tk 1.84 billion changing hands followed by IFAD Autos with Tk 1.21 billion, Brac Bank Tk 1.0 billion, LankaBangla Finance Tk 994 million and Dhaka Bank Tk 926 million.

Reckitt Benckiser was the week's best performer, posting a gain of 19.25 per cent while Stylecraft was the week's worst loser, slumping by 33.22 per cent.

A new issue - Oimex Electrode-- made debut last week and soared 1,042 per cent from its offer price of Tk 10 in the first trading day on Monday.