Jute Spinners -- a junk stock -- has been flying high on the Dhaka Stock Exchange while the company sees losses piling up without any sign of recovery for its operation remaining suspended for more than six years.

The factory has been producing nothing since 2016. Revenue is zero. Other financial indicators are in the negative. Liabilities shot up exceeding twice the value of assets of Tk 296.97 million.

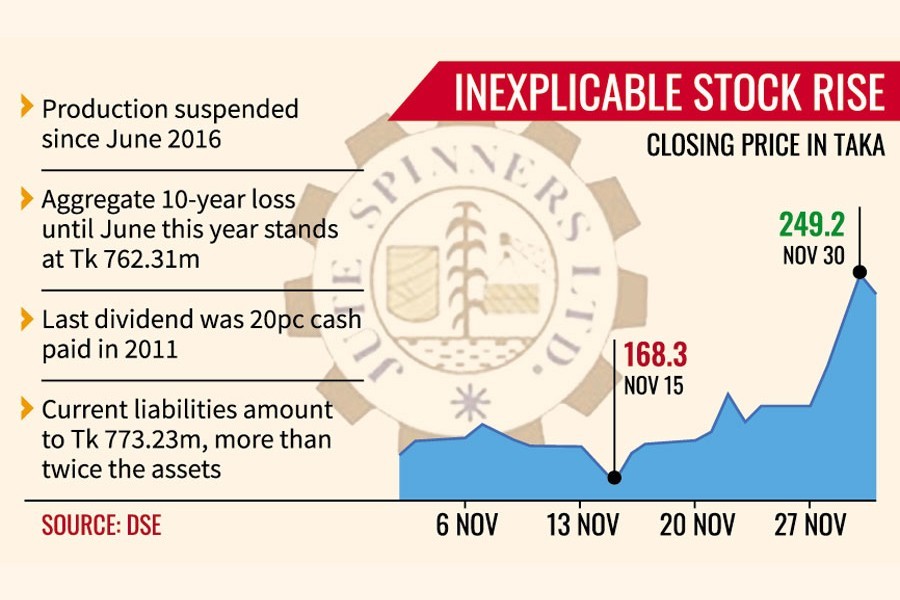

Despite the grim performance, the company's share price jumped 48 per cent, or by Tk 81 each, to Tk 249 in just two weeks' time since November 15.

The stock price rise is an astounding 85 per cent in the past six months without any disclosure of price-sensitive information, such as dividend, for years.

Such an unusual price movement in recent times prompted the prime bourse to serve a show-cause notice to the company authority, enquiring about the reasons behind that.

The company returned a knee-jerk response on Thursday, saying there was no undisclosed price-sensitive information.

The junk stock dropped 3.69 per cent to close at Tk 242 on Thursday after the notice issued.

A stock is identified as junk when the company's commercial production has been shut for six months in a row; it has failed to arrange annual general meetings on time, or has failed to provide dividends to shareholders.

Jute Spinners reported a loss of Tk 76.23 million in the fiscal year ended in June 2022. Losses accumulated over the last 10 years amount to Tk 762.31 million.

Stock's earlier abnormal performance

On September 15 this year, the company announced that it would start "trial production" after the long break.

Its share price, however, started climbing up much earlier and reached Tk 269 on September 19, up 66 per cent from September 6.

"A hike in the share price was reported in mid-September, which was unusual considering the current status of the company," said its auditor Shiraz Khan Basak & Company in its adverse opinion report.

Company Secretary A T M Mostafa also expressed shock at the inexplicable price surge.

"We do not have any undisclosed price sensitive information," he said, which might influence the share price movements.

Mostafa added that the company started trial production at 16 per cent of its existing capacity since most of the machines had been out of order.

The company does not even have a website, although it is mandatory for a listed company to make financial data public on a regular basis.

Asked about the matter, the company secretary said they were working on it.

The auditor in its report said the company's liabilities might be higher than what had been shown.

The chartered accountant firm also said it had drawn attention to labour unrest, the company's inability to pay creditors timely, significant adverse key financial ratios and the discontinuation of dividend payouts.

The company's low paid-up capital -- Tk 17 million -- makes it an easy target for gamblers seeking to manipulate trading, said a merchant banker.

The number of securities is 1.70 million.

"Influential investors by disseminating rumours are trying to manipulate the prices of shares of many companies to earn quick-bucks," he said.

Like Jute Spinners, many other stocks frequently make their way to the top gainers' list, riding on rumours that investors have been putting money into the securities.

"If these stocks face corrections, investors will be the ultimate losers," the merchant banker said. Investors should be careful while buying junk stocks in order to avert any misfortune.

Sponsor-directors owned 39.82 per cent stake in Jute Spinners, listed in 1984, while institutional investors owned 23.20 per cent and the general public 36.98 per cent at the end of October 2022, according to the DSE.

babulfexpress@gmail.com