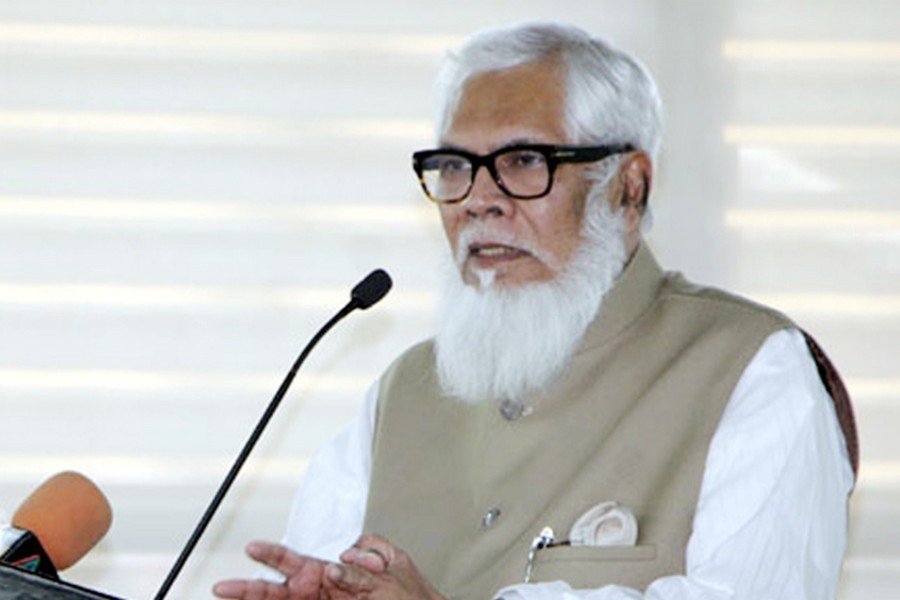

Low presence of institutional or professional investors in daily turnover is 'a basic structural defect' of the capital market, said Salman F Rahman on Tuesday.

In a vibrant and matured stock market, institutional investors are the key players, but small or retail investors account for around 80 per cent in the country's share market, the Prime Minister's Private Industry and Investment Affairs Adviser opined.

"If we look at other markets even in this region, we can see the reverse scenario. We need to bring more professional investors to make our market more vibrant and stronger," he said while speaking as the chief guest at a virtual discussion.

The Bangladesh Merchant Bankers Association (BMBA) hosted the webinar on the importance of investment-related education in developing the stock market - on the occasion of World Investor Week 2021.

BMBA Secretary General Md. Riyad Matin moderated the event, where discussants highlighted the importance of investment-related education that would enlighten the investors to make right decisions.

Mr Salman Rahman hailed various reform initiatives of the new team of the Bangladesh Securities and Regulatory Commission (BSEC) for bringing more institutional investors to the market.

A good number of (small) investors are coming to the market without having a basic knowledge on price-earning (PE) ratio, net asset value (NAV), earning per share (EPS), and recent trading trend of particular stocks, he noted.

"The brokers and professional portfolio managers have a role to educate the investors and help them to make right or less risky decisions."

The PM's adviser said market capitalisation of the mutual funds needs to be strengthened further, so that the retail investors, even those - who do not have enough knowledge - can invest and get dividends from those.

"It is also important for mutual fund trading, so that anyone can exit with either a premium or discount at any stage of the trading."

Mr Rahman also identified the absence of bond market as another weakness of the capital market.

"The government is trying to develop the bond market, which is very important," he added.

Speaking as a special guest, BSEC Chairman Prof Shibli Rubayat Ul Islam said the capital market became matured, and (in line with that) the investors need to behave maturely.

"Trading in the share market is a highly technical matter. So, it requires necessary education. The investors need to know about the stocks they are investing in, possible return, opportunities and risk factors as well."

He said the BSEC have been arranging regular classes on various issues of the market through two of its wings - Bangladesh Academy for Securities Markets (BASM) and Bangladesh Institute of Capital Market (BICM).

"I hope people, who want to invest in the market, will take the opportunity and make right decisions," he added.

BMBA President Md. Sayadur Rahman said academic education is not enough to understand the market properly. Some persons, having sound institutional education, are observed to make sweeping remarks, which, in fact, hurt the market.

"So, I think investment-related education will help people to refrain from making such remarks," he added.

President of DSE Brokers Association of Bangladesh Sharif Anwar Hossain said there are 2.0 million investors in the market, and majority of them are small investors.

"A good number of the small investors, having no minimum education, invest in shares on rumours, emotions and suggestions of others. By doing so, they are not only damaging themselves, but also making the market unstable," he added.

BMBA First Vice President Moniruzzaman and President of Capital Market Journalists' Forum (CMJF) Hasan Imam Rubel also spoke at the online discussion.