Orion Infusion's stock plunged 12.58 per cent on Monday, becoming the day's worst loser, after soaring 'abnormally' by 12 times in the past five months.

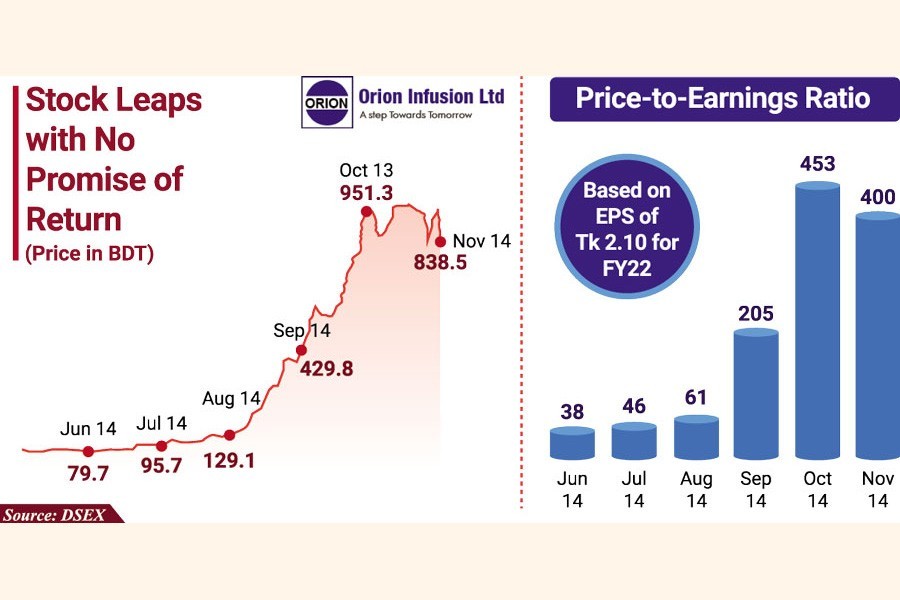

The stock skyrocketed from just Tk 79.70 on June 14 to Tk 959.20 on November 13 amid repeated claims by the company that there was no hidden information behind the abnormal price hike.

The share price retreated to Tk 838.50 on Monday following a corporate disclosure of 10 per cent cash and 10 per cent stock dividend for the year ended in June.

Mir Ariful Islam, managing director of Sandhani Asset Management, said the stock had already been overpriced before the corporate declaration, explaining the price erosion.

The stock shot up unsustainably, he said, adding that the return on investment was unlikely to support it.

A rumour that the company would declare rights issues had spread before the dividend declaration, but that did not happen to the disappointment of investors.

Lower-than-expected dividends prompted investors to dump their holdings before further erosion of their portfolios.

Even after the sharp price correction, the price-to-earnings (P/E) ratio of the stock remained high at 400.

That means investors will get one taka in return for an investment of Tk 400 for FY22.

The P/E ratio is calculated by dividing the stock's market price by its earnings per share for a particular time. It is an important indicator to gauge how expensive or cheap the stock is at the time.

Orion Infusion reported earnings per share (EPS) of Tk 2.10 for the year ended in June 2022, up from Tk 1.37 in the previous year.

A concern of Orion Group, it gained a profit of Tk 42.76 million in FY22, a 53 per cent jump from the previous year, said the company in a filing with the Dhaka Stock Exchange (DSE).

The company's P/E ratio started an upward trend in June this year when the ratio was 38. It crossed 200 in September and reached 450 on October 14 this year.

The overall P/E ratio of the DSE, which is around 15, indicates that Orion Infusion's was way above what could be deemed normal, said a merchant banker, requesting not to be named.

A high P/E ratio poses risks to investors, he said.

Rafiq Ahmed, a big investor, who trades at a leading brokerage firm, echoed the view. The stock rose too fast and the regulator should investigate whether there was any manipulation behind it, he said.

A top official of a brokerage firm, preferring anonymity, said stocks on several occasions rose due to influence by big investors.

Many have a tendency to bet on stocks with weak fundamentals for quick gains, he added.

Meanwhile, Orion Pharma, another concern of Orion Group, reported that profit was 10 per cent lower year-on-year to Tk 847 million in the fiscal 2021-22.

The drug maker declared a 10 per cent cash dividend for the year ended in June 2022. Its share price also plunged by 11.89 per cent to close at Tk 103 on Monday.