Dhaka bourse closed the week with a marginal loss in terms of both index and turnover value, as investors adopted a cautious stance following a standoff between the central bank and the securities regulator.

During the week, the large-cap companies having significant influence on the broad index saw price correction, which was reflected in the DSEX, the benchmark index of Dhaka Stock Exchange (DSE).

Market analysts said the debate involving the central bank and the securities regulator on the use of unclaimed or undistributed dividends of banks and financial institutions by the Capital Market Stabilisation Fund (CMSF) played a role in the lower participation of investors.

In the past week, the central bank ruled out the possibility of use of the unclaimed dividends by the CMSF although the finance minister defended the securities regulator's stance on using the dividends.

During the week, investors' participation declined 19.91 per cent while DSE posted a daily average turnover of Tk 22.24 billion.

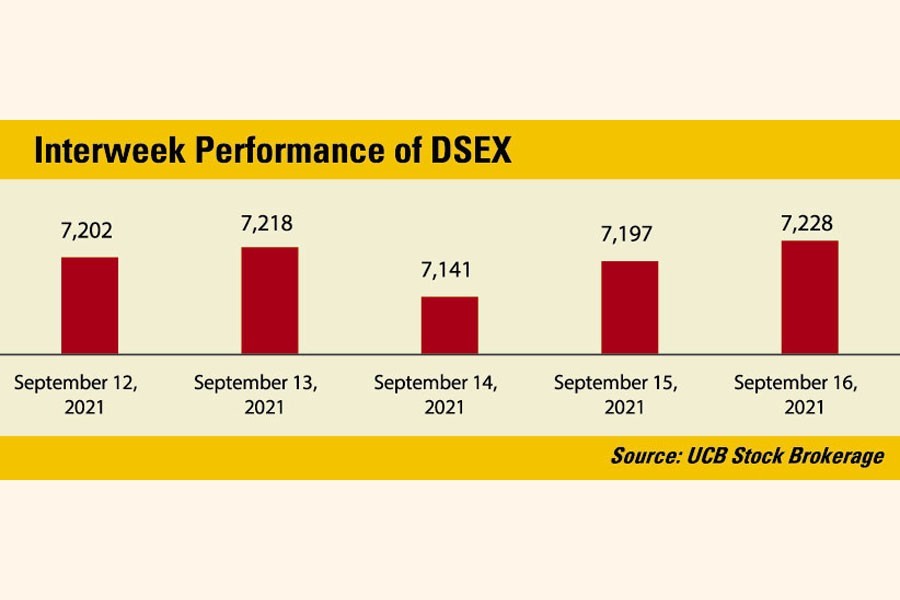

The broad index settled the week at 7,228.31 points, down 0.42 per cent or 30.43 points from the previous week's closing at 7258.75 points.

The Shariah-based DSES index declined 0.96 per cent or 15.21 points to close at 1577.10 points while the blue-chip DS30 index closed at 2674.55 points with a rise of 1.04 per cent or 27.41 points.

Of 382 issues traded on the premier bourse, 84 advanced, 282 declined and 12 remained unchanged.

The daily average turnover of DSE stood at Tk 22.24 billion, down 19.91 per cent than in the previous week.

According to a market review by EBL Securities, the DSE saw corrections across the board due to profit-booking sell-offs.

"Regulatory dilemma regarding forming of market stabilisation fund made investor nervous," it said.

Besides, Walton, Berger and ICB witnessed sell pressure following regulatory directive to offload more shares, said the EBL Securities.

Of the major sectors which saw price correction, engineering sector declined 12 per cent, general insurance 3.5 per cent, fuel & power 2.2 per cent, telecommunications 1.5 per cent, banking 0.7 per cent and pharmaceuticals & chemicals sector 0.6 per cent.

On the other hand, life insurance sector advanced 4.9 per cent, mutual fund 3.2 per cent, services & real estate 0.4 per cent and travel & leisure 5.7 per cent.

Investors mostly remained watchful and preferred to book quick gain to recoup losses as they were afraid of the sustainability of the recent bullish momentum in the market, according to another market review by International Leasing Securities.

Investors' participation was concentrated mostly on financial institutions sector which grabbed 13.1 per cent of weekly market turnover followed by pharmaceuticals & chemicals 11.3 per cent, engineering 10.5 per cent, and textile 10.1 per cent.

Beximco topped the scrip-wise weekly turnover chart, generating a turnover of Tk 5.89 billion, followed by LankaBangla Finance (Tk 3.75 billion), Beximco Pharmaceuticals (Tk 3.36 billion), SAIF Powertec (Tk 2.04 billion), and British American Tobacco Bangladesh Company (Tk 2.0 billion).

National Housing Finance and Investment Ltd was the top gainer with a rise of 27.78 per cent to close at Tk 87.40 each on Thursday.

Walton Hi-Tech Industries saw the highest price correction as it declined 16.65 per cent to close at Tk 1206.40 each on Thursday.

During the week, the Chittagong Stock Exchange (CSE) recorded a loss of 132 points in its CSE 30 index while its two other indices -- CSCX and CASPI -- gained 9.5 points and 10 points respectively.