Factories had closed following years of losses. Then the economy plunged into turmoil. But nothing seems to have kept the stocks of Imam Button Industries and Meghna Condensed Milk Industries from making giant leaps in the gloomy stock market in 2022.

Why? One simple answer -- manipulation.

The junk stocks even featured in the annual top gainers' list.

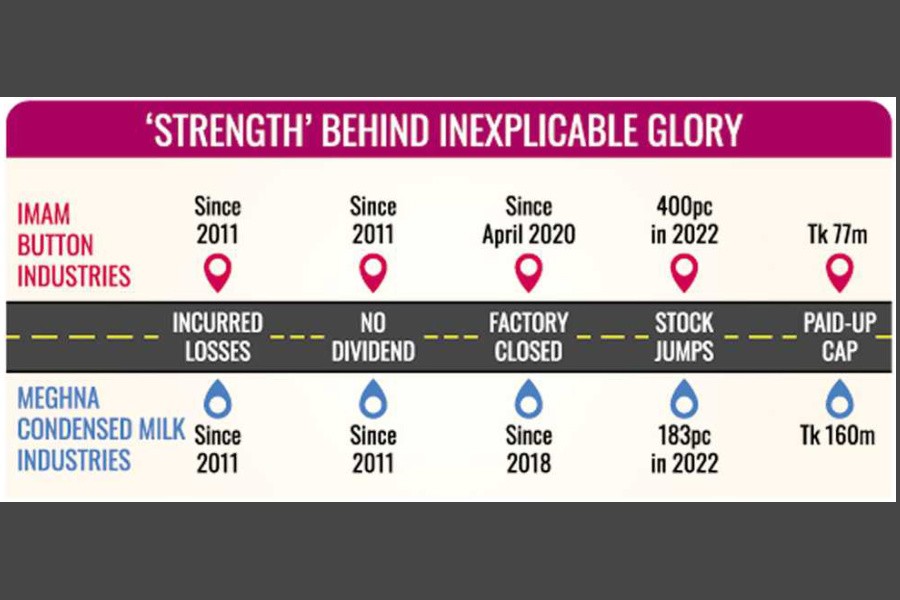

Imam Button's share price jumped 400 per cent while Meghna Condensed Milk's 183 per cent last year when a majority of the listed companies, including those who stood strong against all odds, endured significant price corrections.

While explaining the abnormal rise in the share prices, Prof Abu Ahmed, former chairman of the economics department at the University of Dhaka, said it happens when gamblers push up the prices through serial trading and then spread rumours among general investors.

Some institutional investors are also betting on speculative stocks, which is not a good sign for the market, Prof Ahmed added.

Mohammad Rezaul Karim, executive director of the Bangladesh Securities and Exchange Commission (BSEC), said the surveillance team of the regulator was keeping watch on trading every day and took actions as per the rules.

Loan defaulter Imam Button

Mohammad Ali, managing director of Imam Button and owner of the Chattogram-based Imam Group, fled the country in January 2020 after arrest warrants had been issued against him. He faces dozens of cases for defaulting loans of Tk 8 billion filed by banks and financial institutions, sources said.

The legal cases and the subsequent escape might have led to the production suspension as, according to company secretary (acting) Arabinda Nag, the factory has remained closed since April 2020.

Mr Nag also confirms that no possibility is in the horizon yet of a resumption of production at the Fauzdarhat factory in Chattogram.

Still, the stock becomes the fourth top gainer on the annual winners' chart, riding on rumours that the company has resumed operation. However, no financial reporting has been done after March 2020.

Before it closed, Imam Button had incurred losses since 2011. It did not provide dividends for the years.

A stock gets the label of junk stock when the company's commercial production has been shut for six months in a row or when it fails to hold annual general meetings on time or fails to provide dividends to shareholders.

The share price multiplied six times in five months between February and July last year.

Such an unusual price movement prompted the prime bourse to serve a show-cause notice to the company several times.

The company itself warned investors at least five times that it had no undisclosed information that could have raised the stock abnormally.

Imam Button closed at Tk 117.20 on Tuesday. The stock languished at the floor price for nearly five months through December before it dropped 7.42 per cent. The fall was triggered by the partial relaxation of floor prices for 169 stocks. Imam Button, which was listed on the stock exchanges in 1996, was one of those.

Meghna Condensed Milk: Liabilities outstrip assets

The condensed milk maker was listed on the Dhaka Stock Exchange in 2001 and began counting losses persistently since 2011.

The annual loss in 2022 was Tk 36.5 million. The company's current liabilities exceeded its assets by Tk 478.64 million.

For years, Meghna Condensed Milk reported negative retained earnings, negative net asset value per share, negative net profit.

The company has been out of business for the last four years. But it is the 10th and last top winner in the annual chart of gainers, having seen the stock price surge by 183 per cent in 2022.

Meghna Condensed Milk got itself into a deep trouble due to a huge debt burden. It owes about Tk 643 million to banks, according to the latest financial report.

Officials of the company could not be reached by phone for comments. The company did not provide any contact number of its secretary on the DSE website, a mandatory provision for listed companies.

Its share price closed at Tk 39.60 on Tuesday after a 5.71 per cent fall, again triggered by the partial removal of floor prices.

Prof Ahmed says investors' tendency to become rich overnight gets them into the trap of gamblers.

Manipulative trades happen at a certain time every year. Companies with low paid-up capital are more vulnerable to such illegal acts, said the economist. The BSEC does not take prompt actions, and when they do it is usually too late, he added.