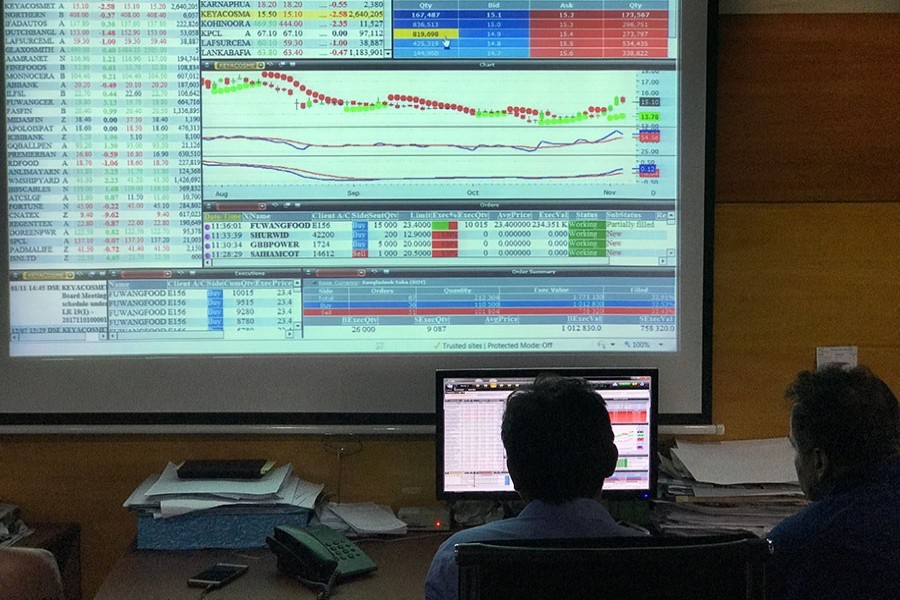

Stocks inched up in the outgoing week, snapping a three-week losing streak, as institutional investors came forward to stop the big declines.

Week on week, DSEX, the prime index of the Dhaka Stock Exchange (DSE), rose 2.56 points to 5,233.

Market analysts said the index crawled back into green, as the Bangladesh Bank and the stock market regulator stepped in to prop up the flagging market.

In the past 15 trading days until July 22, the DSEX lost 455 points amid panic sell-offs triggered by various factors such as imposition of penalty tax on listed companies, move to liquidate People's Leasing and Financial services and a tussle between Grameenphone and the telecom regulator.

In the first two sessions of the week, DSEX shed 164 points, plunging to 31-month low, which spread panic among investors.

A group of aggrieved investors also staged demonstrations in front of the DSE building throughout the week in protest against the inaction of the authorities concerned to stop the free fall.

Finally, the securities regulator formed a committee and held a series of meetings with the market intermediaries during the week to identify the reasons behind the steep fall.

The Bangladesh Securities and Exchange Commission (BSEC) also asked all the stock brokers to ensure legal authorisation when it comes to placing of any sale order.

It also requested the stock dealers, asset management firms and merchant banks to support the market as much as possible.

On Monday, the central bank also verbally asked a number of banks and non-bank financial institutions to support the ailing market.

The institutional investors came forward to support the market in the last three days of the week to stabilise the market, said an analyst at a leading broker.

"A section of investors also became active after the central bank on Monday asked 19 banks to support the moribund market," he said.

"The regulatory interventions such as confirming legal authorisation regarding placing of any sale order coupled with central bank's move encouraged investors to put fresh fund," commented EBL Securities.

The bargain hunting by investors after stock prices fell significantly in recent bearish spell coupled with institutional support helped lift the market, said a leading broker.

The outgoing week saw five trading days as usual. Of them, three sessions closed lower while two others posted marginal gain.

The week also saw two other indices of DSE edge up. The DS30 index, comprising blue chips, advanced 6.61 points to finish at 1,836 and the DSE Shariah Index gained 2.41 points to end at 1,173.

The total turnover on the prime bourse stood at Tk 19.98 billion, up from Tk 16.36 billion in the week before.

The daily turnover averaged out at Tk 3.99 billion, soaring 22 per cent over the previous week's average of Tk 3.27 billion.

The market capitalisation of the DSE also rose 0.57 per cent to Tk 3,844 billion on Thursday from Tk 3,822 billion in the week before.

Block trade contributed 5.10 per cent to the week's total turnover where stocks like BRAC Bank, Square Pharma, IDLC Finance and Fortune Shoes dominated the block trade board.

Among the major sectors, power sector posted the highest gain of 2.0 per cent, followed by food (1.4 per cent), non-bank financial institutions (1.3 per cent), banking (0.8 per cent), and pharma (0.8 per cent).

Mutual Fund sector soared 14 per cent during the week.

On the other hand, textile, telecoms, cement and engineering sectors suffered loss of 2.0 per cent, 1.40 per cent and 1.2 per cent and 1.10 per cent respectively.

Losers outnumbers the gainers, as out of 354 issues traded, 185 closed lower, 153 ended higher and 16 issues remained unchanged on the DSE floor.

Fortune Shoes dominated the week's turnover chart, with 20.85 million shares worth Tk 820 million changing hands. The company accounted for 4.10 per cent of the week's total turnover.

SEML FBLSL Growth Fund was the week's best performer, posting a gain of 59.71 per cent while Meghna Pet Industries was the worst loser, plunging 17.70 per cent.

However, the port city bourse, Chittagong Stock Exchange (CSE), inched down, with its CSE All Share Price Index - CASPI - shedding 11 points to settle at 15,713 and the Selective Categories Index - CSCX - losing 7.0 points to finish the week at 9,551.