More than a year after the securities regulator's directive to small-cap companies to raise their market capital, only a handful of them acted on it and made any progress.

The Bangladesh Securities and Exchange Commission (BSEC) asked 64 listed small-cap companies to increase their paid-up capital to at least Tk 300 million by July last year.

The instruction came in tackling stock price volatility of such companies in the secondary market. Manipulators find it within their investment capacity to influence the share prices.

Until now, only 16 of the companies have expanded their paid-up capital by issuing stock dividends but not all of them meet the target set of Tk 300 million.

The paid-up capital is the money a company has received by selling equity to investors. It can be increased through the issuance of stock dividends, rights issues, repeat public offer (RPO) etc.

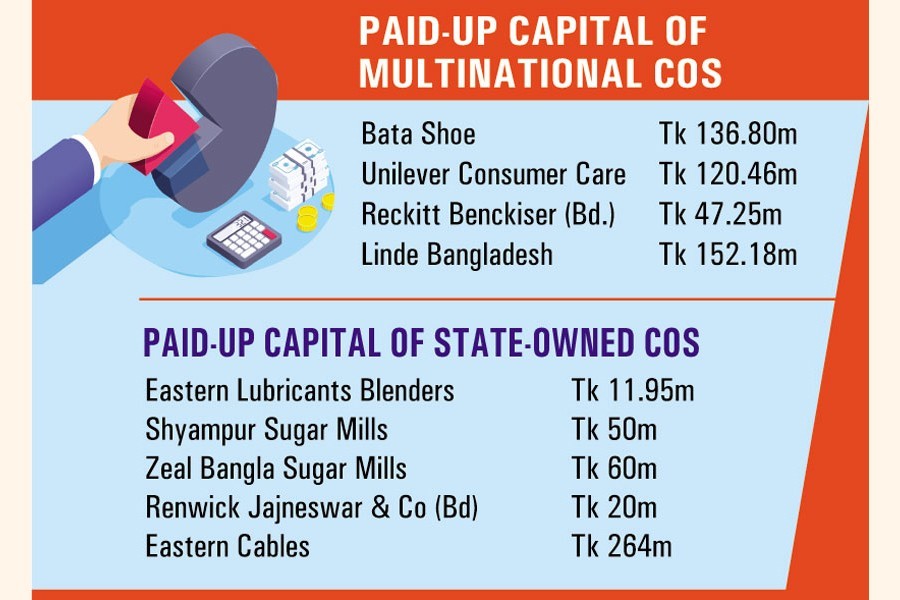

Of the small-cap companies with paid-up capital less than Tk 300 million, four are multinational and six are state-owned enterprises.

Of the multinational companies, Bata Shoe has a paid-up capital of Tk 136.80 million, Reckitt Benckiser Tk 47.25 million, Unilever Consumer Tk 120.46 million, and Linde Bangladesh Tk 152.18 million.

Preferring anonymity, the company secretary of a multinational company said they did not find it necessary to increase paid-up capital.

Md. Hashim Reza, the company secretary of Bata Shoe (Bangladesh), said a letter had been sent to the securities regulator explaining why Bata could not abide by the directive.

Challenges to increase paid-up capital

The issuers identify the hurdles they face in issuing stock dividends.

In September 2021, the securities regulator imposed restrictions on issuance of unjustified stock dividends to inspire companies to distribute cash dividends.

Since then, listed companies are required to confirm through price sensitive information (PSI) that stock dividends or bonus shares would not be given out of capital reserves or revaluation reserves.

The decision came against the backdrop of frequent issuance of stock dividends from reserves even though investors were not aware of the reserves.

A listed company, which has failed to declare at least 10 per cent cash dividend for two consecutive years from the date of listing, is prevented from issuing bonus shares without prior consent.

Companies are also not allowed to distribute stock dividends within three years after raising capital through rights issues or repeat public offer (RPO) or until the full utilisation of rights issues or RPO funds, whichever comes later.

Positions of market players

The multinational companies prefer cash dividends over stock dividends as the majority stakes are owned by foreign sponsor-directors.

The local companies that increased paid-up capital include Sonali Aansh Industries, Gemini Sea Foods, Desh Garments, BD Lamps, and Sonali Paper & Board Mills.

Sonali Aansh doubled its paid-up capital to Tk 54.24 million. Sonali Paper increased paid-up capital to Tk 329.45 million and Desh Garments to Tk 82.88 million.

The companies that are yet to increase paid-up capital include Agricultural Marketing Company (PRAN), National Tea Company, Standard Ceramic Industries, Jute Spinners and Pharma Aids.

The company secretary of Agricultural Marketing Company (PRAN), Kazi Abdur Rahman said the management was working on the matter and an outcome would be visible soon.

Two other local companies said they would have to overcome the restrictions imposed before issuing stock dividends.

Asked about the way out for such companies, Mohammad Rezaul Karim, a BSEC spokesperson, said they would have to improve performance.

Some companies have applied to the commission for permission to raise capital by issuing placement shares, he said, adding that the commission would examine the proposals.

Mr Karim, however, insisted that companies must come up with solutions to increase paid-up capital as small-cap companies create volatility in the market.

BSEC Chairman Prof Shibli Rubayat Ul Islam said some companies had conveyed that they needed an investment plan to increase paid-up capital.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said, "It is not rational that a company will remain listed for a long time with a very insignificant paid-up capital. They can increase their capital with profit reserve."

There is a capital adequacy ratio for banks and such a provision can be introduced for listed companies, he said.

The minimum ratio is 12 for banks and the ratio can be 8-10 per cent for listed companies, which will help determine the required amount of capital for listed companies, Mr Mansur said.

"This will increase the responsibility of the owners."