State-run Bangladesh Shipping Corporation (BSC) soared 18 per cent in just a week as the ocean-going vessel management company won an almost exclusive right to transport government-funded cargoes.

The Ministry of Shipping (MoS) issued the Bangladesh Flag Vessel (protection of interests) rule on February 5, which incorporated a provision that the waterway shipment of state imports must be handled by the Shipping Corporation only.

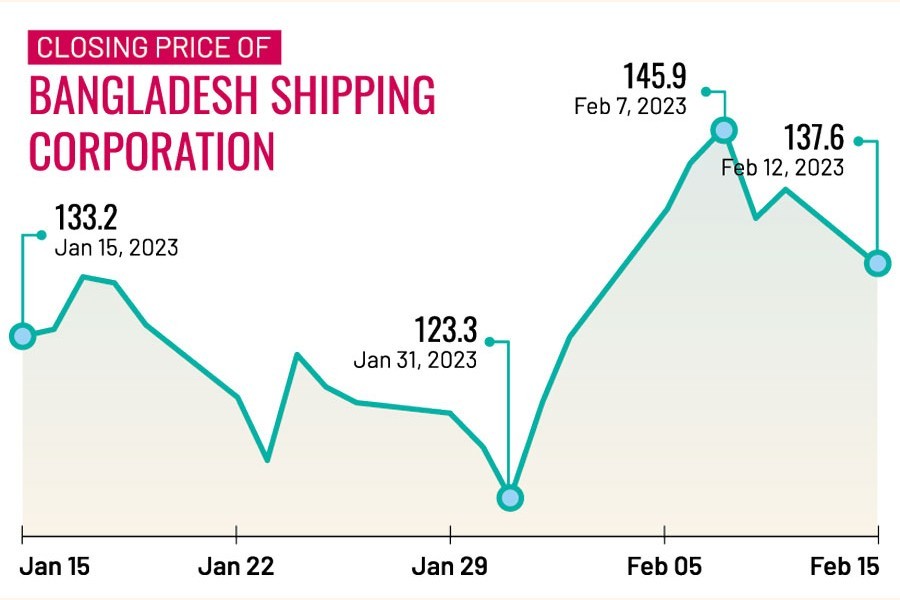

The stock was already on the rise, increasing more than 14 per cent to Tk 140.7 until February 5. Then it climbed further to Tk 145.9 through February 7. It slid down to Tk 137.60 by Sunday.

Experts say the state-run company had gained an impressive profit growth for the FY22 due to a significant rise in freight charges across the world before a reverse trend seen in recent times.

Against the backdrop of the global slowdown in trades caused by shrinking demand for goods, freight charges dropped 30-50 per cent year-on-year in the first half of the FY23, according to the Shipping Agents' Association.

Mostaque Ahmed Sadeque, former president of the DSE Brokers Association of Bangladesh, thinks the recent jump in the stock price resulted from overenthusiastic investors chasing BSC shares.

The Corporation remained in the top daily turnover chart in the past few weeks as investors mounted pressure to grab its shares, buoyed by promising business outlook and in the hope of getting better returns.

It usually imports fertilizer, fuel oil, food items, and motor vehicles.

The exclusive right to carry state cargoes may help grow the business further and that might be one of the reasons for the share price hike, said Mr Sadeque.

BSC posted a staggering 213 per cent growth year-on-year in profit to Tk 2.26 billion in the FY22, thanks to the increase in freight charges. Consecutively, it declared a 20 per cent cash dividend for the fiscal year.

It bagged the shipment right although it has a small fleet of vessels to carry goods, industry insiders say.

However, the rule cites that if the Shipping Corporation falls short of ships to carry cargoes, government goods will be transported in compliance with the public procurement act 2006, international laws, existing regulations concerned, and chartering committee's ground rules.

BSC operates eight ocean-going vessels, of which, one Banglar Samriddhi came under attack in the Russia-Ukraine war. It has filed an insurance claim of around $22.8 million with Sadharan Bima Corporation, but has not yet received any payment.

The company is going to purchase six ocean-going vessels from South Korea at a cost of $ 351 million under a credit programme for carrying bulk cargoes. The first two ships are set to be delivered by 2024 and the rest by 2026. If and when available, these ships will enhance the capacity of the Shipping Corporation.

The Corporation's profit in the first quarter of the FY23 dropped 8.4 per cent to Tk 606.88 million while revenue dropped 14 per cent. Direct fleet expenses rose 9.86 per cent in the quarter.

It is yet to publish a financial statement on its performance in the second quarter of the ongoing fiscal year.

The government held 52.10 per cent shares, institutes 23.90 per cent and individual investors 24 per cent until the end of January.

Meanwhile, BSC has included a board member -- Mostafa Zamanul Bahar nominated by Bangladesh Export Import Company (Beximco) as it brought 5.25 per cent shares of the total holdings of the Corporation through trades in the secondary market.

According to the regulatory rules, an investor -- individual or firm -- can sit on the board of a listed company if they hold at least 2 per cent of the outstanding shares of that company.

BSC included Mr Bahar in the board at 45th annual general meeting held on December 11 last year.