Investors can cut down risk and achieve good returns from long-term investments in mutual funds rather than crowd into weak stocks that rally for no good reasons.

However, the stock market is dominated by individual and even institutional investors who are keen on "short-term speculative investments rather than more realistic and sustainable returns expected from mutual funds," said Reaz Islam, chief investment officer of LR Global Bangladesh Asset Management Company, in an interview with the Financial Express.

A misconception pervades that mutual funds cannot outperform the market, he said.

Market movements, of course, impact the performance of MFs since 60 per cent of the assets are listed instruments, but the value of this part is determined by the stocks the portfolios are comprised of.

Apart from a few exceptions, listed mutual funds performed better than other listed securities and the market when long-term risk-adjusted returns are compared.

The main reason behind such outcome is that fund managers diversify portfolios weighing on investment risks and ensure proper timing for bets.

"A good manager should be able to outperform the benchmark (net of all fees and expenses) over a medium to short term."

Many listed MFs provided superior dividend yields compared to other investment options against their heavily-discounted prices on the bourses.

Yet, the MF sector is highly stunted, compared to the size of the stock market.

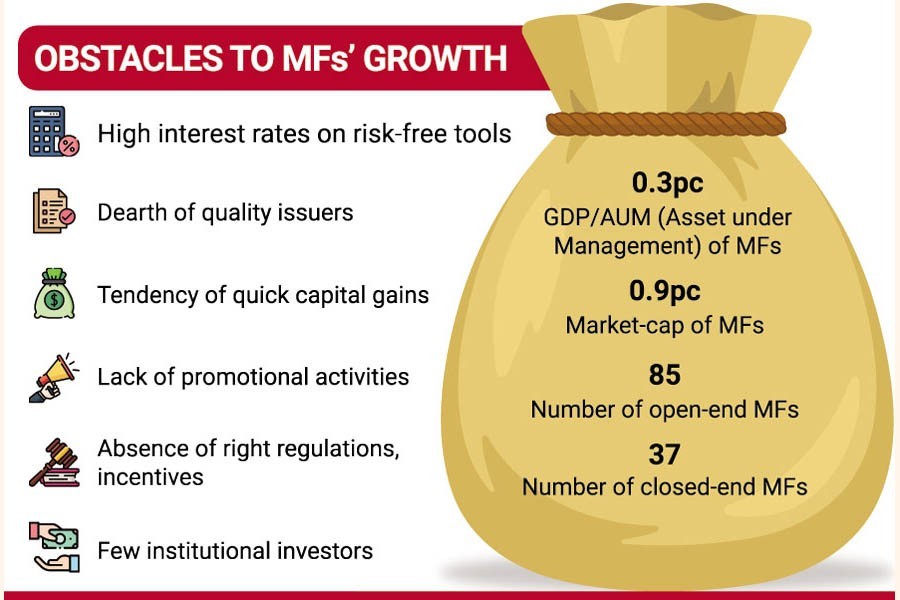

The total asset under management (AUM) of MFs in Bangladesh is a mere 0.9 per cent of the total market capitalization. The figure is around 13 per cent in India, Pakistan and Nepal.

When compared to GDP, Bangladesh's AUM stands at only 0.3 percent while it is 16.8 per cent in India, 1.7 per cent in Pakistan and 6.3 per cent in Vietnam.

"Without a stable and growing capital market, the MF industry cannot sustainably grow," said Mr Islam.

In Bangladesh, investor participation in the capital market is low even outside the MF sector, he said, blaming the undersized MF industry on the lack of financial literacy of investors and the lack of regulations and incentives to invest in MFs.

He explained that both the supply side and the demand side fall short of the standards.

A dearth of quality stocks, not-so-satisfactory performance of listed companies and less-than-expected dividend payouts at the supply side, and the lack of long-term institutional investors, including pension funds and insurance companies, at the demand side curb the MFs' growth.

Mr Islam, however, explained why open-end mutual funds pose higher risks than close-end MFs in the stressful market condition prevailing now.

In case of open-end MFs, fund managers have to meet the weekly liquidity requirements in the bearish market, which leads to forceful offloading of quality assets. So, the remaining unit holders absorb the economic pain of illiquid assets.

In such a scenario, the open-end MFs are likely to underperform irrespective of capable asset managers and their commendable track records.

"This is the key structural issue where long-term assets are being funded with short-term investments."

A well-developed commercial paper market, tradable treasury securities, and the availability of other highly-liquid investable assets, including transferable savings certificates, are prerequisites for a congenial environment for open-end mutual funds.

Referring to positive impacts of open-end MFs, Mr Islam said such investment opportunities might increase investor participation in the stock market.

LR Global does not manage any open-end fund "since the market at this time is not suitable for such a fund structure".

The closed-end MFs managed by LR Global Bangladesh are AIBL 1st Islamic Mutual Fund, NCCBL Mutual Fund-1, DBH First Mutual Fund, Green Delta Mutual Fund, LR Global Bangladesh Mutual Fund One, and MBL 1st Mutual Fund.

The size of these assets ranges between Tk 1 billion and Tk 3.39 billion, and the aggregate assets under management amount to more than Tk 9.40 billion as of November 7.

Mr Islam said 80 per cent of their portfolios comprised secondary market investments, yet the total return and alpha (return above benchmark) on a NAV basis or price basis was higher than the market's return.

Since its inception, the asset manager has disbursed cash dividends equivalent to more than 58 per cent on an average of the value per unit.

"Unfortunately, even after the consistent good performance compared to the market (DSEX) and dividend yields in double digits, the market discount to NAV of our funds have not improved materially. This issue exists with most closed-end funds indicating unusual investor behavior."

In order to address the market discount issue, a comprehensive plan and a collective effort by all stakeholders are required without any further delay.

Provided the fund NAVs are accurate, there is simply no rationale for these instruments to trade beyond 10-15 per cent discount or premium consistent with global markets, Mr Islam said.

The discount or a premium around NAV reflects the cost or benefit of liquidity in the stock exchange where investors can exit or enter when they want.