Most of the listed multinational companies (MNCs) have recommended substantial amount of cash dividends for the year ended on December 31, 2020, maintaining their profit growth.

Currently, there are twelve multinational companies listed with the Dhaka Stock Exchange (DSE), which account for approximately 24 per cent of DSE's total market capitalisation.

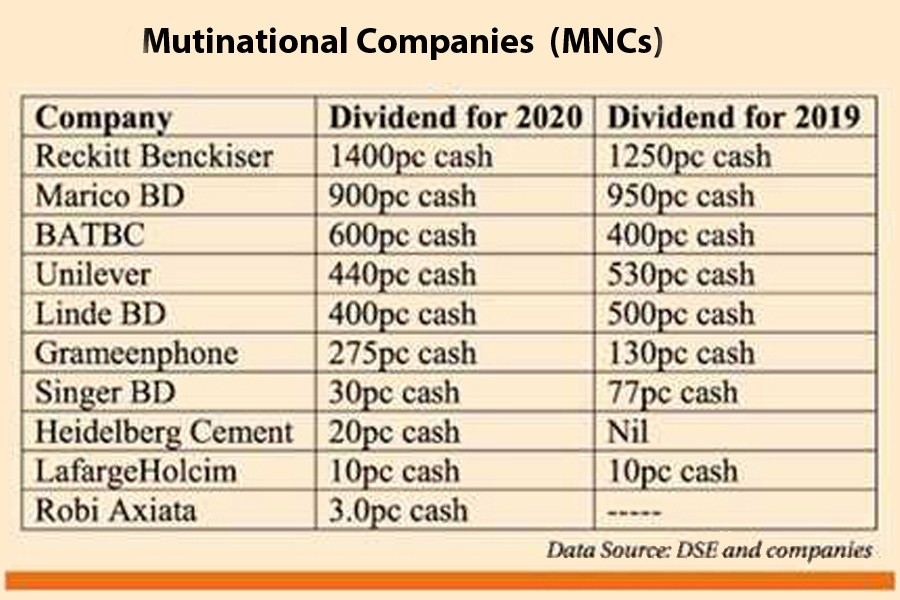

Of the listed MNCs, ten declared dividends for the year 2020, so far as of Wednesday, according to available data with the DSE.

Four multinational companies declared higher dividends than that of the previous year, four recommended lower, one declared similar to the previous year while one declared dividend for the first time after listing.

Market insiders said the most listed MNCs are declaring significant amounts of cash dividends every year after their listing on the local bourses, as brand value, better management, and product quality helped them attaining significant growth in profits.

"The multinational companies are well-managed and have reputation of their product quality, making them to earn more as well as pay hefty dividends," said a leading merchant banker.

He noted that dividend in cash is an indicator of the financial strength of a company.

Reckitt Benckiser topped the list in terms of dividend declaration this year like the previous year. The company declared a record 1400 per cent cash dividend for the year ended on December 31, 2020.

This is the highest dividend declaration of any listed company in the history of Bangladesh capital market. In 2019, it disbursed 1250 per cent cash dividend.

The company's earnings per share surged 19.32 per cent year-on-year to Tk 156.38 for the year ended on December 31, 2020.

The company's EPS increased due to strong revenue growth driven by increased demand of personal hygiene products during pandemic, company officials said.

Marico Bangladesh is the second highest in terms of dividend declaration as it declared total 900 per cent cash for the year ended on March 31, 2021 (year-end). Its EPSrose to Tk 98.69 for the year ended on March 31, 2021 as against Tk 84.01 in the previous year.

British American Tobacco became the third highest in terms of dividend declaration as the company declared 600 per cent cash for the year 2020. Its EPS jumped to 60.48 for the year 2020 as against Tk 51.37 in the last year. In 2019, the company provided 400 per cent cash dividend.

Unilever Consumer Care declared a 440 per cent cash dividend for the year 2020. Unilever Consumer, former GlaxoSmithKline (GSK) Bangladesh's EPS plunged by over 46 per cent to 43.94 for the year ended on December 31, 2020 in the wake of the coronavirus pandemic.

Linde Bangladesh, a pioneer in industrial gases in Bangladesh, declared a 400 per cent cash dividend for the year2020. Its EPS stood at Tk 70.55 in 2020.

Grameenphone (GP), the largest market-cap listed company, declared total 275 per cent cash dividend for the year 2020. Its EPS rose to Tk 27.54 for the year2020 as against Tk 25.56 of the previous year.

Singer Bangladesh declared 30 per cent cash dividend for 2020. In 2019, the company disbursed 77 per cent cash dividend.

Heidelberg Cement declared 20 per cent cash dividend for the year 2020 out of funds available for appropriation. In 2019, the company declared 'no' dividend. The company incurred net loss of Tk 80.84 million in 2020 as against net loss of Tk 186.66 million in the previous year.

LafargeHolcim declared 10 per cent cash dividend for the year 2020. In 2019, the company also paid 10 per cent cash dividend.