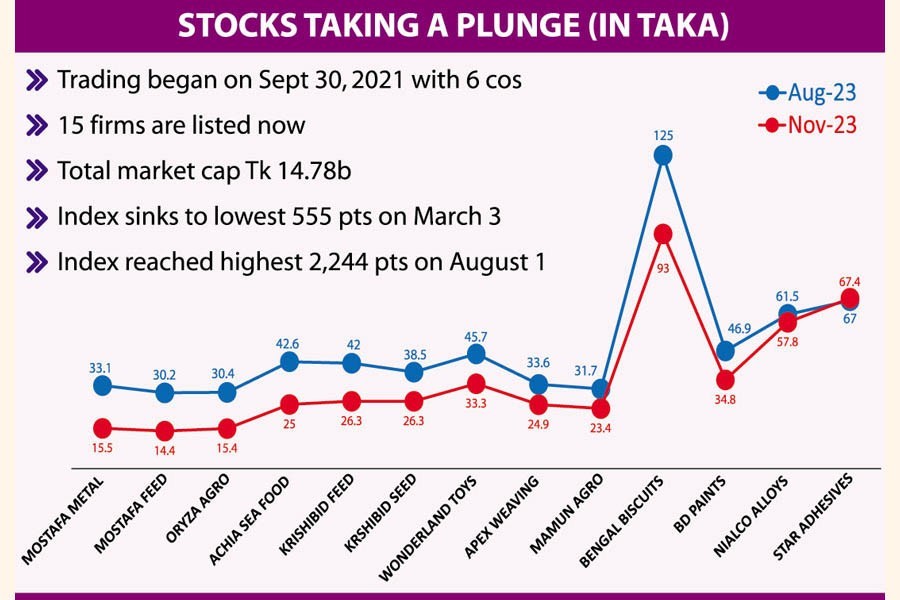

The Small Capital Platform Index -- DSMEX -- plummeted 40 per cent or 898 points to 1,346 over the three months to November 23 after the securities regulator had revised the minimum investment to Tk 3 million from Tk 2 million for trading on the board.

The policy change, if implemented, would have required investors to increase their portfolio in three months through the third week of December to stay eligible for trading on the platform.

The regulator in its September 21 directive also said that if the minimum investment criterion was not met, investors would have to leave the board by selling off their securities. But a High Court stay order more than a week ago has kept the matter hanging.

By the time the stay order came, the market plunged. It rebounded only for a day from 1359 points to 1484 points following the HC order and then retreated and settled at 1349 on Thursday.

Bangladesh Securities and Exchange Commission (BSEC) increased the minimum investment amid widespread criticisms that easy access led to an overpricing of SME stocks.

Barrister A M Masum, lawyer representing the BSEC, said the previous policy of Tk 2 million minimum investment will stay in effect as long as the stay order is in place. The next hearing will take place on December 5 on the matter at the Appellate Division.

Meanwhile, an official of the securities regulator said the investment limit had been revised time and again considering market situations.

"The SME market is not for all investors, and such a precautionary move is applied across the world for the risks involved. It is to protect small investors," the official said.

The SME market was introduced to facilitate the growth of small companies that face hurdles while trying to avail bank loans.

Trading on the prime bourse's SME board started on September 30 last year to open up opportunities for small and medium enterprises (SMEs) to raise capital from the stock market. The free-float base index was 1000 points.

Initially, the BSEC did not allow general investors to trade on the SME platform without prior permission considering the high 'risk' posed by small-cap companies. An investment of at least Tk 5.0 million was needed at the time to be a qualified investor (QI) to trade on the SME platform.

Due to low response from investors, stocks sank driving the index down below 600 points within five months from early February this year.

The market regulator took several steps to increase investor participations in the SME platform, but those were not successful. One of the hurdles was the registration process.

To overcome the roadblock, the securities regulator on February 17 cut down the investment requirement to Tk 2.0 million in listed securities on the SME board. The BSEC also removed the mandatory registration requirement, saying registration would complete automatically if an investor met the criterion.

All these developments triggered a turnaround of the index and it soared by 304 per cent, or 1689 points, to 2,244 points, the highest, between March 3 and August 11.

The SME board thrived as it drew more investors.

Some SME stocks saw three- to four- fold price increase, while the DSEX, the main index of the Dhaka Stock Exchange, dropped 8.12 per cent, or 548 points, during the period.

The removal of the complicated entry procedure attracted investor participations, a merchant banker said. "As the number of shares of SME companies is low, share prices climbed up very fast," he added.

However, the regulator did not stick to its stance while facing criticisms by market analysts that easy access had led to the overpricing of SME stocks.

Alongside increasing the minimum investment to Tk 3 million, the stock market regulator reset the circuit breaker at 10 per cent, down from 20 per cent, enforced in the daily trading of SME shares.

As a result, the market reversed. Investors started selling shares. By Wednesday, most SME stocks plunged up to 53 per cent, except for Yousuf Flour Mills and Star Adhesives.

Yousuf Flour Mills rose 22 times on November 13 when the circuit breaker was not applicable for the stock after the declaration of a 10 per cent cash dividend.

Of the 15 stocks, 14 traded regularly with no data available of Himadri Ltd since June 29 this year.

While issuing the stay order to be effective for three months, the HC on November 16 asked the BSEC to impose floor price on the SME board like in the main market to stop a free-fall of stocks.