It is new products and an online distribution channel that helped LafargeHolcim grow at a time when other cement manufacturers are scrambling to make a profit and some even have endured the pain of significant losses in recent quarters.

Holcim Water Protect and Holcim Shokti have drawn positive responses from customers so much that they took up 5.0 per cent of the total Holcim brand volume since the launching last year.

"We received overwhelming support and repeat orders from customers for these new and innovative products," said Rajesh Kumar Surana, chief executive officer of LafargeHolcim Bangladesh.

The post-Covid time and Russia-Ukraine war posed unforeseen challenges for the cement industry; freight charges and prices of raw materials in the global market have gone up while public and private construction works have been slowed down in austerity measures to relieve inflationary pressure.

But LafargeHolcim has got tools to get around the obstacles to gain profits.

The company introduced a new distribution channel, SHOJON last year. Customers from the areas having no presence of Holcim can request for products online and get those delivered to the addresses given.

This move turned out to be another game changer, helping Holcim increase its sales volume by as much as 10 per cent, Mr Surana said.

The cement manufacturer has also ventured into the business of aggregates, an import substitute.

In the first six months through June 2022, the sales of aggregates comprised 6.0 per cent of the company's revenue, which rose to 12 per cent by the end of the July-September quarter.

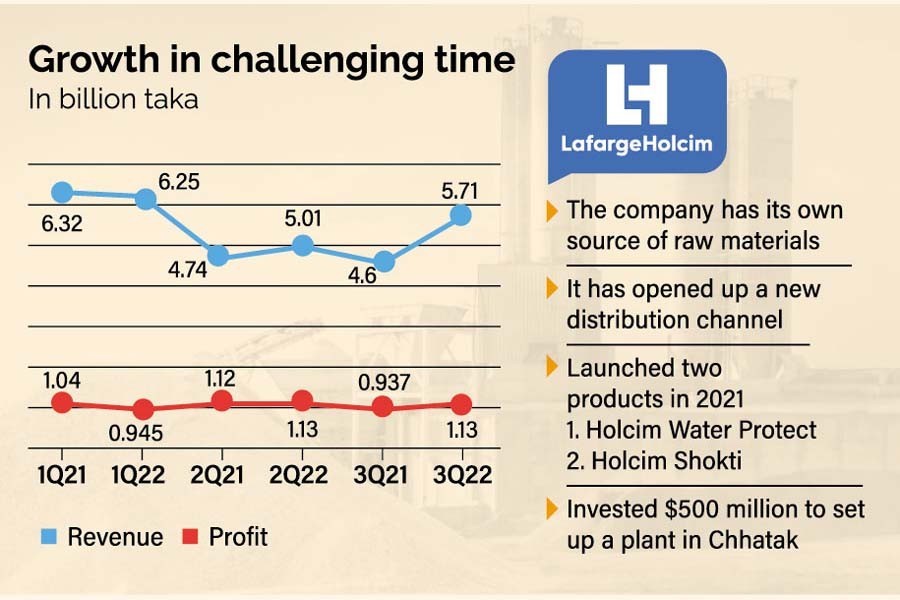

The company gained nearly Tk 1.14 billion consolidated net profit in the quarter ended in September, up from Tk 937 million a year ago.

During the quarter, it saw an unprecedented increase in raw material prices. But the rising cost of production was partially mitigated by the significant growth in the business, Mr Surana said.

The multinational cement manufacturer posted a 24 per cent year-on-year revenue growth and 21 per cent increase in profit in the third quarter of this year.

"The success of the last quarter entirely comes from the strong top-line growth," said the CEO, adding that the innovative digital supply channel and new business segments had contributed highly to the top-line growth.

LafargeHolcim had been operating at an advantage even before the emergence of the ongoing adverse macroeconomic situation.

It sources the core raw material, limestone from mines in Meghalaya, India. A conveyor belt carries the material from there to its factory at Chhatak in Sunamganj.

Such an arrangement offers an opportunity to avoid freight charges and running the risk of facing a volatile global market of raw materials.

Lafarge's cement plant in Chhatak is the only fully-integrated plant in Bangladesh where clinker and cement of premium quality are produced.

The company also started the production of aggregates at the plant in January 2021.

Mr Surana said he was very optimistic about the prospects of the company.

LafargeHolcim Bangladesh, a member of Holcim Group based in Switzerland and Cementos Molins in Spain, has been operating in Bangladesh for almost two decades.

The company invested $500 million to establish one fully integrated cement plant in Chhatak, and three grinding stations in Meghnaghat, Narayanganj and Mongla. This is the largest foreign direct investment in the construction industry of Bangladesh.

In 2021, the company's annual sales increased by 27 per cent to Tk 20.53 billion and profit jumped 64 per cent to Tk 3.88 billion. The company paid a 25 per cent cash dividend for the year.

LafargeHolcim also disbursed 15 per cent interim cash dividend, based on six months' financial results for the months through June.

The stock closed at Tk 66 on Thursday, rising 1.69 per cent over the day before.

Among the seven-listed cement makers, Aramit Cement suffered a loss of Tk 7.62 per share in the nine months to March 2022, Heidelberg Cement incurred a loss of Tk 4.27 per share in the nine months through September this year, and Crown Cement reported annual loss of Tk 1.54 per share for the year ended in June.

Premier Cement's EPS fell drastically by 91 per cent to Tk 0.37 for the nine months through March 2022. The EPS of Confidence Cement also dropped more than 40 per cent for the July 2021-March 2022 period.