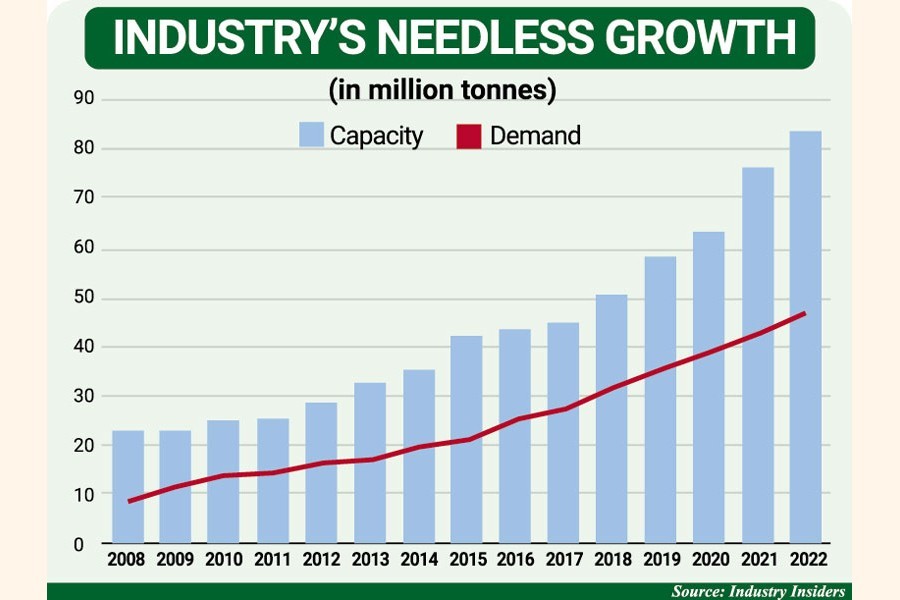

The capacity expansion of the cement industry since 2008 far outstripped demand leaving a significant part of it sitting idle to the cost of profit.

The industry's production capacity rose an astonishing 271.64 per cent to 83.29 tonnes in the last 14 years while the demand increased only 105 per cent to 46.72 tonnes.

One of the seven cement makers listed with the capital market, Meghna Cement Mills built a new plant last year in Mongla to double its annual production capacity to two million tonnes, despite a sluggish growth in public and private development works due to the pandemic.

Every additional capacity of one tonne requires an investment of $40, said Masud Khan, chief adviser of another listed company Crown Cement Group.

The industry's aggregate cost for excess capacity amounts to around $1.46 billion. And then there are maintenance costs.

Mr Khan said big players had built their capacity anticipating a jump in demand in five to ten years. "They thought if they were not prepared for the growing demand, they would lose their market share. That was why they continued expansion bearing the burden of excess capacity."

Insiders say the cement makers hoped that urbanization would boost the domestic demand.

Experts, however, said companies, listed or non-listed, increased their capacity over the years imprudently without any feasibility study on the market.

Therefore, the expansion happened at a faster pace than the demand.

Meghna Cement is not using its full capacity, said company Secretary Asaduzzaman, because of the government's strict measures against not-so-necessary imports amid the depleting foreign exchange reserves.

Financial statements reveal that Crown Cement had 31 per cent unused capacity in the fiscal 2020 and 18 per cent the year after while Heidelberg Cement had 38 per cent idle capacity in the calendar year 2021.

The rising prices of raw materials in the global market and the devaluation of taka against dollar have dealt a blow to the industry in recent times. The impact has been reflected in the listed companies' income disclosures for the outgoing fiscal year and the last few quarters.

Besides, the demand did not rise as speculated owing to the slide in government expenditures and reduced need in the real estate, said Masud Khan.

Soaring inflation triggered a slowing down of government projects and deceleration of the growth in the housing sector.

Another reason that Syed Kamruzzaman, company Secretary of Aramit Cement, pointed out as crucial behind the decline in demand is the completion of public mega projects.

"All companies, including the leading ones, are affected because of the excess capacity and their profits plunged. We are suffering too," Mr Kamruzzaman said.

Mr Khan said the expansion might result in a wider gap between capacity and demand in the coming years if the consumption did not go up as expected.

Big players enhanced their capacity to defeat their peers while small companies followed suit without thinking about the consequences, insiders say.

Requesting anonymity, an official of Meghna Cement said, "Our business group wants to ensure leadership in the cement sector implementing the expansion plan. We hope the demand will rise in future".

As the production costs rose for costlier raw materials, most of which are imported, and higher finance expenses, the unused capacity adds to the economic pain.

"The situation may deteriorate next year if the growth of the gross domestic product (GDP) declines," said Mr Masud Khan, chief adviser to Crown Cement Group.

Most of the listed companies saw their earnings in July-September 2022 go down. The companies said profits had been dwarfed by the rise in finance costs rendered by the high currency exchange rate.

The local currency saw 10 per cent depreciation against American dollar between June and October this year.

So, cement makers pay higher to import raw materials, such as clinker, gypsum, iron slag, limestone, and fly ash, not only because these cost more in the global market but also because taka is getting cheaper.

Of the listed companies, LafargeHolcim Cement is in a comfortable position for having access to a cost-effective source to get clinker from.

Most of the cement manufactured is meant for the domestic market. An insignificant amount is exported mainly to the seven sisters of India.

The Export Promotion Bureau recorded $9.57 million worth of exports of cement, salt, stone etc. in the fiscal 2022.

There are 37 active cement factories in Bangladesh and more than Tk 300 billion has been invested in the industry, according to the Bangladesh Cement Manufacturers Association.