The trustee shall act on behalf of and in the "exclusive interest of investors" as obliged by the trust deed and law, reads an agreement signed by Sandhani Life Insurance and fund manager Universal Financial Solutions (UFS).

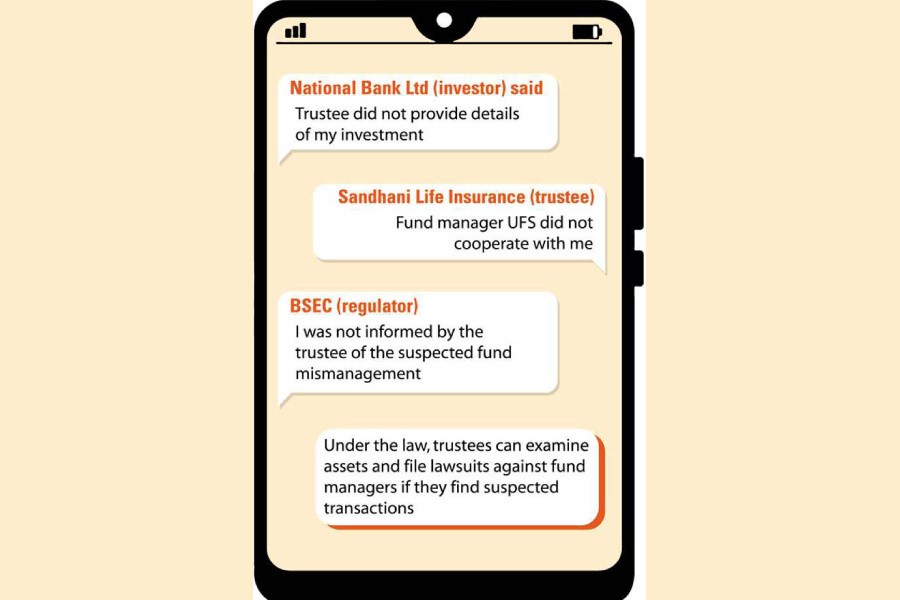

More than one and a half years after the trust deed was signed, investor National Bank Ltd (NBL) made a complaint that it has failed to get any report on the utilization of its investment from the fund manager UFS and the trustee Sandhani Life Insurance.

The managing director of the UFS, Syed Hamza Alamgir recently made news for having fled the country with Tk 1.58 billion from four unit funds that were under the supervision of state-run Investment Corporation of Bangladesh. The two other funds where the NBL invested Tk 500 million were under the supervision of Sandhani Life Insurance.

Sandhani appointed an auditor and valuer and collected quarterly reports from the fund manager as required by the law. But when there were anomalies, it should have reported to the securities regulator and filed a lawsuit on behalf of the unit holders, according to the rules and the deed.

It should have scrutinized the reports and made sure if the assets were in the forms as declared. Then the trustee could report the fund misappropriations to the Bangladesh Securities and Exchange Commission (BSEC).

Instead, the BSEC, when informed by a third party about the fund embezzlement, launched an investigation last month, a senior official from the commission said requesting anonymity.

National Bank Ltd. (NBL) said it had failed to track their investment of Tk 500 million as the asset manager had not given a single report on the fund utilisation.

NBL's Managing Director Md. Mehmood Husain said they had communicated with Sandhani repeatedly as well but failed to get details about the investment made by the lender.

In this case too, the trustee did not report the fund manager's breach of the rules to the BSEC.

Md. Mizanur Rahman, company secretary of Sandhani Life Insurance, said the UFS had not cooperated with the trustee when it sought information. He also claimed that the trustee had duly reported the matter of non-compliance to the regulator.

The BSEC, however, says violation of the rules by trustees is commonplace -- even for other securities, such as mutual funds.

There is a total of 109 trustees, including the state-run ICB, for mutual funds, asset-backed securities, debt securities, and alternative investment funds.

Some of the trustees simultaneously work for different types of funds.

A senior official of the regulatory body said that it had found misconducts committed by trustees of MFs -- both open- and close-end.

He said many trustees had received made-up reports from fund managers, but they could not identify the anomalies because they did not verify the existence of assets.

Prompted by the findings, the BSEC on January 9 asked trustees of all MFs to submit information within seven working days on all the assets managed by them.

The state-run ICB is one of the trustees. It is responsible for the scam-hit unit funds from where Tk 1.58 billion was allegedly siphoned off by the UFS top executive.

Despite repeated attempts over the phone, ICB's Managing Director Abul Hossain could not be reached for comments.

Terming the fund embezzlement as destructive for the mutual fund sector, former chairman of the securities regulator Faruq Ahmad Siddiqi said the securities regulator should take measures under the law against those responsible based on its findings.

The BSEC should make the trustees more accountable.

Mohammad Rezaul Karim, spokesperson of the securities regulator, said that after the completion of the investigation, the regulator would take measures in line with the laws.

As per the rules, the trustees are meant to keep watch on all the transactions done by fund managers of mutual funds.

For failing to do so, they face actions, including scraping of their licences and imposition of penalties under the Securities and Exchange Commission (Mutual Fund) Rules 2001.

As of now, no such action has been taken by the regulator.

It says no major incident similar to the scam involving the UFS had come to light before.

Preferring anonymity, a senior official of a leading merchant bank said misdeeds of the trustees had not been reported in most cases.

"Some mutual funds previously invested a substantial amount of funds on non-listed securities in breach of rules. The trustees did not play their due role to check those unlawful activities," the official said.

He said a trustee had once sought the regulatory approval to change the asset manager of two funds only when pressured by unit holders.

"The trustee can cease the assets if it finds irregularities. But the trustees did not do that and they were not brought to book."

mufazzal.fe@gmail.com