The prime index of the Dhaka Stock Exchange (DSE) witnessed a mild correction last week that ended Thursday as risk-averse investors booked profit on sector-wise stocks.

Market operators said the market backed to the red as many listed companies' quarterly earnings and dividend declarations failed to meet the investors' expectation.

"Lower-than-expected earnings results and dividend declarations of many companies prompted investors to book quick-gain," said an analyst at a leading brokerage firm.

"Investors were busy with rebalancing their portfolios following the earnings disclosures and year-end dividend declarations," commented EBL Securities, in its weekly market analysis.

A good number of listed companies disclosed their un-audited quarterly financial results while some 20 companies, including six banks recommended dividends last week.

The week featured five trading sessions as usual. Of them, three sessions drifted lower while two sessions finished marginally higher.

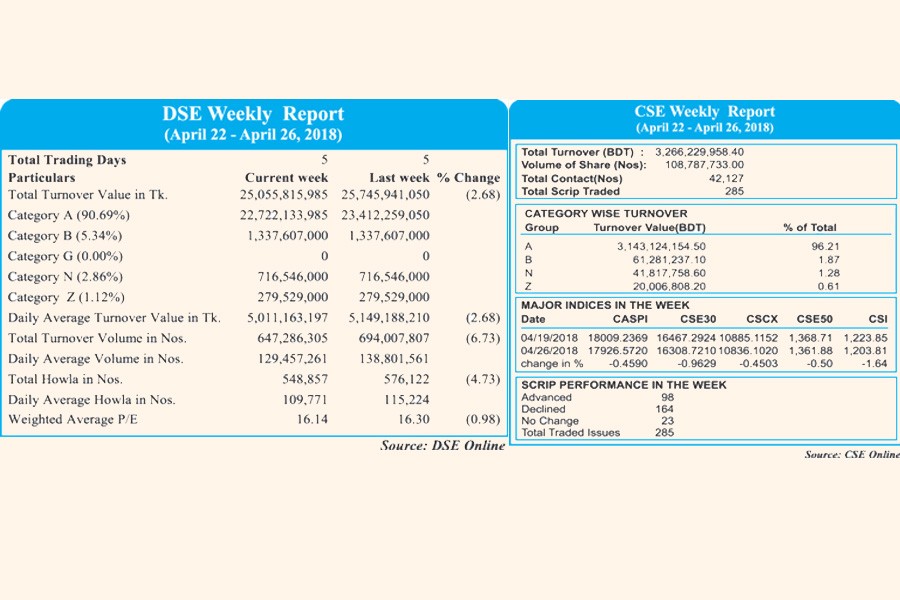

DSEX, the prime index of the Dhaka Stock Exchange (DSE), settled the week at 5,814, losing 29.67 points or 0.51 per cent over the week before.

"Such correction was triggered as investor booked quick profit from last week market improvement," commented City Bank Capital Resources, a merchant bank, in its weekly market analysis.

Two other indices also closed lower with the DS30 index, comprising blue chips, fell 32 points to finish at 2,172 and the DSES (Shariah) index shed 22 points to settle at 1,344.

Port city bourse the Chittagong Stock Exchange (CSE) also returned to the red with the CSE All Share Price Index - CASPI - falling 83 points to settle at 17,926 and Selective Categories Index - CSCX -losing 49 points to close at 10,836 points.

Turnover, another important indicator of the market, stood at Tk 25.06 billion last week against Tk 25.75 billion in the week before.

Block trade contributed 7.30 per cent to the week's total turnover, where stocks like Al-Arafah Islami Bank, Grameenphone, Islami Bank, Shahjibazar Power, UCB and BRAC Bank dominated the block trade board.

The daily turnover averaged Tk 5.01 billion, which was 2.68 per cent lower than the previous week's average of Tk 5.15 billion.

The banking sector kept its dominance in turnover chart, grabbing 20 per cent of the week's total turnover, followed by pharmaceuticals with 13 per cent and power 12 per cent.

"The market slipped into the red after a single-week break as the shaky investors went on selling spree," commented International Leasing Securities, in its weekly analysis.

The stockbroker the market faced mild correction in the week as the some investors preferred to book quick-gain on their investment while others were busy reshuffling their portfolios based on the quarterly earnings and year-end dividend declarations.

"Investors mostly booked profit on the telecom, life insurance, and financial institution and cement sectors' stocks as several issues from these sectors might have failed to match the investors' expectation in its latest earnings declarations," said the stockbroker.

The trading of the week started with pessimism and lost 66.1 points in the first three sessions of the week, while investors were optimistic and prime index gained 36.4 points in the last two sessions.