Investors concentrated mostly on pharmaceuticals & chemicals sector Tuesday which grabbed 18.4 per cent of market turnover.

Textile, fuel & power, banking and cement issues also dominated in the day's turnover.

Top ten traded stocks captured around 40 per cent of total turnover featured by the premier bourse DSE.

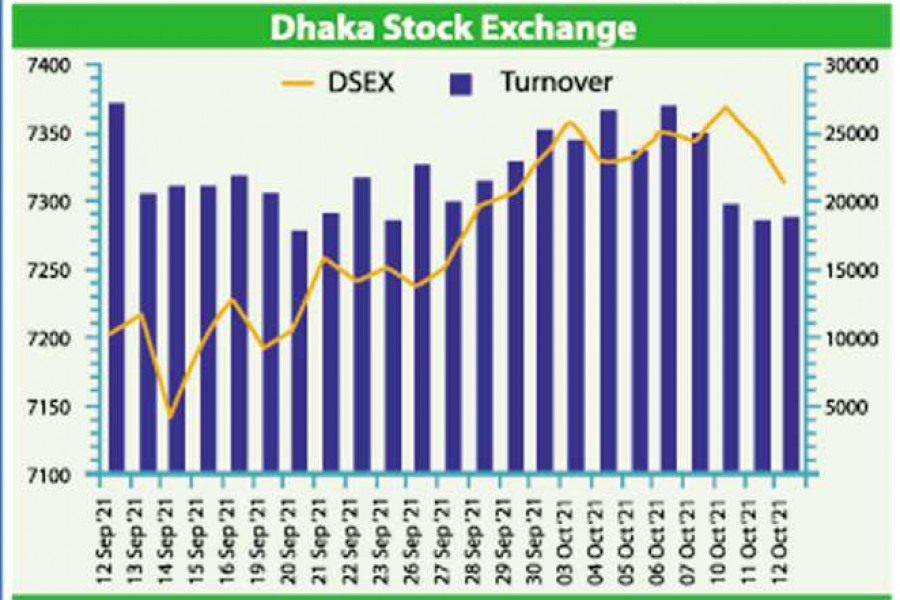

Broad index of Dhaka bourse on the day closed marginally lower extending the losing streak for second consecutive session as selling pressure continued in large cap companies.

The market operators said many investors adopted cautious stance and that's why the turnover on Dhaka Stock Exchange (DSE) remained almost unchanged.

The market opened the day's session positively but soon later the DSE broad index DSEX nosedived.

After half an hour, a recovery stance was observed but it failed to sustain and finally closed the session negatively.

The DSEX settled at 7313.98 with a loss of 0.43 per cent or 31.58 points.

The shariah-based index DSES went down 0.35 per cent or 5.60 points to close at 1591.04.

DS30 index comprising blue chip securities closed at 2749.88 with a loss of 0.26 per cent or 7.40 points.

According to a market review of International Leasing Securities, Dhaka bourse closed lower as the shaky investors continued profit booking sell offs as there were price upsurges in the previous few sessions.

"The market started with a negative note and the shaky investors' sell-offs in major sectors led the benchmark index to loss 32 points," the review said.

It said heavy sell pressure in cement, financial institution, textile, telecom, engineering and fuel & power sectors pushed down the DSEX.

Of total issues traded, 93 advanced, 244 declined and 38 points were unchanged on Tuesday on the premier bourse DSE.

At the end of the session, the DSE posted a turnover of Tk 18.63 billion which was 0.82 per cent higher against the turnover of the previous session.

Of total turnover, Tk 227 million came from transactions executed in block board of the premier bourse.

According to another market review of EBL Securities, the price fall of heavy weight companies like LafargeHolcim Bangladesh, Beximco Pharmaceuticals and Robi Axiata played a significant role behind the correction observed in broad index.

"Investors trimmed their position in sector outperformers and favoured selling shares that have reached their peak," the review said.

Of major sectors which saw price correction, engineering declined 1.0 per cent, financial institutions 2.8 per cent, fuel & power 0.8 per cent, telecommunication 1.2 per cent, textile 2.2 per cent and travel & leisure 0.8 per cent.

Of the sectors which witnessed price appreciation, bank advanced 0.1 per cent, general insurance 0.6 per cent, pharmaceuticals & chemicals 0.4 per cent and tannery 1.7 per cent.

LafargeHolcim Bangladesh topped the chart of scrip wise turnover chart with a value of Tk 1.50 billion followed by Orion Pharma Tk 1.30 billion, IFIC Bank Tk 873 million, Power Grid Company of Bangladesh Tk 842 million and Delta Life Insurance Company Tk 727 million.

NCC Bank was the number one gainer with a rise of Tk 9.71 per cent to close at Tk 27.10 each.

Tamijuddin Textile Mills was the worst loser after declining 7.51 per cent or Tk 12.20 to close at Tk 150.20 each.

CASPI, benchmark index of Chittagong Stock Exchange (CSE), declined 0.59 per cent or 128.03 points to close at 21360.84 points on Tuesday.

Of 301 issues traded, 73 advanced, 206 declined and 22 were unchanged and the port-city bourse posted a turnover of Tk 630.62 million.