The share prices of junk stocks, which came under Dhaka Stock Exchange (DSE) scanner, have been soaring in the last one month without undisclosed price sensitive information.

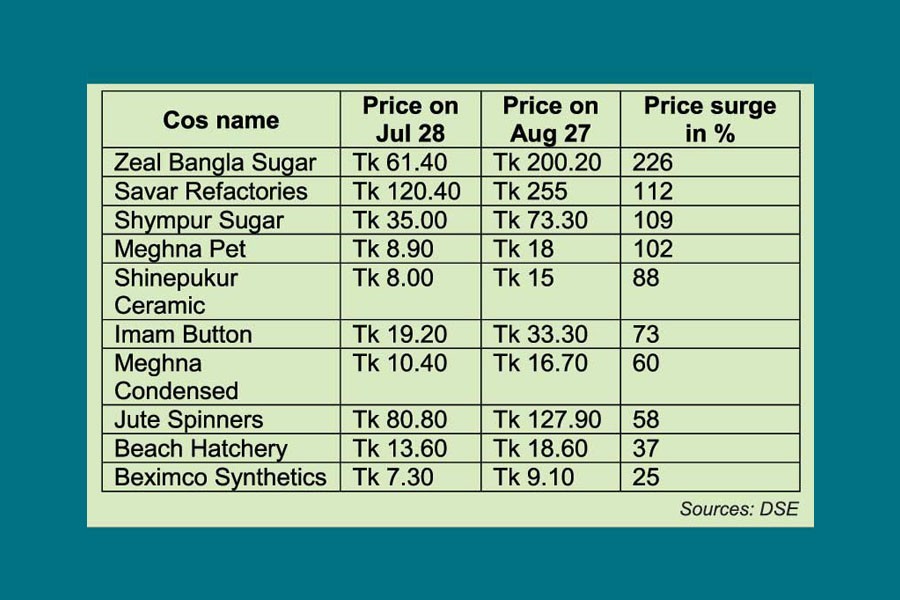

The companies are Zeal Bangla Sugar Mills, Savar Refactories, Shympur Sugar Mills, Meghna Pet Industries, Shinepukur Ceramic, Imam Button Industries, Meghna Condensed Milk, Jute Spinners, Beach Hatchery and Beximco Synthetics.

These companies remained under DSE scanner in the last two years since August 2018 as they failed to declare dividend (cash/stock) for the last five years from the date of declaration of last dividend.

The companies that fail to declare dividend, fail to arrange annual general meeting on time or keep their factories shut for six months in a row, stock exchanges put them into the 'Z' category. Currently, 54 companies are in 'Z' category.

Within a month, share price of Zeal Bangla Sugar Mills shot up by more than 226 per cent or Tk 138.8 each to close at Tk 200.20 on Thursday. The company's share price was Tk 61.40 a month ago on July 28, 2020.

Following the abnormal price hike, recently the DSE served show-cause notices on some companies.

The companies, however, in knee-jerk responses informed the DSE that there was no undisclosed price sensitive information for recent unusual price hike of their shares.

Imam Button's share price jumped more than 73 per cent within a month to close at Tk 33.30 each on Thursday despite the company's production remained suspended since April this year due to the Covid-19 pandemic.

The company replied to a DSE query that it was unable to earn sufficient revenue, for which it has been making losses since 2011.

Share prices of such poorly performing companies are on the rise, although transaction and price movement of these companies' shares do not match their fundamentals.

The overall market PE (price-earning) is 13.06 as of Thursday. But stock-wise PE ratio is extremely high for those poor performing firms, meaning returns from investment on such companies cannot be assumed.

Market analysts said some influential investors by disseminating rumours are trying to manipulate the prices of shares of the companies under question.

The investors should not pay heed to any rumours related to companies and take their investment decisions prudently, said an analyst at a leading brokerage firm.

The junk shares have been on an upward trend since the stock market regulator took some initiatives to bring reforms to these companies, said a merchant banker.

Recently the stock market regulator dictated that the companies that have been in the 'Z' category for the last two years would have to reconstitute their existing board of directors.

If they fail to do so, the sponsors and directors will not be able to remain in the board of these companies or any other listed firms, according to a decision of the Bangladesh Securities and Exchange Commission.

The regulator will appoint special auditors and observers to ensure compliance and good governance in the companies.

The BSEC also decided that the time for trading settlements for the companies in the 'Z' category would be reduced to four days instead of 10.

Such decisions of the stock market regulator might have created a positive impact on investor confidence, said the merchant banker.

But BSEC and DSE should remain alert to see whether gamblers were on the prowl to cash in on the developments, he added.