The block board of the Dhaka bourse has not seen any boost to its daily turnover volume due to low investor participation even after the November 15 relaxation of the floor price restriction.

The new policy allows stocks to be traded at up to 10 per cent below the floor prices set for the open market. The floor prices were determined by the average of daily closing prices of July 28 and the preceding four sessions.

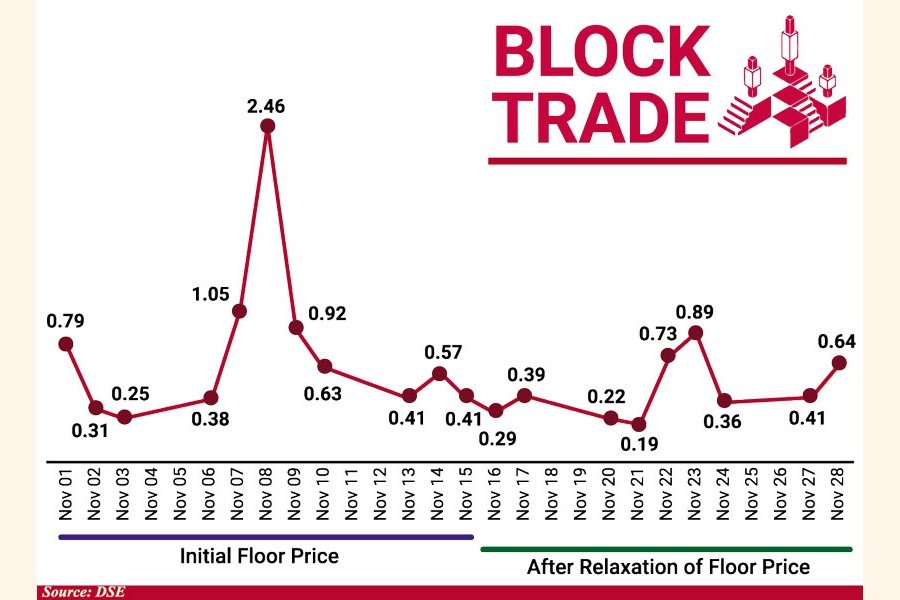

Instead of an expected rise, block market transactions shrunk remarkably, with turnover volumes hovering between Tk 0.189 billion to 0.892 billion over the 13 sessions through November 28.

On the other hand, in the previous two weeks with the usual floor price in place, daily transactions peaked at Tk 2.46 billion and hit Tk 0.255 billion at the lowest.

Md. Ashequr Rahman, managing director of Midway Securities, said an investor needs to sell shares of at least a single scrip amounting to Tk 0.5 million in the block board. Buyers also need at least Tk 0.5 million to take part in the transaction.

"The number of such type of high net worth investors is very insignificant compared to that of general investors. So, it's very usual that the turnover value will not be something significant amid the extended price movement limit."

Besides, block transactions take time as stock brokers have to find out the trading partners of the sellers, Mr Rahman added.

Insiders said many sellers wanted to offload their holdings in the block market, but they were buying time to see where the market would settle amid the prevailing global and domestic economic tension.

Asif Khan, chairman of Edge Asset Management Company, said it was difficult to identify what exactly held back transactions on the block board.

"Hypothetically, we can say that sellers are unwilling to offload holdings with losses, while buyers are awaiting more lucrative prices."

Bangladesh Securities and Exchange Commission eased the price movement on November 15, facing complaints from market operators that a substantial amount of transactions had been pending in the block market because of a majority of the listed securities being stuck at floor prices.

Proving the anticipation wrong, the daily turnover volume headed downward due to lower investor participation.

The block market trading is distinguished from the main market on account of the minimum transaction volume.

At the main market, any individual can participate by buying or selling at least one stock, the value of the shares is irrelevant.

But the minimum amount of a transaction in the block market has to be Tk 0.5 million no matter how many shares are traded.

Trading on the block board is negotiated by stock brokers. Sellers put forward amounts and rates of securities, and brokers deliver the information to interested buyers.

After the deal settlement, the information about the block transaction is posted on the bourses.

The number of trades executed in the block board ranged from 35 to 51 before November 15, whereas it was between 40 and 59 afterwards.

The market turnover declined significantly on the premier bourse too in recent times due to low participation of investors.

After November 9, the Dhaka Stock Exchange recorded daily turnover of less than Tk 10 billion. The trade volume sank to Tk 3.28 billion on November 24, the lowest in a month.

mufazzal.fe@gmail.com