Asset valuation has become an issue of anxiety for the securities regulator in the run up to the launching of the Real Estate Investment Trust (REIT).

Ensuring that investors get good returns or dividends from the funds injected in REIT would depend on fair prices of lands and flats.

Flats are often overpriced. Lands in many cases are overvalued too. The worries have forced the regulator to give a second thought about the criteria set for valuers of assets to come under REIT.

"We are thinking if we should engage those who are already in the (valuation) business or not," said Shaikh Shamsuddin Ahmed, a commissioner of the Bangladesh Securities and Exchange Commission.

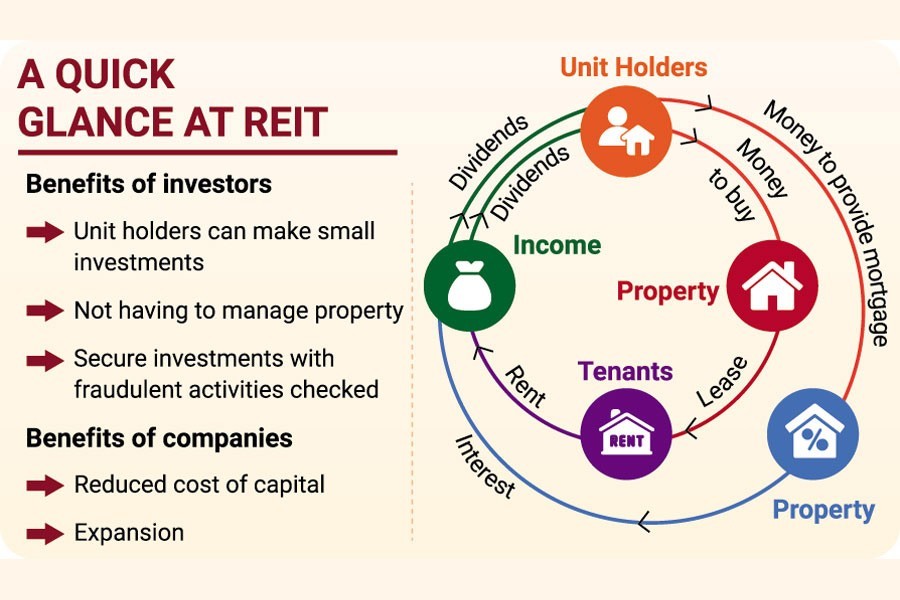

REIT is a fund or trust that owns and manages income-producing real estate, such as office buildings, shopping malls, apartments, hospitals, hotels, resorts, and industrial properties. It can provide mortgages on real properties as well.

At the formation stage, IPO (initial public offering) is floated to raise money to be used to buy an assortment of properties or provide mortgages or both. Income generated from mortgages or rents from properties leased out is given back in the form of dividends to the REIT unit holders after the deduction of management cost.

The BSEC has been working on equity-based REIT.

Three committees -- steering committee, consultative committee and working committee formed by the BSEC have already suggested rules for asset valuation.

But the BSEC commissioner asked the committee members to scrutinize the proposed regulations to plug any loopholes, if any, to prevent fraudulent activities, said a member of the working committee, requesting anonymity.

A draft proposal will be ready by next week to seek public opinions, he said.

Usually, the construction departments of property developers fix the value of flats, said company secretary of Eastern Housing Limited (EHL) Selim Ahmed.

"There is no specific valuer. The consultation firms also play a role in determining values of assets," he said.

Flats are valued considering land price, construction and fittings costs, and development expenses.

However, the real estate sector has no means as yet to check fraudulent activities by rogue developers and to take any punitive action through arbitration, said Mr Ahmed.

And the legal remedy is lengthy.

Features set for REIT asset valuers

A valuer must be recognised by the BSEC as is the case for auditors of the companies listed with the bourses. The practice is followed worldwide. Also, the valuer should follow a globally-accepted methodology.

It is recommended that the technical valuer is a member of the Institution of Engineers, Bangladesh (IEB) or the Institute of Physics.

An official of the Dhaka Stock Exchange said the companies designated as asset valuer must have accountants, chartered accountants and experienced civil engineers.

The REIT Management Company or the trustee or any of their directors or key executives should in no way bear any connection to the valuer. On the other hand, the assigned valuer will be forbidden to hold units of the REIT scheme.

Asset valuation is required before the registration of the REIT scheme and then at least once in every quarter, as suggested.

Above all these, promoters, directors, members or partners will be disqualified if they have ever been convicted of any offence of "moral turpitude".

REIT helps contain corrupt practices in valuation, construction and handover of flats built with public money.

Such investment schemes create scope of public participation in infrastructure and real estate, where investors enjoy the flexibility to choose the property they would put their money on.

The investors are also allowed to transfer their units of the asset-backed securities as they do in case of mutual funds.

Executive director of the Policy Research Institute (PRI) Ahsan H Mansur said REIT is imperative for the development of the real estate sector.

"The trustees should be liable for any fraudulent activities conducted by the companies," he said.

Neighbouring country India introduced such a scheme in 2019 for the first time, and three schemes -- Mindspace REIT, Brookfield REIT and Embassy REIT -- have gained popularity in the country since then, having drawn funds from both institutions and retailer investors.