Stocks witnessed downward trend in early trading on Monday as risk-averse investors are booking profit on sector-wise issues after sharp recent upsurge.

After hitting the DSE key index 10 months high in the previous day, the Dhaka Stock Exchange (DSE) and the Chittagong Stock Exchange (CSE) saw downturn.

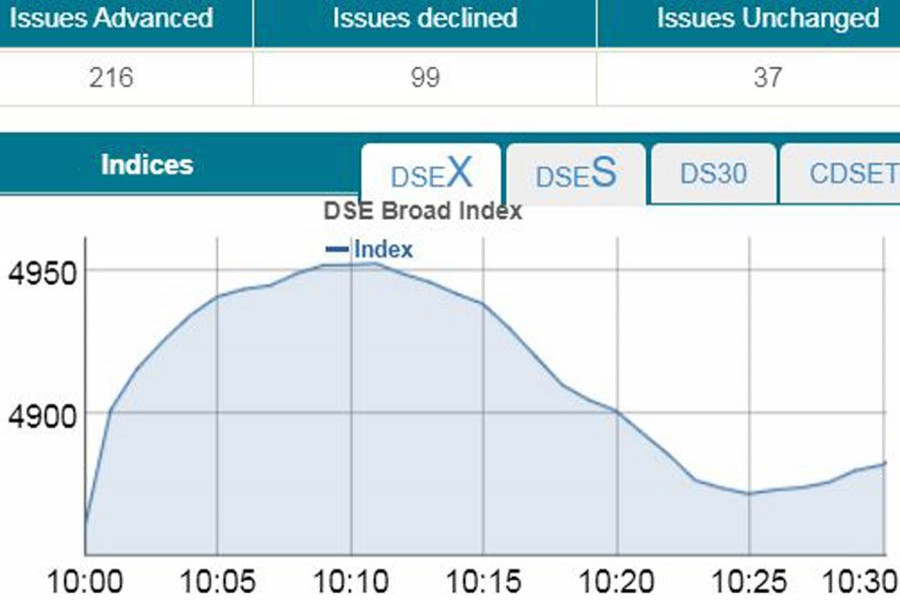

Within 30 minutes of trading, the DSEX fell more than 30 points while the CSE All Share Price Index (CASPI) of port city’s bourse lost 47 points at 10:30am when the report was filed.

DSEX, the prime index of the DSE, went down by 30.87 points or 0.63 per cent to reach at 4,787 points at 10:30am.

The two other indices also saw negative trend till then. The DS30 index, comprising blue chips, shed 7.68 points to reach at 1,632 and the DSE Shariah Index (DSES) declined 6.05 points to reach at 1,103 points till then.

Turnover, the important indicator of the market, jumped to Tk 5.59 billion within first 30 minutes of trading when the report was filed at 10:30am.

Market insiders said stocks down at opening after as investors went for selling shares to take profits after the recent surge in stock prices.

Investors are booking profits on sector specific stocks which saw significant rise in the recent rally, they said.

However, enthusiasm sustained as some investors remained active in the market amid high hopes following regulatory moves to restore discipline in the market, taking turnover to Tk 5.59 billion within first 30 minutes of trading.

Of the issues traded till then, 140 advanced, 188 declined, and 25 remained unchanged.

Orion Pharma was the most traded stocks till then with shares worth Tk 284 million changing hands, closely followed by IFIC Bank, Beximco Pharma, Brac Bank and Asia Pacific Insurance.

The port city bourse – the Chittagong Stock Exchange – (CSE) also saw downward trend till then with CSE All Share Price Index- CASPI-losing 47 points to stand at 13,808, also at 10:30am.

The Selective Category Index – CSCX –also shed 42 points to stand at 8,319 points till then.

Of the issues traded till then, 94 gained, 83 declined, and 22 issues remained unchanged with Tk 110 million in turnover.