Stocks witnessed a big jolt in the outgoing week due to dearth of quality stocks and liquidity crunch.

All indices plunged more than 3.0 per cent in the week, as worried investors dumped their holdings amid growing panic.

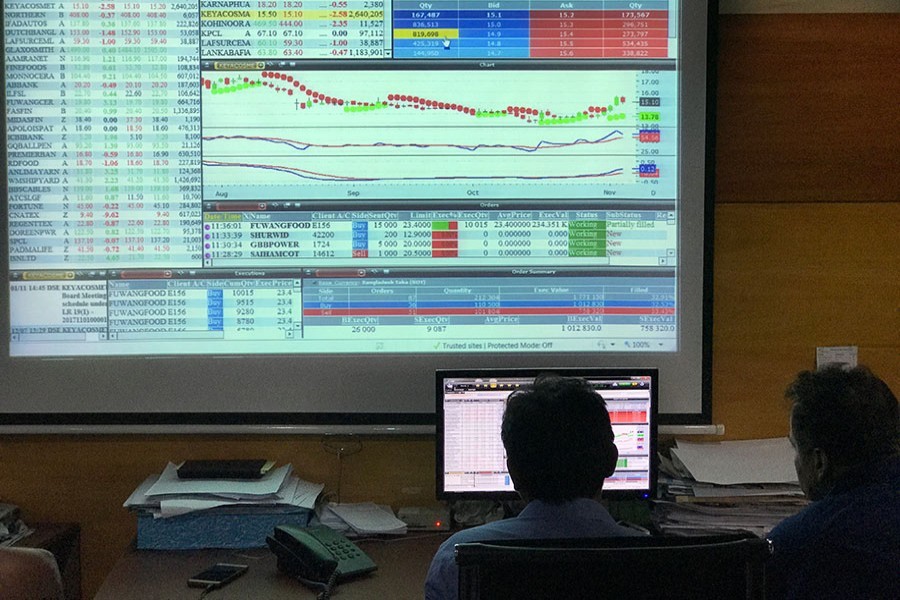

Week-on-week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), slumped 157 points or 3.36 per cent to settle at 4,514.

The DSEX has lost a cumulative 267 points in the past one month while it shed 1,436 points since January 24, this year, when the index peaked at 5,950.

The market capitalisation also eroded Tk 165 billion in one month while it wiped out Tk 763 billion in the past ten months, the DSE data shows.

Dearth of quality stocks and liquidity crunch exacerbated the ongoing confidence crisis among investors.

Institutional investors were not playing a supportive role amid liquidity crunch while foreign investors have continued pulling funds out of the market amid low confidence, said an analyst said.

The foreign investors withdrew record Tk 857 billion in last nine months (March-November) this year from the country's premier bourse due mainly to lack of confidence.

A merchant banker said continuing fall in the private sector credit growth, declining exports, poor tax revenue collection and heavy government bank borrowing reflected a gloomy state of the country's economy.

He noted that ongoing erosion in stock prices reduced investment ability of the market intermediaries and high net worth investors.

Some brokerage firms also went for forced sales to minimise risks in margin loans, he added.

Dr. AB Mirza Azizul Islam, former adviser to the caretaker government, said the market continues its declining trend due to various reasons including the poor macroeconomic outlook.

Mr Islam, also former chairman of the securities regulator, emphasised bringing good and reputed companies coupled with ensuring good governance for restoring the investors' confidence in the market.

The index slide of the capital market began in late January this year and the market had hardly rebounded since then except periodic ups and down.

The government's market supportive measures, including redefining the banks' capital market exposure and amending public issues rules, also failed to boost the fund flow.

The weekly total turnover on the prime bourse stood at Tk 15.74 billion, down from Tk 23.10 billion in the week before.

The daily turnover averaged out at Tk 3.15 billion, down 32 per cent from the previous week's average of Tk 4.62 billion.

The outgoing week saw five trading days as usual. Of them first three sessions saw sharp fall while last two inched higher.

Two other indices also ended lower. The DS30 index, comprising blue chips, fell 57.70 points to finish at 1,548 and the DSE Shariah Index lost 39.25 points to close at Tk 1,016.

EBL Securities said stocks slumped as the panic-driven investors continued their selling spree due to fear of further fall amid concern over the country's economy.

The stockbroker noted that the investors adopted wait-and-see approach due to confidence crisis about the future market direction.

All the major sectors suffered loss more than 3.0 per cent with food sector witnessed the highest loss of 5.30 per cent, followed by power with 3.78 per cent, engineering 3.43 per cent, financial institutions 3.41 per cent, telecom 3.25 per cent, pharma 3.11 per cent and banking 3.04 per cent.

The market capitalisation of the DSE also plunged 2.46 per cent to Tk 3,436 billion on Thursday, from Tk 3,523 billion in the previous week.

Losers outnumbered the gainers, as out of 356 issues traded, 277 closed lower and 64 ended higher while 15 issues remained unchanged on the DSE floor in the outgoing week.

Square Pharmaceuticals dominated the week's turnover chart shares worth Tk 416 million changing hands during the week.

The week's other turnover leaders were Sinobangla Industries, Khulna Power, Sonar Bangla Insurance and Paramount Insurance.

Anlimayarn Dyeing was the week's best performer, posting a gain of 12.76 per cent while the Makson Spinning was the worst loser, losing 18.18 per cent.

The port city's bourse, Chittagong Stock Exchange (CSE), also saw sharp decline, with its CSE All Share Price Index - CASPI - losing 470 points to settle at 13,733 and the Selective Categories Index - CSCX - shedding 291 points to finish the week at 8,332.