Stocks edged higher in the last week of the year as bargain hunters put fresh bets on some oversold issues as part of year-end restructuring of their portfolios.

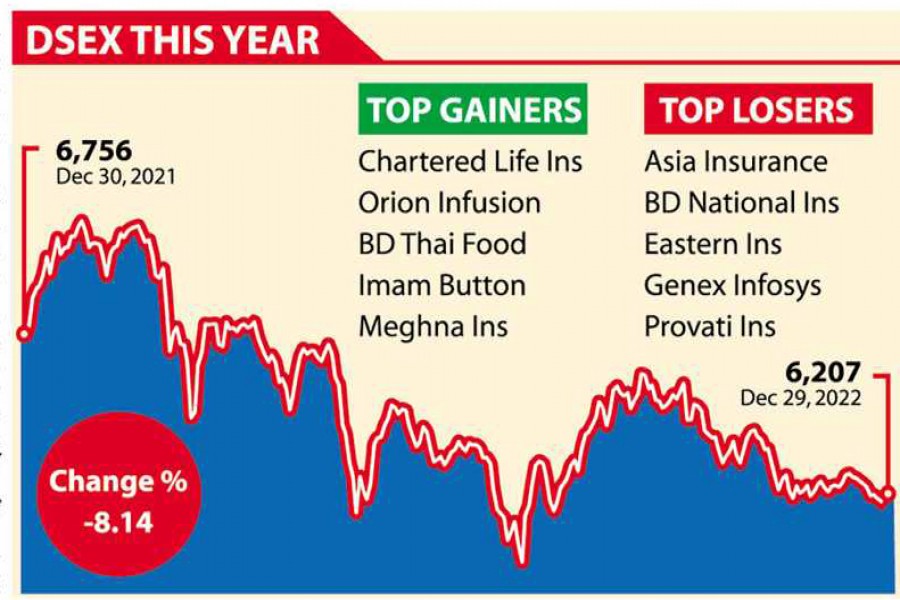

The stock market, however, had a rough ride in the outgoing year amid economic uncertainties resulting from global adversities such as the Ukraine war and runaway inflation.

During the week, the market witnessed see-saw movements in the first two days while the last two sessions managed to close marginally higher, offering some hope to the investors. The market was closed on Sunday on the occasion of Christmas Day.

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), finally inched up 4.60 points to settle the week at 6,207, after losing over 54 points in the previous week.

The week's total turnover amounted to Tk 10.72 billion as against Tk 16.81 billion in the previous week. And the daily turnover averaged out at Tk 2.68 billion, down 20 per cent from the previous week's average of Tk 3.36 billion.

The investors' participation has yet to rebound across the bourse as liquidation opportunities got squeezed and investors still preferred to remain on the sidelines, causing the average turnover to drop, market insiders said.

Although the regulator has brought some changes recently, the impact would be less as it allows a slight drop every day and is only for small and junk companies.

Trading was restricted to only a handful of stocks as most large-cap stocks remained stuck at floor over the past few weeks, said a merchant banker.

The investors were not confident enough to put fresh stakes in stocks amid the ongoing depressed market condition, he said.

"The market turnover is drying up in absence of buyers while the large-cap stocks that dominated the market turnover chart earlier, remained at floor price trap".

However, stocks rebounded as investors have begun to show their interest in some sector-specific stocks to rebalance their portfolios.

The bargain hunters showed their buying appetite on the stocks with lucrative prices during the last two days of the week, said International Leasing Securities.

The securities regulator has extended the time frame till December 31, 2023 for adjusting negative equity accounts of merchant bankers and stock brokers' clients that also tempted the investors to remain on the trading floor, it added.

The opportunist investors revealed their buying interest on IT, service, and jute and paper stocks to recover the benchmark index from its bearish trend.

However, the risk-averse investors continued to sell off in ceramic, travel, textile and general insurance sectors' stocks in anticipation of further loss, said the stockbroker.

According to EBL Securities, stocks ended marginally higher in the final week of the year due to investors' year-end restructuring of their portfolios.

The removal the floor price of 169 low-cap securities and plan to gradually uplift the floor price of mid-cap and large-cap securities in the upcoming year has fueled the uncertainty regarding the short-term outlook of the market, it said.

Of 381 issues traded, 67 advanced, 117 declined and 197 remained unchanged on the DSE floor.

The pharma sector dominated the turnover chart, grabbing 23 per cent, followed by the small-cap paper sector (14 per cent) and IT (11 per cent).

Orion Infusions dominated the week's turnover chart with shares worth Tk 545 million changing hands, closely followed by Intraco Refueling Station (Tk 513 million), Monno Ceramic (Tk 445 million), Orion Pharma (Tk 365 million) and Bashundhara Paper Mills (Tk 351 million).

Islami Commercial Insurance was the week's top gainer, soaring 45.60 per cent while Monno Ceramic was the worst loser, shedding 6.12 per cent.

Two other indices of the DSE also edged higher. The DS30 Index, comprising blue-chip companies, gained 0.79 points to close at 2,195 and the DSES Index advanced 1.19 points to finish at 1,359.

The Chittagong Stock Exchange (CSE) also inched up with the CSE All Share Price Index (CASPI) gaining 1.0 points to settle at 18,328 and its Selective Categories Index (CSCX) advancing 1.0 points to close the week at 10,982.

Of the issues traded, 58 declined, 41 advanced and 151 issues remained unchanged on the CSE trading floor.

The port-city bourse traded 20.51 million shares and mutual fund units with turnover value of Tk 878 million during the week.