Meghna Cement Mills, a concern of Bashundhara Group, gained Tk 55.87 million in profit in the fiscal 2021-22 ended in June, a turnaround from Covid-induced losses the year before.

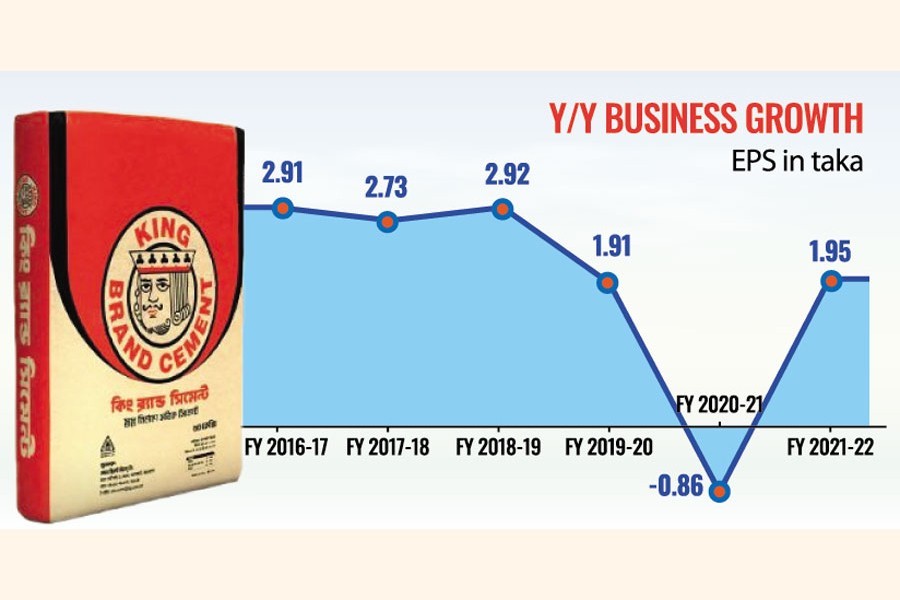

As a result, earnings per share rose to Tk 1.95 for FY22 from Tk (0.86) in the previous year. The company suffered losses amounting to Tk 24.60 million in FY21.

The achievement is the result of "efficient management, appropriate business strategy, and own distribution channels", said company Secretary Md Asaduzzaman.

"Everything is going well, and I hope the company will perform well in the days to come," he said.

Meghna Cement uses packaging materials produced by a concern of Bashundhara Group at a competitive price and has its own distribution channels to the advantage of its business, said Mr Asaduzzaman.

Most of the cargo-vessels and trucks deployed to carry products to different corners of the country are owned by the company.

Moreover, Meghna Cement runs continuous promotional programmes focusing on innovation and customers, officials in the company said.

It recorded profit at a time when most other cement makers have been enduring pain of huge losses due to the soaring prices of raw materials, higher freight charges and devaluation of local currency against dollar.

The cement industry is reliant on imports for 90 per cent of the raw materials they use.

Incorporated in 1992, Meghna Cement Mills is the first manufacturing unit of Bashundhara Group and it is one of the largest cement makers in the country.

Meghna Cement produces portland composite cement and ordinary portland cement under the King Brand portfolio.

Its annual production capacity is more than 1.0 million tonnes. A new plant was built in Mongla last year to double the production capacity, company sources said.

Meanwhile, the net asset value per share dropped to Tk 57.90 in FY22 from Tk 62.49 a year earlier. The net operating cash flow per share also plunged to Tk 15.14 from Tk 42.66 during the period.

The board of directors has recommended 5 per cent cash and 5 per cent stock dividends for FY22, the same as for the previous fiscal year.

The company declared bonus shares as the retained earnings will be invested in new material-handling projects and the launching of new products, it said.

Listed in 1996, the stock closed at Tk 72 on Tuesday, losing 0.55 per cent from the day before.

Among the seven-listed cement makers, Aramit Cement suffered a loss of Tk 7.62 per share in the nine months to March 2022, Heidelberg Cement incurred a loss of Tk 4.27 per share in the nine months through September this year, and Crown Cement reported an annual loss of Tk 1.54 per share for the year ended in June.

Premier Cement's EPS plummeted by 91 per cent to Tk 0.37 for the nine months through March 2022. The EPS of Confidence Cement also dropped more than 40 per cent for the July 2021-March 2022 period.

However, LafargeHolcim's EPS jumped 21 per cent year-on-year to Tk 0.98 for the July-September quarter of 2022 as the company mostly depended on its own sources of raw materials.

A slowing down of public construction works due to the government's austerity measures and sluggish private initiatives for inflation contributed to a decline in the demand for cement, industry insiders say.

According to the latest industrial data of the Bangladesh Bureau of Statistics, the cement manufacturing sector has witnessed a growth of only 0.26 per cent year-on-year to 17.90 million tonnes in the last 10 months until April 2022.

The country has attained self-reliance on cement, making the sector as 37th largest in the world.

Manufacturers have a combined annual production capacity of 58 million tonnes against the local demand for 33 million tonnes. The industry facilitated direct employment of 60,000 people and indirect employment of another one million.