Most of the listed banks posted higher profits in 2021, compared to the previous year, largely due to higher operating income.

According to market insiders, the central bank's latest relaxation on provisioning, bullish stock market and record imports and exports helped many banks to earn more last year.

Of the 33 banks listed on the Dhaka Stock Exchange (DSE), the consolidated earnings per share (EPS) of 21 banks increased, 11 others saw their EPS fall while one continued to incur losses in 2021, according to data available with the DSE.

EPS is the portion of a company's profit that is allocated to every individual stock. In short, it serves as an indicator of a company's profitability.

Most banks clocked higher EPS due to increased operating income while non-performing loans were under control as a result of extraordinary policy support on provisioning from the central bank, said the managing director of a private commercial bank, preferring anonymity.

"The stock market was also bullish during the period. So, many banks did not need to keep provision. This ultimately boosted their profits," he said.

Between January 1, 2021 and December 30, 2021, the DSEX, the key index of the prime bourse, soared 1,354 points or 25 per cent.

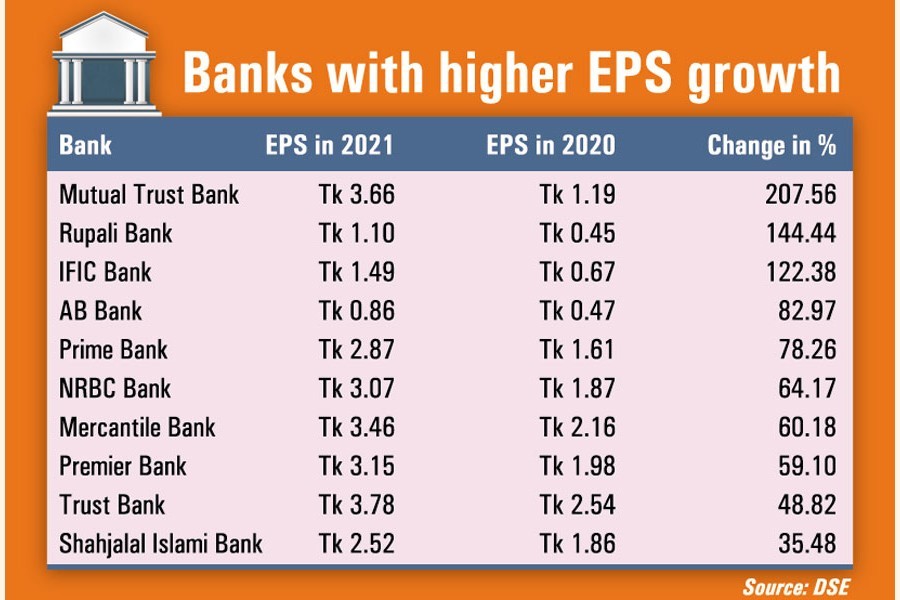

Mutual Trust Bank posted the highest growth in EPS, which surged 207.56 per cent to Tk 3.66 for the year ended on December 31, 2021. Its EPS was Tk 1.19 for the year ended on December 31, 2020.

The EPS of the state-run Rupali Bank jumped to Tk 1.10 for the year 2021, up 144.44 per cent from the previous year when the EPS was Tk 0.45.

IFIC Bank saw its EPS rise 122.38 per cent to Tk 1.49 for the year ended on December 31, 2021, from Tk 0.67 a year ago.

The EPS of AB Bank increased 82.97 per cent to Tk 0.86 for the year ended on December 31, 2021, which was Tk 0.47 a year earlier.

Prime Bank's EPS rose 78.26 per cent to Tk 2.87 for the year 2021 as against Tk 1.61 in the previous year.

NRB Commercial Bank's EPS soared 64.17 per cent to Tk 3.07 for the year ended on December 31, 2021, from Tk 1.87 a year ago.

Mercantile Bank saw its EPS surge 60.18 per cent to Tk 3.46 for the year ended on December 31, 2021 as against Tk 2.16 in the previous year.

Premier Bank's EPS soared 59.10 per cent to Tk 3.15 in the year that ended on December 31, 2021, as against Tk 1.98 in the previous year.

The EPS of Trust Bank also rose 48.82 per cent to Tk 3.78 for the year 2021, which was Tk 2.54 a year earlier.

Shahjalal Islami Bank logged an EPS of Tk 2.52 for the year ended on December 31, 2021, as against Tk 1.86 a year ago.

Bank Asia, The City Bank, First Security Islami Bank, Pubali Bank, Social Islami Bank, Eastern Bank, Dhaka Bank, NCC Bank, Uttara Bank, Dutch-Bangla Bank and Islami Bank also saw their EPS increase between 0.33 per cent and 34.48 per cent in 2021.

On the other hand, National Bank posted the highest decline in EPS, which fell 89.28 per cent to Tk 0.12 in 2021.

SBAC Bank, ONE Bank, Standard Bank, BRAC Bank, Exim Bank, Al-Arafa Islami Bank, Southeast Bank, UCB, Union Bank and Jamuna Bank also saw their EPS decline between 0.28 per cent and 46.76 per cent in 2021.

ICB Islamic Bank continued to incur losses. It incurred a loss of Tk 0.59 per share in 2021, as against a loss of Tk 0.28 per share in 2020.