Funds raised by listed companies from rights shares soared more than three-fold in the outgoing calendar year 2017 compared to the previous year.

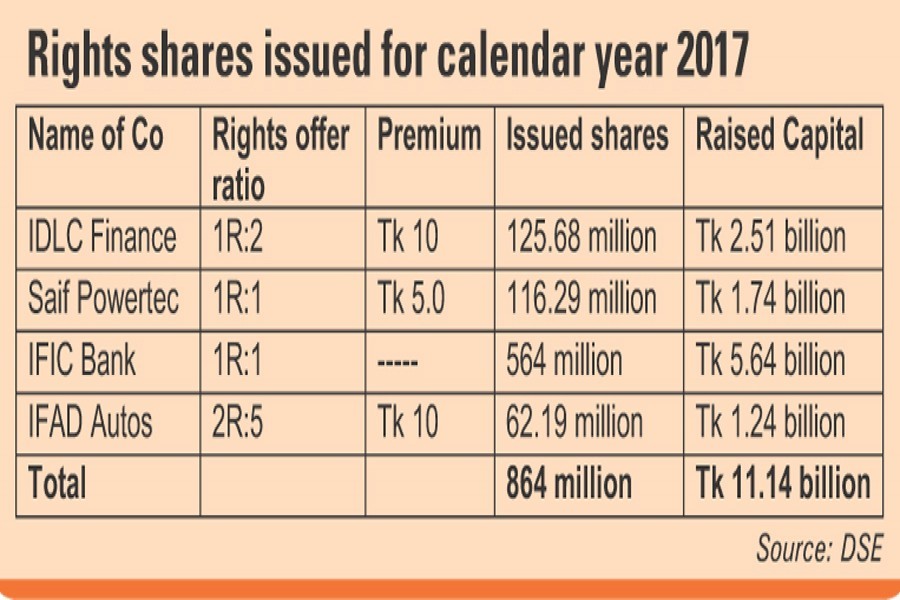

Four listed firms netted around Tk 11.14 billion by issuing more than 868 million rights shares, with IFIC Bank accounting for half of the fund, according to data from the Dhaka Stock Exchange (DSE).

A rights issue is an issue of additional shares by a listed company to raise capital from existing shareholders.

With a rights issue, existing shareholders get the privilege to buy a specified number of new shares from the firm at a particular price within a specified time.

Market insiders said regulatory requirements and a better situation in the secondary market were the main factors behind the jump in capital raised through rights shares.

Of the four firms that raised funds through rights shares in 2017, two were from the financial sector, one from engineering and the rest from services & real estate sector.

Meanwhile, rights subscription of LankaBangla Finance is set to begin on December 17 which will raise Tk 1.59 billion by issuing 159 million ordinary shares of Tk 10 each to comply with the condition of BASEL-III.

"Better situation in the secondary market coupled with fulfil the regulatory requirements of financial companies were the main factors behind the jump in capital raised through rights shares," Khairul Bashar Abu Taher Mohammed, chief executive officer of MTB Capital told the FE.

He noted that the financial sector companies issued rights shares either to reach their capital adequacy ratio or to strengthen their capital base in line with regulatory requirements.

The companies with weak fundamentals should not be allowed to offer rights shares, said Mr Bashar, also the secretary general of Bangladesh Merchant Bankers Association (BMBA).

In 2016, three listed companies collected Tk 3.66 billion by issuing nearly 274 million rights shares, the DSE data shows.

In 2015, the Bangladesh Securities & Exchange Commission (BSEC) did not allow any single company's proposal to raise fund through rights.

IFIC Bank raised nearly Tk 5.64 billion by issuing 564 million ordinary shares at par of Tk 10 each. The purpose of issuing the rights shares was to strengthen capital base of the bank as per the requirement of Basel-III.

Basel III is a comprehensive set of reform measures developed by the Basel Committee on banking supervision to strengthen regulation and supervision and reduce risks of the banking sector globally.

Three other listed companies issued rights shares with premium.

IDLC Finance raised Tk 2.51 billion through 125.68 million rights shares of Tk 20, including premium of Tk 10 each.

The non-bank financial institution issued one rights share for existing two shares. The company issued rights shares for strengthening IDLC's capital so that it can scale up its SME, consumer and corporate lending.

IFAD Autos raised a capital worth more than Tk 1.24 billion through 62.19 million rights shares. The automobile dealer issued two rights shares against five existing shares at a price of Tk 20 each, including a premium of Tk 10 each.

The purpose of the issuance of rights shares is to raise further paid-up capital for expansion of the business, to meet the requirement of working capital and to pay off debts of the company.

Saif Powertec collected more than Tk 1.74 billion by issuing 116.29 million rights shares of Tk 15, including a premium of Tk 5.0 each.

The Chittagong-based company issued one rights share against one existing share. The purpose of the issuance of rights shares for repayment of bank loans and expansion of business (battery project).